Apple Is No Longer the iPhone Company

As iPhone sales continue to fall, services are starting to take over, and that is forging a new Apple.

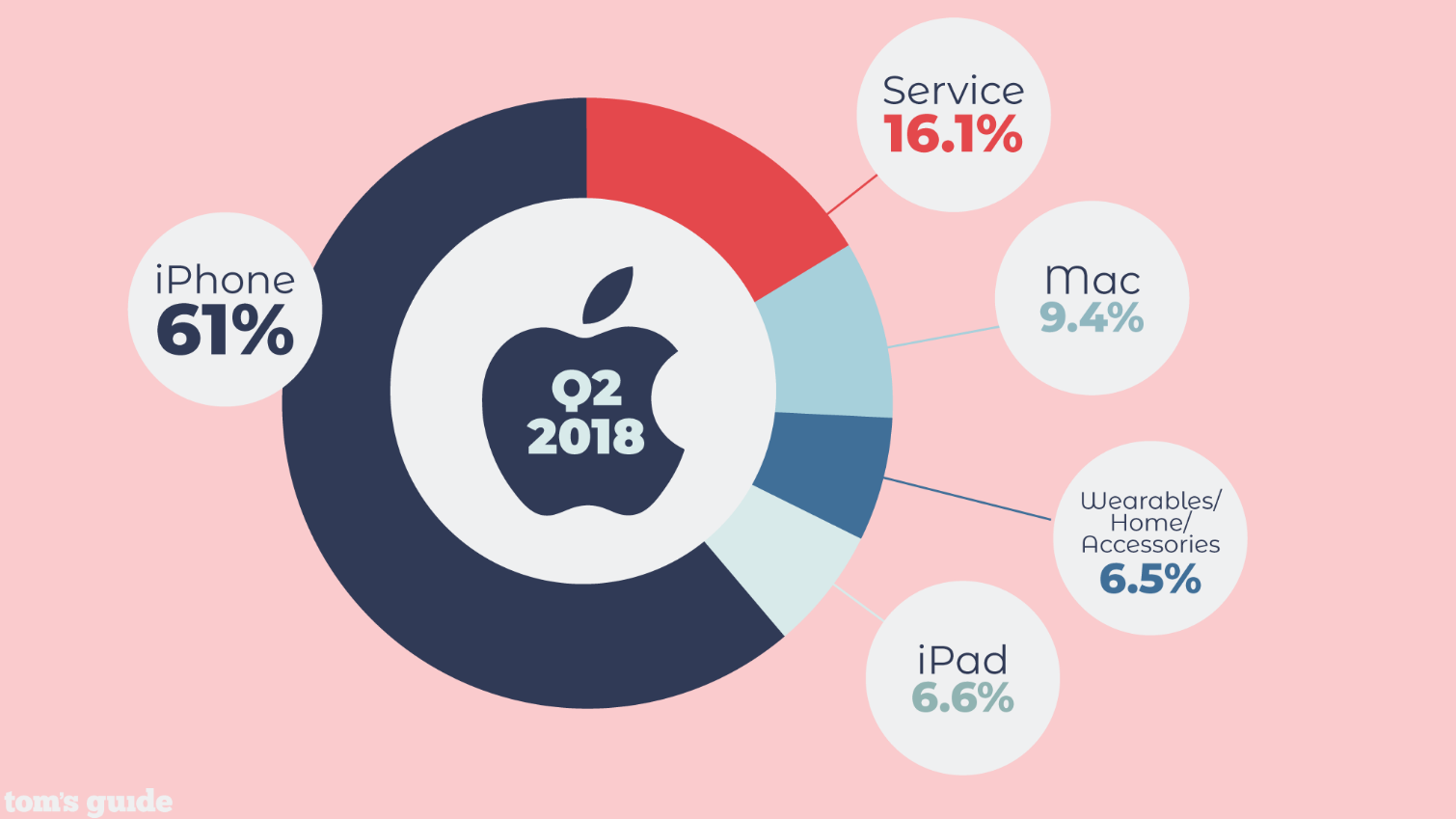

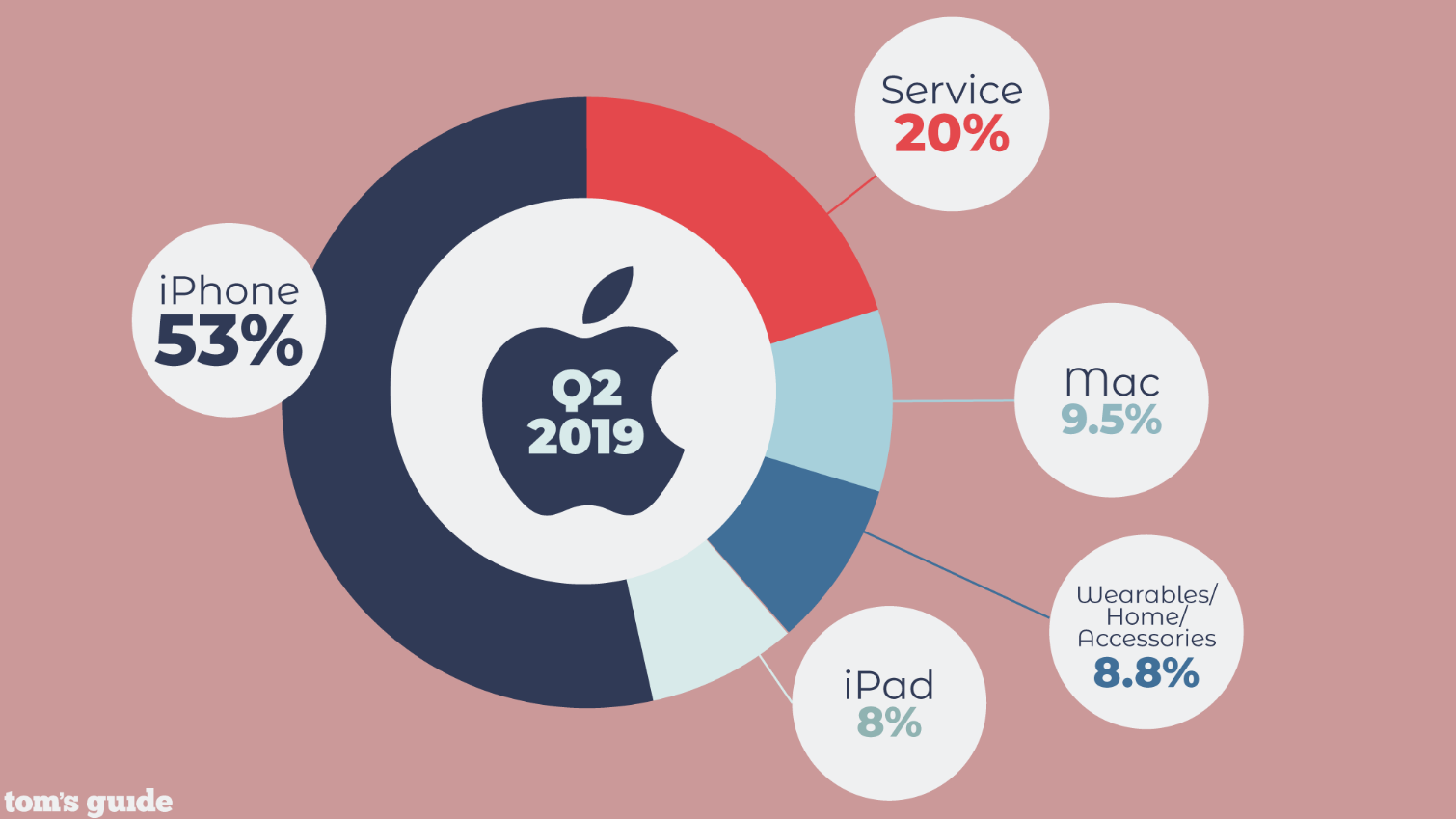

Apple has long been synonymous with the iPhone. But after 12 years that era is starting to come to an end. Just look at the numbers from Apple’s second-quarter results.

In just one year, the iPhone went from accounting for 61% of Apple’s revenue to 53.5%. And it was as high as 69% as recently as Q1 2018. Meanwhile, services, which includes everything from app sales and Apple Music to iCloud storage and all sorts subscriptions purchased through iTunes, went from 16.1% to 19.7% in just one year.

So now nearly one-fifth of Apple’s revenue is coming from services.

“While iPhone hardware sales are lower than they were, the iOS user base continues to grow, and Apple is now monetizing more of the software portion of the platform,” said Avi Greengart, founder and lead analyst for Techsponential. “The margins on these services are above 60%, and Apple is rolling out new services later this year.”

“Services are not a distraction, they are a natural extension of the integrated hardware/software ecosystem Apple has built and are driving real enterprise value.”

Those services include Apple TV+, which will attempt to compete with the likes of Netflix, Hulu and Amazon this fall with high-profile original programming from such heavy hitters as Steven Spielberg, Oprah and J.J. Abrams. Also in the fall, Apple will also be rolling out Apple Arcade, a premium gaming subscriptions service and even a credit card called Apple Card, which is slated for a summer release.

MORE: Apple's iPhone Sales Continue to Slump as Services Surge

“Apple has been slowly transforming itself from strictly hardware and software into hardware, software, and services like a trinity of technology,” said Ramon Llamas, research director at IDC. “Good move, and it gives the company another ‘in’ with its customers with every service it rolls out.”

Meanwhile, other hardware categories are surging as well for Apple, including wearables, thanks to the Apple Watch and AirPods, the latter of which Tim Cook called “a cultural phenomenon” during Apple’s call with investors yesterday (April 30). The iPad has also seen an uptick in sales, thanks in large part to lower-cost models like the 9.7-inch iPad. The new iPad mini and iPad Air will likely continue that momentum, which are cheaper than the iPad Pro.

All of this goes to show that Apple is very much not a one-product company.

“What is more important I think is that for segments like wearables and iPad, Apple saw growth from new users,” said Carolina Milanesi, an analyst with Creative Strategies, “That means that from an overall services perspective the installed base is not done growing.”

Of course, the iPhone is still the primary vehicle for accessing Apple’s services, so it’s not like the company can simply shrug its shoulders at the continued slump. Year over year, Apple made $6 billion less on iPhone sales in its last quarter, partly because customers are simply holding on to their phones longer, and also because recent iPhones have not offered the types of innovations that would compel people to upgrade.

Apple's Evolution: Q2 Revenue Split 2018 vs 2019

According to Counterpoint Research, smartphone sales dropped 5% in Q1 2019, making it the sixth consecutive quarter of shipments falling. So the entire industry is facing the same headwinds as Apple with the iPhone. Nevertheless, Apple is feeling pressure from Chinese giants like Huawei, which just pulled ahead of Apple in smartphone sales and has unseated Tim Cook and Co. as the No. 2 smartphone maker.

“Chinese vendors are certainly introducing novel features ahead of Samsung and Apple. Examples include – periscope cameras now commercialized in the Huawei P30 Pro,” said Peter Richardson, an analyst with Counterpoint Research. Other innovations include “pop-up cameras by Vivo and Oppo, super-fast charging (Huawei and Oppo) and reverse wireless charging – Huawei Mate 20 and now in the P30 Pro.”

What Huawei does not have, nor any other company, is Apple’s tight relationship between hardware, software and services that has engendered a tremendous amount of loyalty. It’s something I’ve called i-Intertia.

“Apple's ecosystem of devices and software is sticky, and becoming increasingly important to about a billion people's lives,” said Gene Munster, managing partner of Loup Ventures. “Services are not a distraction, they are a natural extension of the integrated hardware/software ecosystem Apple has built and are driving real enterprise value.”

Regardless of the category, don’t be surprised if the new Apple leans a lot more heavily into explicitly designing new hardware to move services. For example, future AirPods may have a 5G connection built in to stream Apple Music without a phone. The company’s rumored AR glasses may let you pay for items with your Apple Card simply by staring at the credit card reader. And, of course, future iPhones and iPads will boast gorgeous microLED screens to make its original TV shows look that much better.

When you think about it, this isn’t all that different from Apple’s past strategy. It’s always been about creating an ecosystem that’s so sticky that users wouldn’t want to leave. It’s just that the software and services used to accomplish that are now changing and multiplying.

“Apple was never an iPhone company, it was always a software platforms company that monetized the platform with hardware,” said Greengart.

Sign up to get the BEST of Tom's Guide direct to your inbox.

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

Mark Spoonauer is the global editor in chief of Tom's Guide and has covered technology for over 20 years. In addition to overseeing the direction of Tom's Guide, Mark specializes in covering all things mobile, having reviewed dozens of smartphones and other gadgets. He has spoken at key industry events and appears regularly on TV to discuss the latest trends, including Cheddar, Fox Business and other outlets. Mark was previously editor in chief of Laptop Mag, and his work has appeared in Wired, Popular Science and Inc. Follow him on Twitter at @mspoonauer.