Tom's Guide Verdict

ProtectMyID was among the least expensive identity-theft-protection services we reviewed, but it offered little protection.

Pros

- +

Affordable

- +

Strong login security

- +

Identity-theft alerts for your children.

Cons

- -

Credit scores and reports generally available only for a fee

- -

Rudimentary financial activity monitoring

- -

Very little personal information protection

- -

Few email and SMS alerts.

Why you can trust Tom's Guide

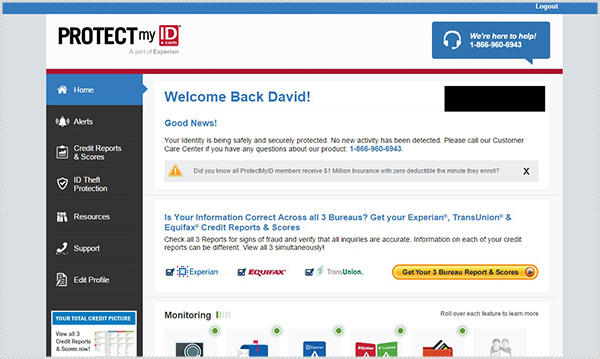

Whereas LifeLock and Identity Guard provide comprehensive protection and numerous extra features for a premium price, ProtectMyID charges just $15.95 per month for a bare-bones feature set. The service — a product of Experian, one of the credit bureaus — offers basic monitoring of your credit score, financial activity and personal information, but little else. After testing it for three months, we were unimpressed.

MORE: Best Identity Theft Protection Services - How We Tested and Rated

ProtectMyID vs. the Competition

It's worth it. Get LifeLock Ultimate Plus if you're very worried about having your identity stolen and you also need antivirus software. But you can get better credit monitoring for less with IdentityForce UltraSecure+Credit.

Get it. IdentityForce UltraSecure+Credit is the best overall service for both credit monitoring and identity protection. It also protects your account with two-factor authentication.

Credit Scores and Reports

Unsurprisingly, ProtectMyID monitors your Experian credit report for any changes that could indicate that you're the victim of identity theft. Unfortunately, ProtectMyID doesn't let you see your credit report for free, except when you initially sign up, and makes you pay for your credit score at all times. If you want to view your report and scores after the first 30 days, you'll have to purchase a single-bureau report from Experian for $9.95, or a tri-bureau report for $31.95. This is a one-time purchase — you'll have to purchase another report if you want to see an update to your score.

Financial Account Monitoring

ProtectMyID's financial activity monitoring is even more rudimentary. The service scans for your personal information on black-market websites where credit-card numbers are traded and sold, but you can't connect the service to your bank account, and it doesn't monitor your card for large purchases or cash withdrawals as LifeLock Ultimate Plus does.

Personal Information Monitoring

ProtectMyID offers very little in the way of personal-information safeguards. Besides your credit card and debit card numbers, the only other personal information that ProtectMyID monitors is your Social Security number and any changes of address at the Post Office. On the positive side, the service will alert you if a credit report is issued in your child's name.

MORE: 10 Simple Tips to Avoid Identity Theft

Notifications

ProtectMyID proved very uncommunicative. I received just one monthly email update, informing me that no Credit Alerts had been detected, and a single SMS message that said the same thing.

Login Security

On the positive side, ProtectMyID offers comparatively strong login security. The service prompted me to enter the last four digits of my Social Security number, in addition to my email address and password, when logging in. This extra layer of security should help keep out anyone who has your login credentials (particularly if you're in the habit of reusing passwords), although this method isn't foolproof.

Insurance

ProtectMyID offers a $1 million identity-theft insurance policy that covers lost wages up to $1,500 per week for up to five weeks; up to $1,000 in travel expenses; and up to $2,000 for elderly, spouse and child care. Also included in the aggregate limit are legal fees and any claims of unauthorized electronic transfers of funds (excluding interest and fees).

Bottom Line

Compared to LifeLock, IdentityForce and Identity Guard, ProtectMyID ($15.95 per month) offers little in the way of protection. The service doesn't monitor the same breadth of personal and financial information, nor does it provide any extra features such as financial calculators or anti-keylogging software. It does provide a greater level of login security than the competition, but this hardly offsets its lack of features.

Credit score monitoring: Poor

Financial activity monitoring: Poor

Personal information monitoring: Poor

Alerts and notifications: Infrequent

Tools and utilities: None

Login Security: Good

David Eitelbach is a UX writer working at Microsoft, writing and reviewing text for UI, and creating and maintaining end-user content for Microsoft Edge and Office. Before this, he worked as a freelance journalist. His work has appeared on sites such as Tom's Guide, Laptop Mag, and Tech Radar.