Apple Card Is a Very Big Deal But It Also Freaks Me Out

Apple’s first credit card solves a lot of pain points and delivers easy-to-understand rewards. But it also changes the company’s relationship with its customers.

Oprah. Spielberg. J.J. Abrams. It’s easy to get starstruck by all the talent Apple put on one stage at its Show Time Event to introduce Apple TV+. But that really wasn’t the biggest news.

That would be Apple Card, Apple’s first-ever credit card that will be available starting this summer. From its focus on privacy and built-in financial advice to its daily cash back and lack of fees, it looks like this card could solve some major pain points for consumers.

But Apple Card will also fundamentally change Apple’s relationship with its customers while making the company an even bigger juggernaut.

“A credit card has the potential to generate tremendous revenue, while also building even more dependence on the Apple ecosystem,” said Zach Honing, editor at large for The Points Guy, a site that reports on how best to use points and miles and analyzes credit cards.

Made in partnership with Goldman Sachs and Mastercard, the Apple Card is “designed to help customers lead a healthier financial life,” said Apple in its press release. How does it do that?

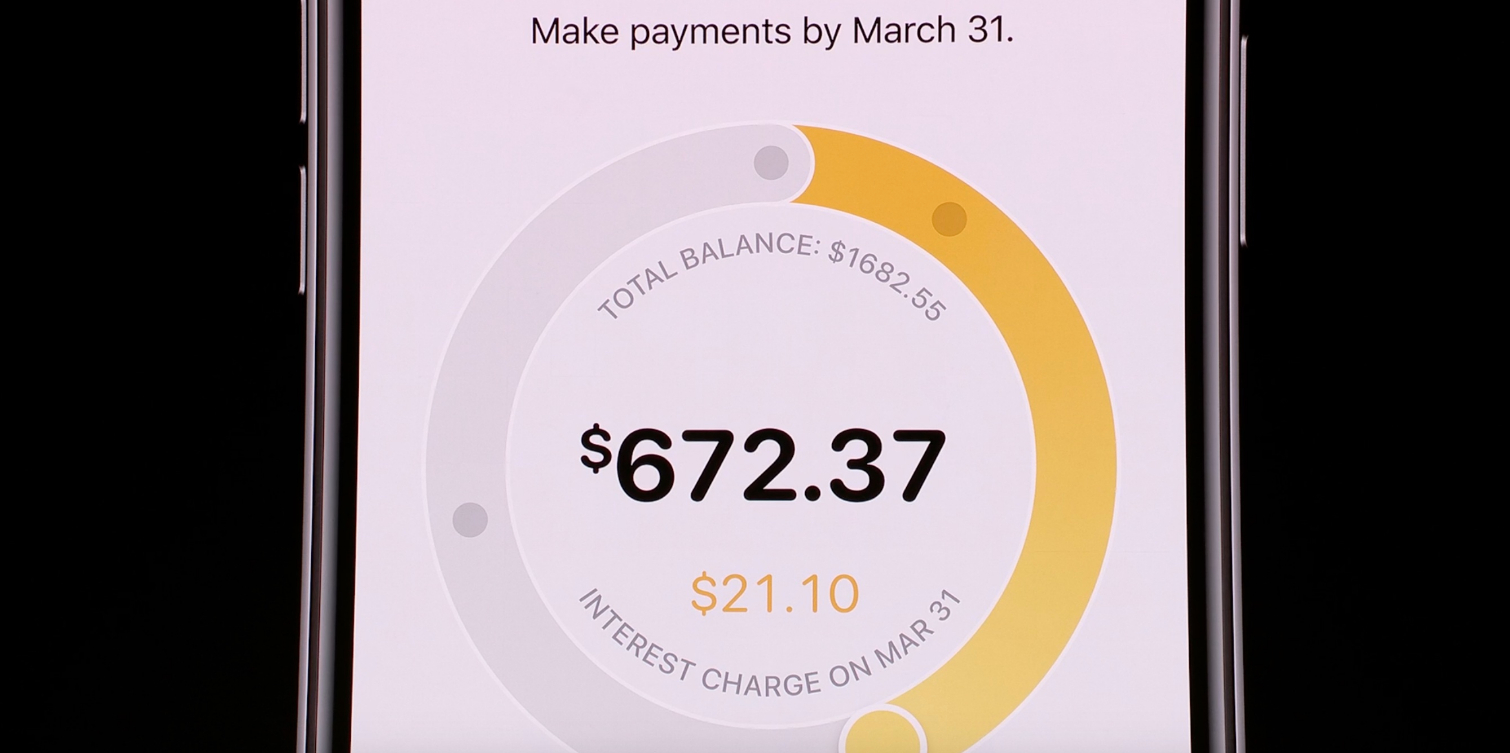

For starters, you have clear visibility into your finances, complete with easy-to-understand views of your spending in real time right within the Wallet app. Apple uses machine learning to not only label purchases but color code them based on category. Interestingly, you can also get help at any time by sending a text using Messages.

“I think it is one of Apple’s better conceived products - the merchant listings in plain English is enough to get me interested,” said Avi Greengart, founder and lead analyst at Techsponential. “The nonexistent fee structure, easy rewards, and clever management tools are unlike anything else on the market.”

Apple Card customers will also get Daily Cash instead of vague points. If you use Apple Card with Apple Pay, you get 2 percent Daily Cash. And if you buy something directly through Apple, whether it’s the Apple Store or the App Store, you get 3 percent back. You can then use that money to put toward your balance or to purchases using Apple Pay.

But as a CNBC report points out, other credit cards offer the same amount of cash back or more, and they can be used for anything you buy, not just for purchases made via Apple Pay. Still, Apple might be able to win over users to Apple Card who usually ignore credit cards.

“While there’s no question that dozens of other products offer more valuable rewards, Apple seems focused on creating an incredibly straightforward earning and redemption structure,” said Honing, “which may be the key to attracting customers who otherwise wouldn’t consider adding a credit card to their wallet.”

Still, there’s something that’s unsettling about letting Apple become my credit card company. I’m okay paying them for physical products like the new AirPods and virtual goods like games and cloud storage, but potentially owing Apple for things that have nothing to do with Apple (food, clothes, home improvement) is a big and weird step mentally.

Others say Apple Card is a totally natural progression for Apple.

“Apple has had a deeper and more structured financial relationship with its customers ever since it launched iTunes,” said Greengart. “I don’t think that this is that big a stretch or is going to be a problem.”

Look, I get it. Apple Card is not a typical credit card. And the company seems to have covered all the privacy bases with Apple Card, befitting its track record. Every purchase is secure, authorized via Face ID or Touch ID and a one-time dynamic security code. Apple also doesn’t know where you’ve shopped, what you’ve purchased or how much you paid.

But ultimately, Apple Card is not just a panacea for traditional credit card woes. It’s the ultimate lock-in tool for Apple’s ecosystem. It’s not a coincidence that you get the most money back using Apple’s card to buy Apple stuff.

“This is clearly about driving traffic to Apple Pay and keeping people within the Apple ecosystem,” said Greengart. “Like Apple Watch, Apple Card does not work with Android.”

As products like the iPhone plateau in terms of innovation and sales, Apple must look for other avenues for revenue, especially recurring revenue. Its services business brought in more than $10 billion during the last quarter, and Tim Cook has said that it wants to double that revenue by 2020. The Apple Card looks to be an instrumental vehicle for reaching that goal.

But given that so many of us already have credit cards, who is Apple Card for?

“I think Apple Card really only makes sense for folks just starting to get their feet wet, and perhaps for 3 percent back on Apple purchases, including services like iTunes and TV+,” said Honing.

Given my current relationship with Apple right now, I’m not sure I’m looking for that sort of next-level commitment.

Image credit: Apple

Sign up to get the BEST of Tom's Guide direct to your inbox.

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

Mark Spoonauer is the global editor in chief of Tom's Guide and has covered technology for over 20 years. In addition to overseeing the direction of Tom's Guide, Mark specializes in covering all things mobile, having reviewed dozens of smartphones and other gadgets. He has spoken at key industry events and appears regularly on TV to discuss the latest trends, including Cheddar, Fox Business and other outlets. Mark was previously editor in chief of Laptop Mag, and his work has appeared in Wired, Popular Science and Inc. Follow him on Twitter at @mspoonauer.