How wearing a fitness tracker can lower your insurance

Many health insurers and employers offer discounts to people who wear fitness trackers and achieve activity goals. Here's how you can save.

Your fitness tracker or smartwatch can do more than help you take 10,000 steps or read text messages on your wrist. A growing number of insurance and employee wellness companies offer incentives to consumers who wear fitness trackers and achieve fitness goals.

Under a provision of the Affordable Care Act that went into effect in 2014, employers can offer wellness incentives of up to 30 percent of the total cost of health care coverage. According to the Health Affairs blog, that amounts to nearly $1,800 for an employee-only health plan. (Incentives can reach 50 percent for programs that address smoking cessation.)

Ready to reap the financial benefits of tracking your fitness activity? Here’s what you need to know.

How It Works

In many wellness programs, employees get an incentive — typically a gift card or insurance premium adjustment — for completing a survey called a health risk assessment or undergoing a biometric screening measuring blood pressure or cholesterol levels. However, there is little evidence that surveys or screenings either improve health or lower health care costs.

Building on the principles of behavioral economics, and taking advantage of increasingly sophisticated wearable devices from vendors such as Fitbit, Garmin, Misfit and Withings, more companies are tying incentives to fitness activities that are monitored regularly and that are more likely to result in long-term behavior change. It’s a lot like the “good driver” discounts that auto insurers such as Allstate, Progressive and State Farm offer drivers who agree to have their driving behavior monitored.

MORE: Best Fitness Trackers for Running, Swimming and Training

Individuals typically enroll in wellness incentive programs in one of three ways: directly with an insurer through their employer, indirectly with an insurer through a third-party employer wellness company, or directly with a consumer-facing wellness company. Here are examples of these types of programs and the rewards they offer:

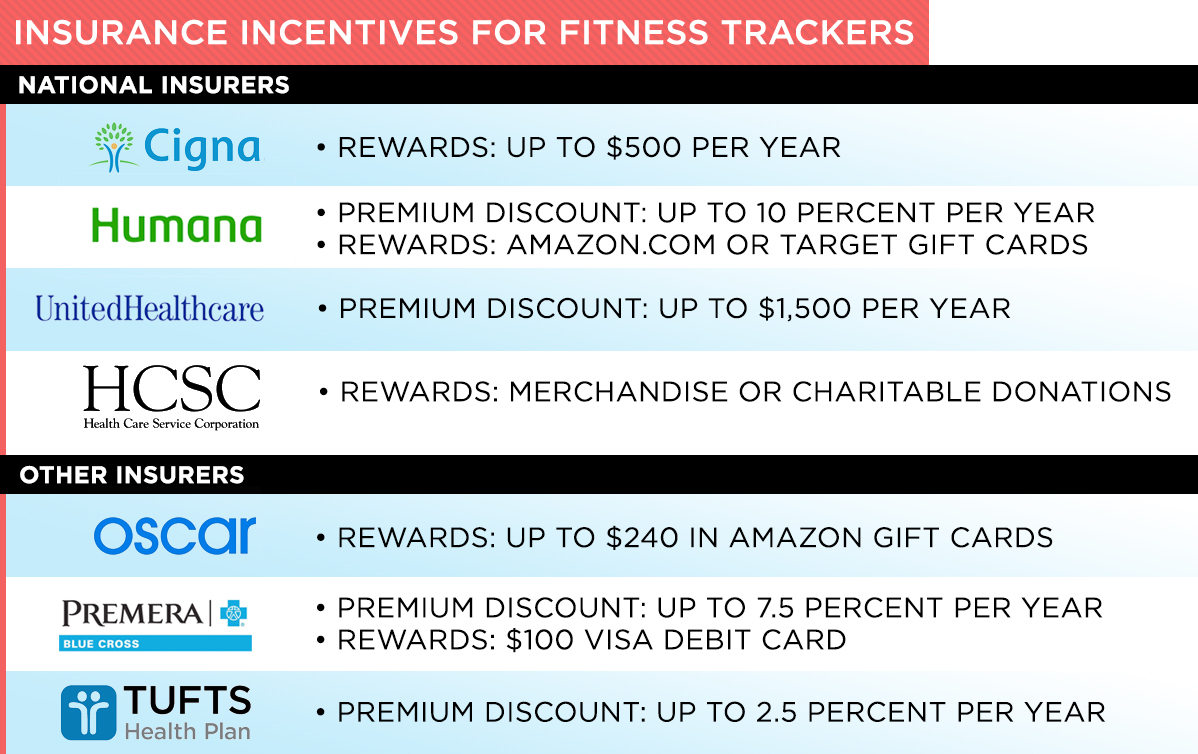

Many national health insurers in the United States offer some type of incentive that is tied to activity tracking. For example, UnitedHealthcare Motion provides daily incentives for step goals that total nearly $1,500 per year for an employee and spouse. Meanwhile, participants in the HumanaVitality program receive discounts on healthy food at Walmart in addition to gift-card rewards.

Sign up to get the BEST of Tom's Guide direct to your inbox.

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

A number of smaller insurers offer incentives as well. The most notable is Oscar, which gives members a free Misfit Shine and offers up to $240 annually in Amazon gift cards if members achieve activity goals.

Third-party employer wellness companies such as StayWell, Vitality, Virgin Pulse and Welltok create programs with varied incentives for their individual clients. (Editor’s note: The author participates in a Virgin Pulse program that offers a premium discount as well as a cash bonus.)

Wearable device makers have created their own wellness divisions, which work directly with employers to create customized programs. Employees at BP, a client of Fitbit, were eligible for a lower deductible if they hit step goals during the company’s Million Step Challenge.

Direct-to-consumer companies offer incentives that aren’t tied to employer benefits. For example, bounts is a company that gives consumers the chance to earn vouchers from brands such as Nike and Starbucks when they use activity-tracking apps such as Fitbit, Garmin or RunKeeper. People with a premium membership (about $20 a year) are entitled to cash incentives.

In a partnership with Vitality, John Hancock offers discounts of up to 15 percent on term life and universal life insurance policies to members who share activity data and basic medical information. The insurer gives members a free Fitbit to track data. Additional perks include Amazon gift cards and hotel discounts.

In the future, activity data may be used for more than just doling out rewards. One company, Appirio, was able to negotiate a 6 percent discount in health plan premiums from Anthem using data collected during a Fitbit challenge. In addition, insurer Cigna has hinted that data from fitness trackers may be used to determine group insurance pricing, with lower rates for members who, according to the data, are making a concerted effort to get or stay active.

Some Concerns

For all the financial benefits of sharing data from your fitness tracker, there are a couple reasons to think before you leap.

One concern is privacy. Participating in a wellness program means sharing a lot of information with your health insurance company or employer. According to a survey by the consultancy PwC, more than 80 percent of consumers are concerned about the possible invasion of privacy that wearable devices may present, as well as the possibility that data may fall into the wrong hands. (That concern is real: Nearly 80 million Anthem members had their personal information compromised after a hack last year.)

If privacy matters to you, carefully read the terms and conditions of any app before you start to use it. Be wary of any app that does not explicitly state that users own their data and have the power to determine who uses it. The Federal Trade Commission found that many wellness apps submit data to third parties, many of which aggregate it and sell it for marketing purposes.

Another concern is the shifting priorities of wellness programs themselves. As the Chicago Tribune reported, companies have had a hard time earning a return on investment (ROI) in their wellness programs, and they are starting to rethink their approach. For example, employers that are more interested in cutting costs may link wellness incentives to insurance premiums, while companies that want to try to build a “culture of health” may offer more intrinsic rewards.

MORE: One Year On, Fitness Band Security Still Pretty Bad

It can take companies three or more years to start seeing ROI for a wellness program, so don’t be surprised if the types of rewards you receive change from one year to the next, as your company tries to figure out what will work best.

How to Get Incentives

If you have employer-sponsored insurance, check with your benefits manager to see what types of wellness programs your company offers. If you are self-insured, check with your insurer directly. (Keep in mind that you may need to wait until the next open-enrollment period to participate.)

If you don’t have a fitness tracker yet, don’t worry: Many wellness programs offer free or subsidized devices to participants — the idea being that these costs will contribute to even greater savings on health care costs in the long run. In addition, your employer may let you use health savings account (HSA) or flexible spending account (FSA) money to pay for a fitness tracker.

Check with your doctor before you begin any rigorous wellness challenges or try to walk 10,000 steps a day (about 5 miles). You may be eager to earn incentives, but you also want to stay healthy while you do it, and your doctor can help you do that.

MORE: The Best GPS Watches for Sports and Athletics

Many employers complement their activity-based incentives with additional wellness offerings such as lunchtime walking groups, fitness classes during work hours or subsidized gym memberships. These programs help companies develop a culture of health and wellness, which is linked to everything from improved productivity to better attraction and retention of talent. If your employer offers programs that interest you, take advantage of them. If not, talk to your benefits manager about starting a program yourself.

Finally, since you already have a fitness tracker, you can make the most of it and use your technology to run your first 5K. Or, if you’re already active, just keep doing what you’re doing and earn those incentives.

Brian Eastwood is a freelance writer for Tom’s Guide, focusing primarily on running watches and other wearable tech. Brian has been a professional writer and editor since 2003. He has covered healthcare tech, enterprise tech, higher education, and corporate leadership for a range of trade publications. Brian is a lifelong Massachusetts native and currently lives outside of Boston. Outside of work, he enjoys running, hiking, cross-country skiing, and curling up with a good history book.