Tom's Guide Verdict

With three agency credit scores and reports as well as ID theft insurance and credit locks, Norton LifeLock Ultimate Plus covers just about everything and can include Norton 360 protection. Unfortunately, its protection can be overwhelming and expensive.

Pros

- +

Instant credit freeze

- +

Thorough identity protection

- +

Three credit bureau scores and reports

- +

Can include the Norton 360 security suite

Cons

- -

Gets expensive

- -

Lacks credit simulator

Why you can trust Tom's Guide

Monthly cost: $35

Yearly cost: $340

Family plan: $39/month

No. of bureau scores: 3

No. of bureaus monitored: 3

Frequency of credit reports: Equifax: daily; TransUnion and Experian: annual

Type of credit score: VantageScore 3.0

Credit-improvement simulator: No

Credit-lock/freeze button: Yes

Security software: Optional AV, VPN, PW manager

Investment account monitoring: Yes

Max. ID-theft coverage: $3 million

Data Breach Alerts: Yes

Medical Records Monitoring: Yes

Payday loan monitoring: Yes

Sex Offender Alert: Yes

Title Change Alert: Yes

Two Factor Authentication (2FA): Yes

The 600-pound gorilla in the ID Protection space, LifeLock has one of the most comprehensive services for preventing an identity theft and if that fails, surviving it.

With lots of insurance, monitoring and credit scores, the service has a multitude of plans and the ability to add Norton’s excellent malware protection as well. Its array of plans and subscriptions can be confusing, none of which include simulators to try out what-if credit scenarios and it gets expensive with add-ons like malware protection and VPN access.

Our LifeLock Ultimate Plus review will help you decide if this is the best identity theft protection service for you or if you’d be better off with something simpler.

LifeLock Ultimate Plus review: Costs and what’s covered

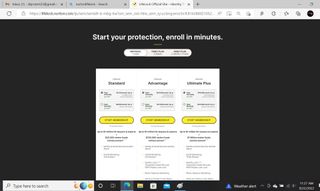

With a slew of options to choose from (with and without Norton 360 malware protection), LifeLock continues to have one of the widest assortments of plans. It allows fine-tuning of coverage that others lack but can come at the cost of frustration.

The LifeLock lineup starts with the $12 a month ($125 per year) Standard package that includes $1 million in insurance as well as $25,000 to recover stolen funds. It comes with single bureau credit monitoring from Equifax but no scores or full credit reports; you can get free reports from all three agencies annually.

By contrast, the Advantage subscription ($23 a month or $240 a year) adds the ability to instantly lock your credit and can monitor your phone for evidence of a SIM Swap or Port-Out attack. It continues with single credit bureau monitoring and scores as well as monthly access to reports. The plan includes $1 million for restoring your identity and increases the reimbursement for stolen money to $100,000. There’s also monitoring of court records and payday loan companies for your personal data. The Advantage subscription has one more thing: AI-based monitoring of changes to recurring charges or unusual charges.

I looked at the top-of-the-line Ultimate Plus plan that costs $35 a month or $340 a year, one the most expensive plans available. It adds credit monitoring from all three agencies, daily reports from Equifax; TransUnion and Experian deliver annual reports. In the background, Norton LifeLock keeps an eye on your social media presence in a bid to prevent damage to your reputation in addition to monitoring of your bank and investment accounts for a take-over. There are also address- and home-title-change alerts. Finally, it keeps an eye on File Sharing Network searches for signs of your sensitive information. The Ultimate Plus plan ups the insurance to include $1 million for recovering stolen money due from identity theft for a total of $2 million.

There are also Family plans that can include a pair of adults, up to five or seven children (under 26 years old) that live with the family. These plans top out at a total insurance level of $3 million and can cost up to $680 per year.

Finally, it’s easy to add Norton 360 malware coverage. For the Ultimate Plus plan, the added cost is $10 a year for a total of $350. It covers the security of an unlimited number of computers (Windows, Mac, Android and iPhone/iPad) and includes a firewall, parental controls, VPN and other features.

Now part of Gen Digital, LifeLock is too new to have a Better Business Bureau rating. In the recent past, Norton LifeLock had a highly sought-after A+.

LifeLock Ultimate Plus review: How we Tested

In the late summer of 2022, I signed up for LifeLock’s Ultimate Plus plan and paid for the monthly subscription; I was reimbursed by Tom’s Guide. I checked my credit scores and alerts several times a week and used several computers when doing so. Over my three months with Ultimate Plus, I checked in with the support staff with a coverage question and at the end canceled the service.

LifeLock Ultimate Plus review: Credit scores and identity monitoring

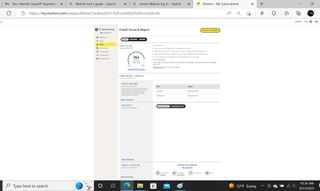

The company’s Ultimate Plus plan provides daily data from Equifax and scores from TransUnion and Experian monthly. The VantageScore 3.0 score is a good alternative to FICO for creditworthiness.

Ultimate Plus checks for activity on your credit card, bank and investment accounts as well as action at the major payday loan companies. It includes a freeze on payday loans. It also works with people-search firms like Intellius and Spokeo to scan for your name.

In addition to watching for address and home title changes, the Ultimate Plus plan watches for your personal information on the dark web that might be an early indication of identity problems. The personal indicators include Social Security number, name, address; the system can piece together fragments from different sources.

The Social Media Monitoring protection watches for indications of odd posts, cyberbullying or indications of an account take-over.

It works with Facebook, Instagram, LinkedIn, Twitter, YouTube, TikTok and Snapchat.

LifeLock Ultimate Plus: Insurance and services

The LifeLock service is unique in that it doesn’t use an insurance company, like AIG. Instead, the company self-insures against your losses. This technique might be a cause for concern if the company were not such a large, well-financed and established firm.

That said, The Ultimate Plus plan includes up to $1 million to cover lawyers, consultants, experts and accountants to help you get your life back. This includes paying for new documentation (like a driver’s license and passport) and can cover lost wages and travel expenses for meetings and court appearances. There’s also another million dollars to cover stolen funds. This $2 million reserve matches the max that Bitdefender will pay out in an identity crisis as well. For family plans, the limit can rise to $3 million.

LifeLock Ultimate Plus review: Notifications and alerts

There are a variety of LifeLock alerts to let you know when something fishy is going on with your credit scores or accounts. The warnings can arrive via text or email and are shown prominently on the service’s interface. They range from data breaches to payday loans and attempted account hacks. The credit card and bank accounts have thresholds that are set by default at $500 for transaction alerts; they can be raised or lowered.

The recently added Phone Takeover monitoring watches your phones (and SIM card) for signs of abuse. In addition, any utility account can be monitored and frozen if there’s a sign of misuse. The sex offender alert shows if someone on the registry has moved into your area but doesn’t include a map.

During my three month use of Ultimate Plus, I received four alerts, mostly for inquiries made on my credit history.

LifeLock Ultimate Plus review: Setup

Protecting my identity started at the LifeLock site, where I clicked on “Start Membership”, picked the monthly Ultimate Plus plan and created an account.

After paying (credit card or PayPal), I added my address, Social Security number, date of birth and phone number and accepted the company’s license.

Once I confirmed my email address, I saw the Dashboard with an alert about a data breach. There was, however, one more thing. On my first log in, the service jumped to the Monitored Information page, where I needed to fill in things like my mother’s maiden name and even my gamer tag. Oddly, it required me to enter the credit card I used to pay for the service.

My last task was to load the LifeLock Identity by Norton app on my Galaxy Note 20 smartphone. All told, the process took 15 minutes.

In addition to a large amount of self help online, like videos, tips and downloads, Norton LifeLock has staff on call all-day and -night to answer questions and concerns; others limit the tech support phase to 10 or 12 hours a day, and often just weekdays.

The Ultimate Plus plan adds priority care. The tech support people quickly answered a question about the credit freeze feature after waiting in the phone queue for five minutes.

LifeLock Ultimate Plus review: Interface and utilities

It’s easy to get into the LifeLock service to make changes or just see credit scores. The web interface’s Dashboard showed everything from alerts and credit scores to Social Media Monitoring and Identity Lock. It loaded quickly but there’s a lot of zooming required. The best balance was at 50% or 67% zoom and some scrolling.

In the upper left is small green text that reassuringly says, “Monitoring active”.

The current credit score shows up near the top and one click below the surface is a cornucopia of data from the report. It includes loans, credit card accounts and recent credit inquiries. My favorite is the total credit card debt section that I wish were true, but it missed a card’s balance. I was able to see the detailed Equifax, Experian and TransUnion credit data and download the full credit report.

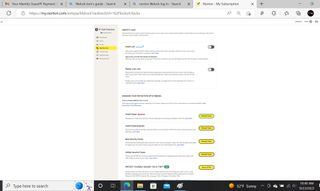

All the major items – from ID restoration and Transactions to Alerts and Monitored Info – are listed in the menu on the left. The Identity Lock is the place to go to lock accounts, including credit freezes that extend to all three bureaus – not just one. There’s also a way to suspend utility and bank accounts.

Meanwhile the Privacy Monitor shows potential vulnerabilities and has contacts for remedying the problems. The items can be automatically fixed but only if you pay $125 a year for the Privacy Monitor Assistant.

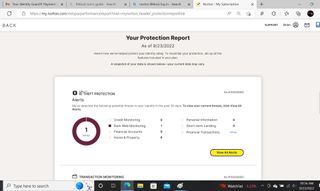

It’s well hidden, but in the upper right of the interface is a blue-lined box. Click on it to get Norton LifeLock’s Protection Report. It combines alerts that require immediate attention with data breaches and how much of the services features I was using but lacks an overall score.

There’re two things missing from the Norton LifeLock ID protection equation: a credit simulator to help decide how actions will impact credit scores and articles on identity theft and how to avoid it. There are, however, several stories in the Support pages of Norton’s site that were generally helpful but undated.

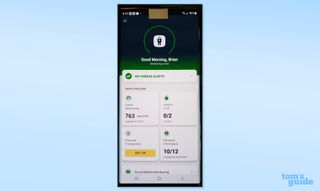

The app’s look and feel matches the browser approach but with brighter graphics. Alerts are at the top while credit scores and locks are below. There’re links to ID restoration specialists and support a level below. It can use a phone’s fingerprint scanner and two-factor authentication.

At the top of the app are LifeLock’s alerts, with details available with a left swipe. Below are the current credit score, recent financial transactions and information that needs to be entered. My favorite is the Identity lock that let me start a TransUnion Credit Lock or a Payday Loan Lock.

Over my three months of using Norton LifeLock Ultimate Plus, the web interface forced me to log out in order to log in several times, a problem I encountered after an hour or so of inactivity. Other times, the entire service appeared unavailable with a note for me to try back later.

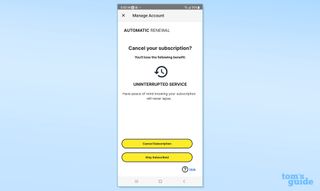

LifeLock Ultimate Plus review: Cancellation

To move on from LifeLock, I used the Android app. After several screens making sure I really wanted to leave, I was able to cancel the subscription.

I got confirmation a few minutes later.

Norton LifeLock Ultimate review: Verdict

No other identity protection service does as much as LifeLock’s Ultimate Plus plan, and that’s good and bad. It includes the expected ($2 million insurance, credit scores and monitoring) and goes the extra mile with innovative features (SIM card takeover protection and social media monitoring). It can even be bolstered with Norton 360 security protection.

That said, it is for those who want an all-encompassing system that can best be described as smothering. It’s also among the most expensive with family plans pushing $680 a year. Still, if you want the most comprehensive protection, LifeLock is the way to go.

Brian Nadel is a freelance writer and editor who specializes in technology reporting and reviewing. He works out of the suburban New York City area and has covered topics from nuclear power plants and Wi-Fi routers to cars and tablets. The former editor-in-chief of Mobile Computing and Communications, Nadel is the recipient of the TransPacific Writing Award.