AllClear ID Pro Review

AllClear ID Pro is the least expensive of the identity-theft-protection services we reviewed. It also offers the least amount of protection.

After a massive data breach, healthcare provider Anthem offered its customers a complimentary two-year subscription to AllClear ID Pro. At $14.95 per month, AllClear ID Pro is the least expensive of the identity-theft-protection services we reviewed. After three months of testing, it became clear that it's also the least robust in terms of protection, ease of use and extra tools.

MORE: Best Identity Theft Protection Services - How We Tested and Rated

[Editor's Note: AllClear ID no longer sells its services directly to consumers. We think it's a fine service to use if your employer, or a company with which you've done business, provides AllClear ID services to you for free. But to obtain identity protection for yourself, you'll need to check out the other services we've reviewed below.]

Competing Identity-Protection Services

It's worth it. Get LifeLock Ultimate Plus if you're very worried about having your identity stolen and you also need antivirus software. But you can get better credit monitoring for less with IdentityForce UltraSecure+Credit.

Get it. IdentityForce UltraSecure+Credit is the best overall service for both credit monitoring and identity protection. It also protects your account with two-factor authentication.

Credit Scores and Reports

AllClear ID monitors your credit reports with all three bureaus for any changes that could indicate identity theft, and will notify you via a secure phone alert if any suspicious activity is detected.

However, unlike LifeLock Ultimate Plus, IdentityForce UltraSecure+Credit and Identity Guard Platinum, the service does not let you see your current credit report or credit score, or provide any tools for improving your credit history. All in all, it's a bare-bones experience — which is typical of AllClear ID as a whole.

Inexplicably, AllClear ID had trouble verifying my identity when I first signed up for the service. To activate credit monitoring, I had to fax customer service a copy of my utility and cellphone bills — an annoying and time-consuming process. I didn't experience this issue with any of the other identity theft-protection services.

Sign up to get the BEST of Tom's Guide direct to your inbox.

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

Financial-Account Monitoring

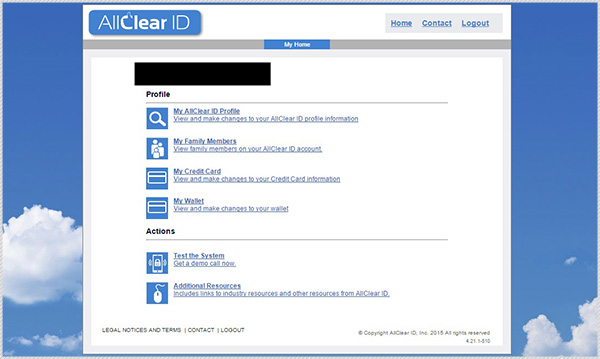

Ostensibly, AllClear ID Pro monitors the Web for your credit-card number and bank-login information. However, I could not find any way to enter my bank login information on the AllClear ID home screen. I contacted AllClear ID regarding this problem, but did not get a response.

AllClear ID will also help you cancel any lost or stolen cards and order replacements, but most credit card companies and financial institutions offer an identical service for free.

Personal Information Monitoring

AllClear ID Pro monitors your Social Security number and little else. On the home screen, I couldn't find any way to enter additional information such as my driver's license number, additional email addresses and phone numbers, or my mother's maiden name. Again, I did not receive a response when I asked AllClear ID about this.

Like ProtectMyID, AllClear ID can monitor your child's Social Security number for fraudulent activity, but this service costs an extra $4.95 per month.

MORE: 10 Simple Tips to Avoid Identity Theft

Notifications

AllClear ID Pro delivered monthly fraud detection updates via email, but little else. The service will contact you by phone if it detects potentially fraudulent activity, but I never received a call during the testing period, even when I made very large purchases with my credit card in several cities. The service doesn't support SMS notifications.

Login Security

AllClear ID uses an extremely secure two-step authentication method. You must first enter your email address and password on the site, at which point you'll receive an automated call from AllClear ID prompting you to enter your PIN on the phone's keypad (established when you first sign up for the service). You can press the star key to prevent anyone from accessing your account if you believe you've received a call due to an intrusion attempt.

Insurance

AllClear ID Pro provides a $1 million identity-theft insurance policy identical to that offered by ProtectMyID, with the exception that the limit on elder care and child care is $1,000 rather than $2,000.

Bottom Line

AllClear ID Pro's $14.95 per month price seems attractive at first glance, but such a low price inevitably means you'll have to make compromises. AllClear ID Pro monitors your credit reports with all three credit bureaus, but it provides very little in the way of financial activity and personal information monitoring. AllClear ID Pro does have the tightest login security of any of the identity theft-protection services we reviewed, but competing services such as LifeLock and IdentityForce are much better overall.

Credit score monitoring: Poor

Financial activity monitoring: Poor

Personal information monitoring: Poor

Alerts and notifications: Infrequent

Tools and utilities: None

Login Security: Excellent

David Eitelbach is a UX writer working at Microsoft, writing and reviewing text for UI, and creating and maintaining end-user content for Microsoft Edge and Office. Before this, he worked as a freelance journalist. His work has appeared on sites such as Tom's Guide, Laptop Mag, and Tech Radar.