Apple Card Doesn't Need to Be Revolutionary to Be a Hit

Apple's credit card won't reinvent the finance industry. But that's not necessary for iPhone users to embrace Apple Card.

After Apple introduced Apple Pay in 2014, it was almost inevitable that the company would continue down the path into financial services and offer a credit card.

Apple Card, announced this week, isn't a revolutionary new product that will change credit cards forever, nor is it the best deal in the world of payment cards. But its unique attributes, combined with Apple's power as a platform owner, make this card a likely success — and a good choice for iPhone users.

It's just a credit card ...

People tend to judge Apple according to extremely high standards, and the company doesn't help itself with its hyperbolic product announcements.

The truth is, the Apple Card is just a credit card. It's got some decent features and unique attributes, but it's still a card — with industry-standard interest rates and an application process involving a credit check. It's also integrated with the larger U.S. financial system, which sets limits on what Apple and its banking partner, Goldman Sachs, can provide.

The Apple Card doesn't need to be revolutionary; it just needs to be simple, integrated and secure.

Credit cards are powerful financial instruments because of fees charged to the seller on every transaction. As competition in the credit card world has grown, cards have offered rewards to users — in essence, sharing part of their percentage of the sale with the buyer. (Some cards also charge customers annual fees, but Apple's card is free of these and all other fees.)

Credit card reward systems can be complicated. Cardholders earn points that are convertible into cash, gift cards or airline miles. Getting cash back often requires action on the part of the cardholder. Some cards offer increased amounts of return on certain types of purchases, and some cards — my Discover card, for example — actually change the rules every quarter!

MORE: Apple Card Is a Very Big Deal, and It Also Freaks Me Out

If you are the credit card equivalent of a coupon clipper, you can really benefit from studying all the options and choosing the card or cards that best fit your spending patterns and the rewards you desire most.

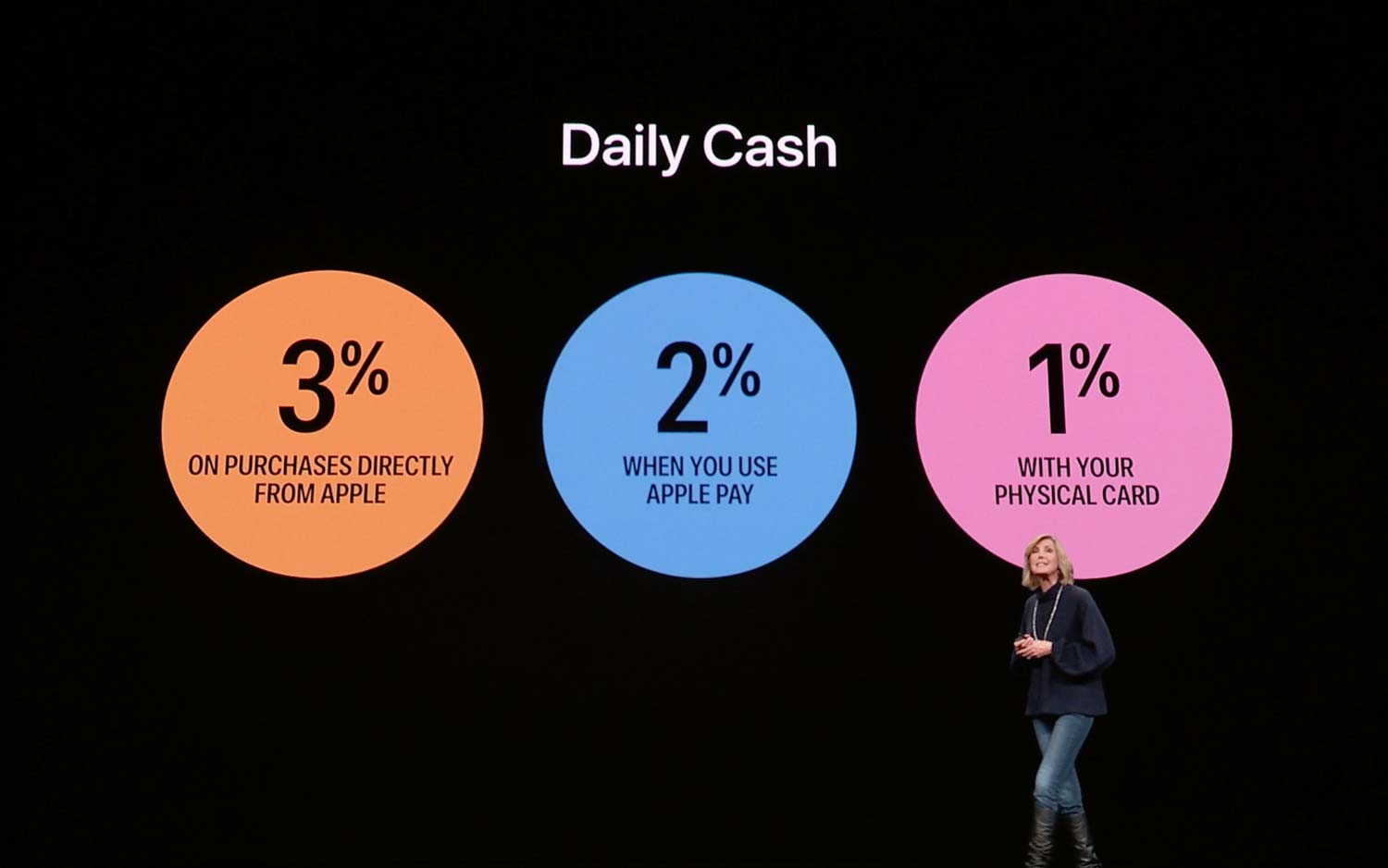

But here's the thing: Most people aren't coupon clippers. Apple's rewards — 2 percent for all Apple Pay purchases, 3 percent for purchases from Apple, including in the App Store — aren't as good as those you'll find on other cards, but they're decent. (There's only a 1 percent reward for purchases with Apple's physical card, so Apple is providing a strong incentive for cardholders to use Apple Pay whenever possible.)

A large class of users will prefer the Apple Card’s simple, iPhone-oriented reward system over a more complex one involving redeeming points and targeting purchases.

What you get in return, though, is a simple reward-redemption system, namely that Apple deposits cash into your Apple Pay Cash account every day as you make purchases. Your cash total is visible at all times, and you can use it to buy anything, so long as you use Apple Pay Cash. (You can also choose to have your cash go toward paying down your monthly bill.)

Apple, of course, benefits by pushing even more transactions into Apple Pay. But I do believe that a large class of users will prefer this simple, iPhone-oriented reward system over a more complex one involving redeeming points and targeting purchases. And surely Apple's most loyal customers are a great target audience for a card that offers 3 percent cash back on every single Apple purchase they make.

… But it's not quite a regular card

Apple is also using its platform-ownership powers to make the Apple Card a bit more than the usual card. For the Apple Card, and only the Apple Card, Apple is expanding the powers of the Wallet app, the same place you store other credit cards for Apple Pay purposes, as well as tickets, boarding passes and other stuff.

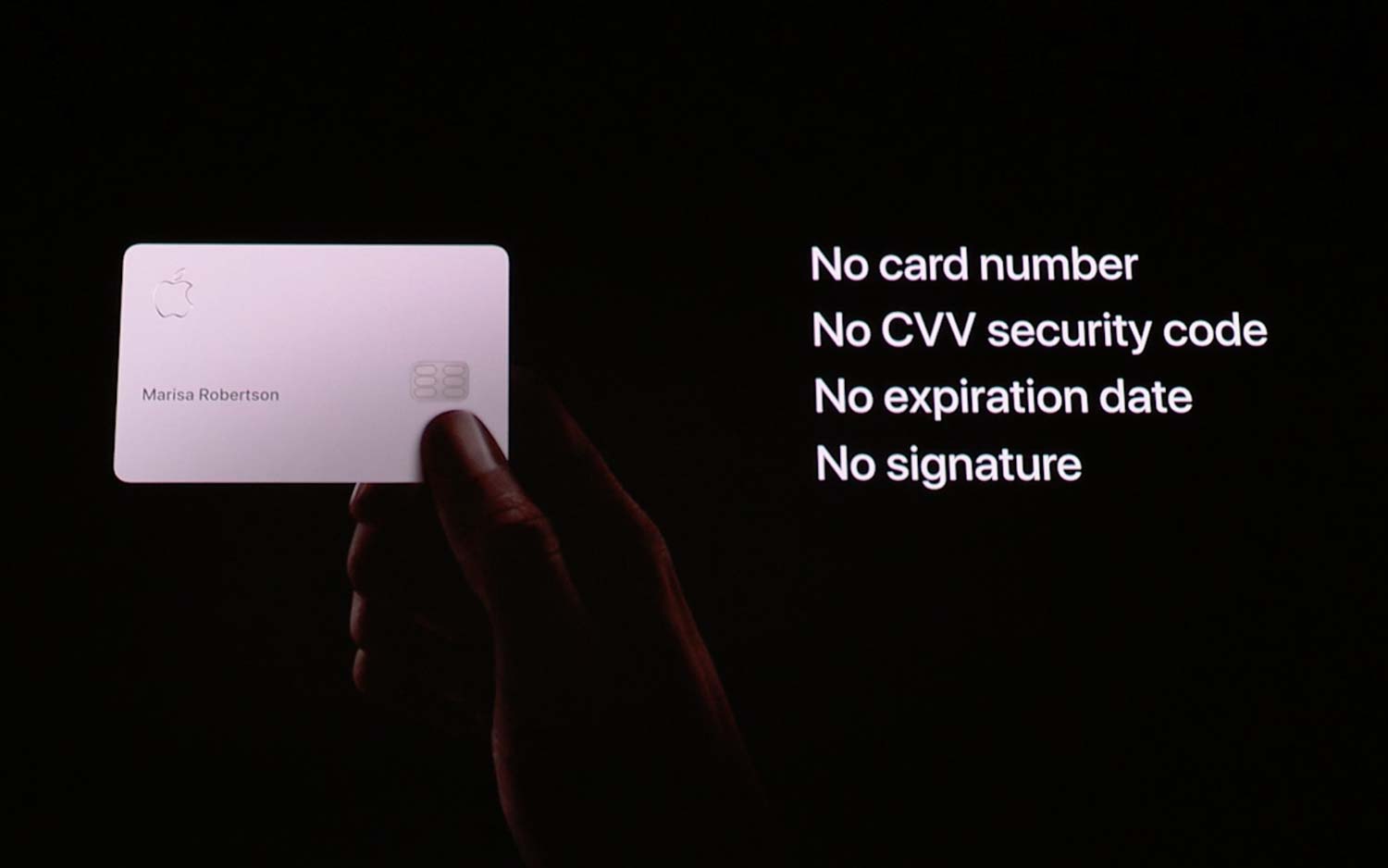

Every iPhone has the Wallet app, and now Apple can point out that the very best features of that app work only with Apple Card. And they're nice features; you can apply for a card within the app, see auto-categorized transactions to get a sense of where and how you're spending, and even generate one-time card-security codes and numbers to reduce the chance your card data will be fraudulently used. A signature isn't required on card purchases, and Goldman Sachs isn't allowed to resell your data to third parties for advertising or marketing purposes.

A lot of these features have been possible in the U.S. credit card system for a while, but Apple is choosing to enable them all and embed them inside a pre-installed app on every iPhone. This is very much on brand for the company. During last week's press event, there wasn't a single Apple announcement without a pause to point out the card's built-in privacy and security features.

Outlook

So, who will the Apple Card be best for? The card is for someone who prefers contactless payments over using physical cards, buys a bunch of stuff online, cares about privacy and security, appreciates being able to use iPhone apps to track personal data, isn't willing to make an effort to comparison shop to find the best credit-card rebate deals, and buys a lot of Apple gear. That's probably your average iPhone user in a nutshell.

The Apple Card doesn't need to be revolutionary; it just needs to be simple, integrated and secure. And those are three things today's Apple does better than most players out there.

Credit: Apple

Sign up to get the BEST of Tom's Guide direct to your inbox.

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

Jason Snell was lead editor of Macworld for more than a decade and still contributes a weekly column there. He's currently running the Six Colors blog, which covers all of Apple's doings, and he's the creative force behind The Incomparable, a weekly pop culture podcast and network of related shows.