Tom's Guide Verdict

TaxSlayer Classic is the best tax software for those on a budget, but H&R Block and TurboTax offer more guidance.

Pros

- +

Inexpensive, simplified pricing structure

- +

Low-cost classic version services all tax situations

- +

Lets you work on up to four years of returns

- +

Tax expert guidance for Premium and Self-Employed levels

Cons

- -

Context-sensitive help lacks depth

- -

No cryptocurrency guidance

- -

Lacks a donation calculator

Why you can trust Tom's Guide

Mobile app: iOS and Android

Online support: E-mail, chat (Premium and Self-Employed only)

Phone support: Non-toll-free, 9 a.m. to 9 p.m. ET weekdays

Tax pro assistance: Part of Premium and Self-Employed tiers

TaxSlayer Classic 2023 is the best tax software for those who want to save money on their taxes while retaining some of the conveniences of more pricey packages. Apart from the entirely free Cash App Taxes and FreeTaxUSA, TaxSlayer remains the least expensive way to file a federal return across a wide variety of tax situations, including for investments and self-employed.

While pricing and support structure remain the big differentiators for TaxSlayer, the service’s friendly interface and clear guidance also stand out. And it is the only service beyond FreeTaxUSA that allows you to do three years of back taxes online in addition to the current year. Sure, TaxSlayer Classic doesn’t provide as much hand-holding as you get with pricier competitors such as H&R Block and TurboTax, but it gets the job done without sacrificing features like importing some W-2 documents by photo.

Editor’s note: This review is of TaxSlayer Classic 2023, which covers the 2022 tax filing year.

TaxSlayer Classic 2023 review: Cost

TaxSlayer has four tiers of service in its online Federal portfolio. The structure of the services is slightly different from competing tax-preparation software.

Simply Free is just that, and it handles W-2 and education deductions and credits, but it doesn't include Earned Income Tax Credit and Child Tax Credit, as it does on TurboTax, for example. The $29.95 Classic tier handles most tax situations, while Premium ($49.95) adds priority phone and email support and Ask a Tax Pro expert assistance. The $59.95 Self-Employed tier is best for those who contract, freelance or have a side hustle (technically, the necessary tax forms are in the Classic version, but you need to go to Self-Employed to get tax expert help), and it adds support for IRS audit assistance for three years and live chat and help from a tax pro.

If you have investments and don’t need help, TaxSlayer Classic should suffice. And if you have Schedule C deductions and income from a small business or side-hustle, the self-employed tier is the most reasonable among all the paid services.

In its site menu, TaxSlayer lists out a dedicated Military tier, which allows active service members to do their Federal return for nothing (by contrast, TurboTax does the same, but uses its onboarding questions to create a military-appropriate experience).

TaxSlayer Classic 2023 review: State filing

State tax filing is included with the free version. State filing costs $39.95, up $3 from last year, for the other tiers of service. That’s still $15 cheaper than TurboTax. Military members file for free, same as with TurboTax.

TaxSlayer Classic 2023 review: Features

TaxSlayer has never been big on fancy features. Instead, its interface and navigational flow continues to improve, even if the guided navigation still has a few hiccups. There aren’t any significant changes this year for the Classic version. Last year the service gained CSV file imports for investment transactions; before that, it was using a photo to populate W-2 data fields).

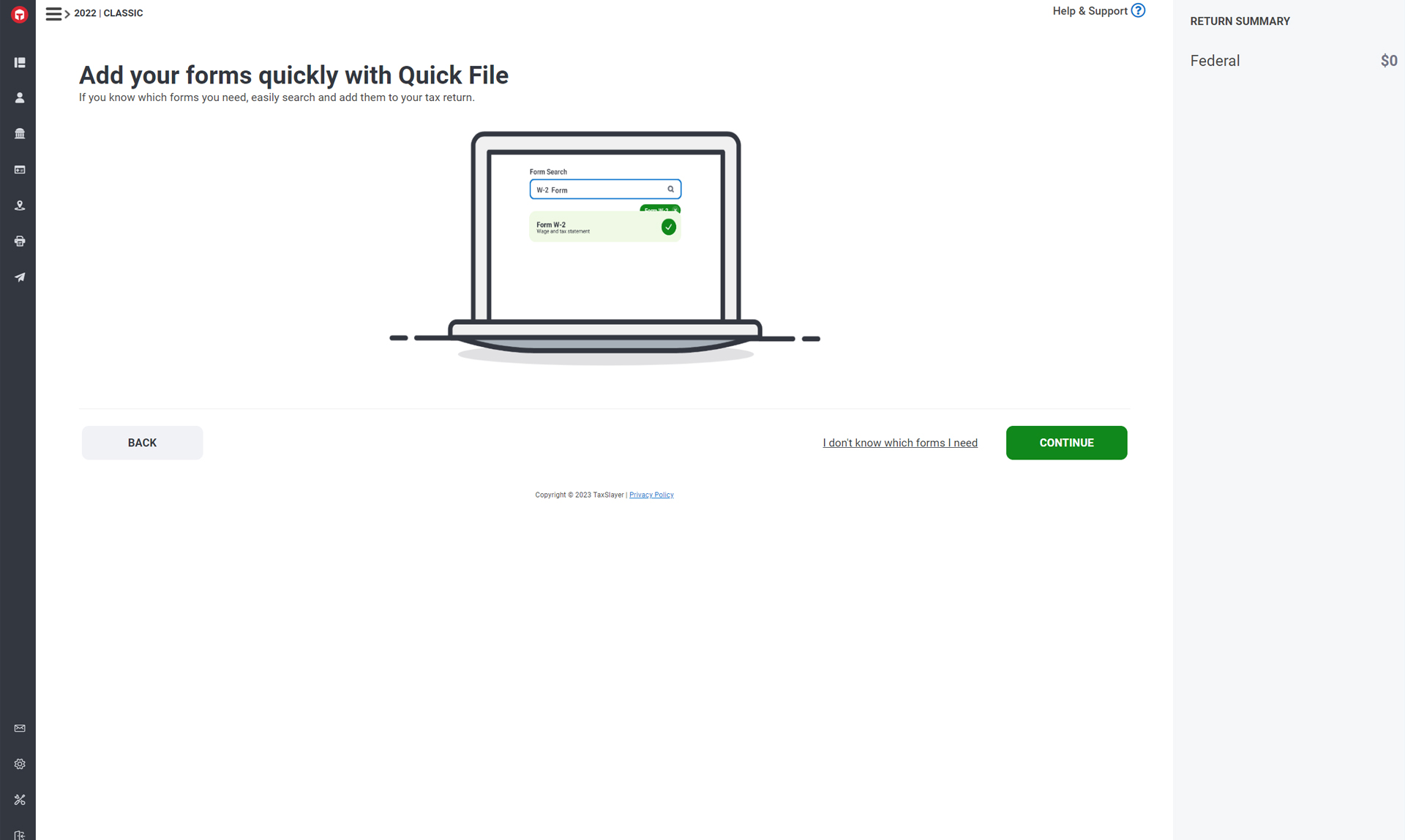

TaxSlayer continues to tweak its Quick File experience, which provides a streamlined process by letting you jump directly to specific forms you know you need. When you step up through the paid tiers, you gain additional features, most of which are related to support (which we’ll discuss next).

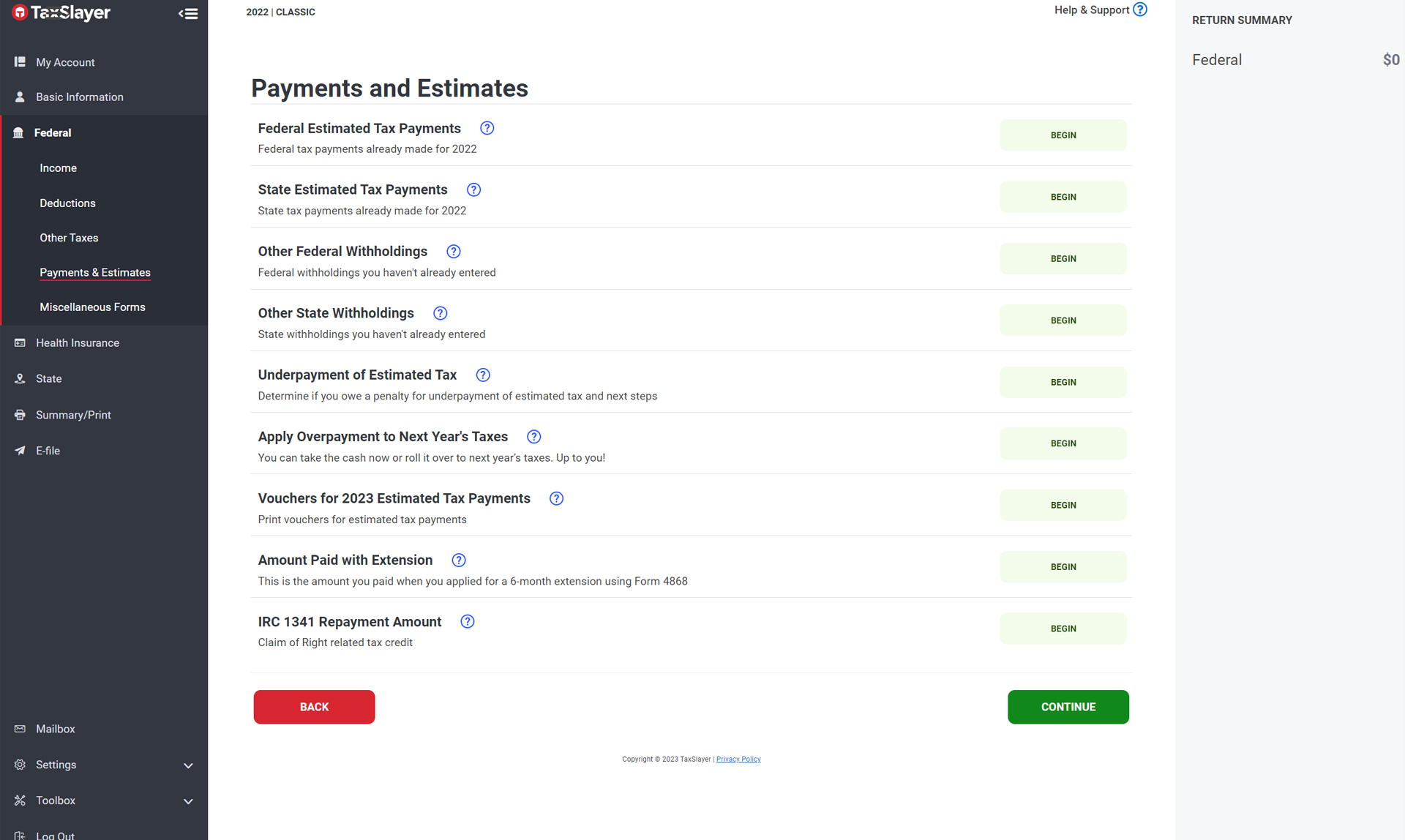

The Premium and Self-Employed tiers bump the IRS Audit Assistance to three years. The Self-Employed tier also gains additional relevant guidance for 1099 income and extra in-service help to maximize work expense deductions. And you get a guide to self-employment, quarterly estimated tax payment reminders and year-round tax and income tips.

The Simply Free version of TaxSlayer covers fewer tax situations than competitors, but it does include free phone and email support.

TaxSlayer Classic 2023 review: Available help

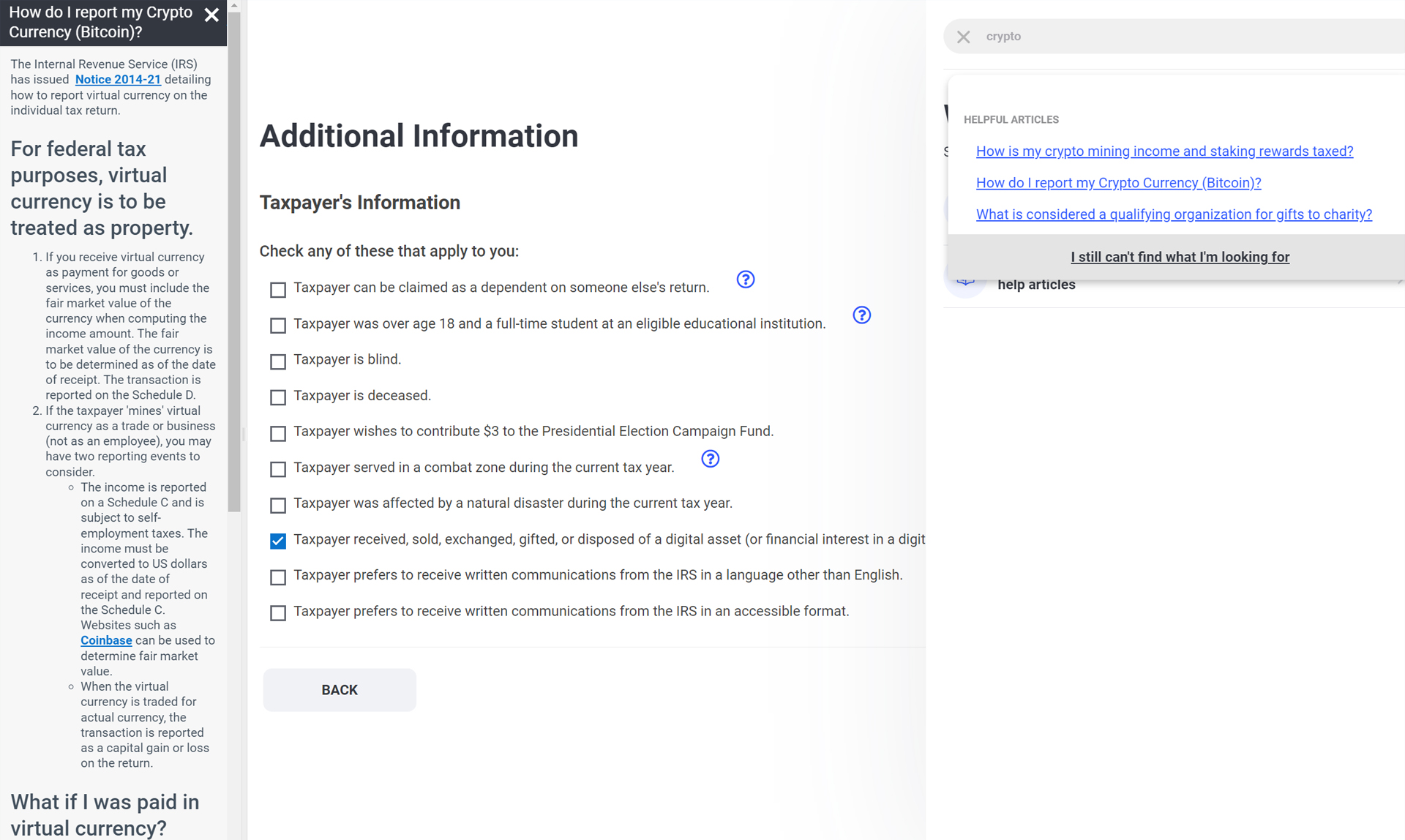

The Support Center front page is slightly improved, and the cohesive presentation goes deeper than just the surface. Classic users can get help by email or non-toll-free phone, from 9 a.m. to 9 p.m. ET. Whether accessing help from inside the service or via the Support Center, the content lacks the depth and detail of some competitors. A crypto entry refers to “virtual currency” and links to an IRS document, instead of explaining things clearly within TaxSlayer.

Overall, the look is similar to last year’s help design, with fly-out panels on the right that collapse away if not needed. The answers at right, when clicked, sometimes appear in a fly-out pane at left. We found the pane awkward to read on the left; your eye flows across the screen more naturally from left to right, and that pane seems like it would be better served as an overlay at right.

Put simply, the site’s support pages are light on guidance and help. While the Premium and Self-Employed tiers can’t fix the written support, at least with those levels you get priority phone and email support, and tax pro assistance.

TaxSlayer Classic 2023 review: Ease of use

Signing up for TaxSlayer Classic is a standard affair. We selected Start For Free for the Classic tier, and walked through the terms of service immediately after creating an account. Next, it shows you the different tiers, to pick which one is best for you; this is an improvement over the hard upsell to Premium the service had last year. We proceeded to work on our taxes in the Classic version.

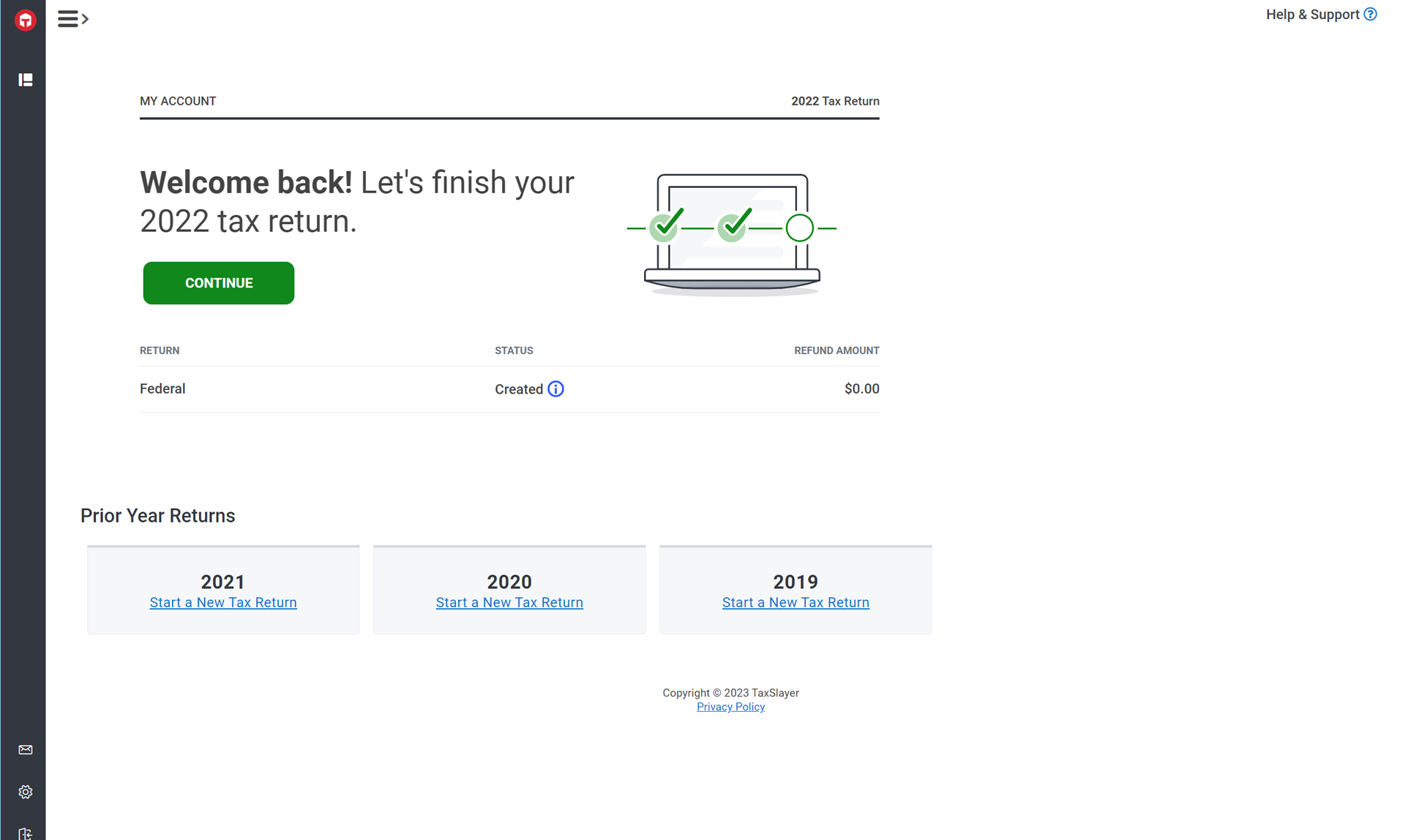

The first stop was to upload our prior returns (if not a returning user). If you’ve used TaxSlayer before–or you navigate to the My Account view–the service welcomes you back and shows either your prior year returns. And if you never did a return for a recent tax year, this screen will even give you a chance to start one for up to an additional three years back–the only one of the services that lets you file previous years’ returns.

Once inside the service, we found a pleasingly minimalist yet styled interface, with a black nav bar along the left side and a slide-out, context-sensitive help pane at right. Large-type headline fonts and graphics help differentiate text, with green and pale red buttons to navigate among options. The left nav bar is sometimes replaced by help articles (more on this later), an incongruent use of the space given the help pane’s locale.

The first intake screen asks for your personal information (name, social, birthday and occupation). The second covers residency information (including part-time and non-resident status), followed by 10 (down from 12) on-boarding questions, among them whether the taxpayer served in a combat zone or was affected by a natural disaster during the current tax year. Amidst these questions, TaxSlayer slips in whether you ever “received, sold, sent, exchanged, or otherwise acquired financial interest in virtual currency during the current tax year.” That’s curiously stilted language to use for cryptocurrency, and the service lacked a learn more info panel to explain. (And when we searched crypto in the help pane, an article popped up with more information on the left.)

Then we added filing status. Rather than a “learn more” pane, this time the service offered up a Filing Status Wizard which walked us through the criteria for filing. Next up was a screen for entering dependents (though no mention here of the child tax credit). Finally, we could enter an IRS Identity Protection PIN if necessary.

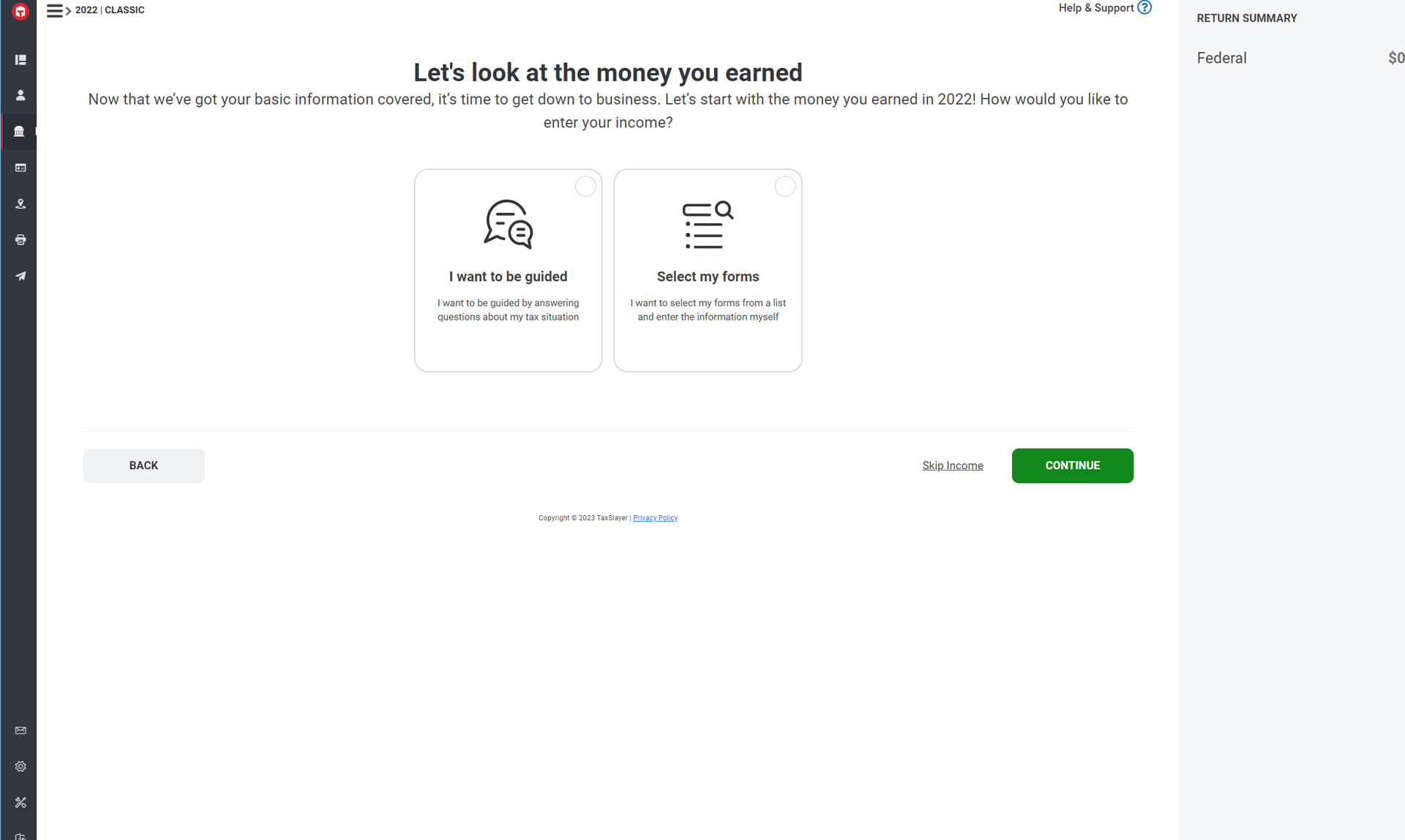

Moving into the meat of the Federal return, TaxSlayer first offers the chance to use Quick File. This improved option lets you enter the numbers or keywords for the forms you need, and then the service walks you through the data entry.

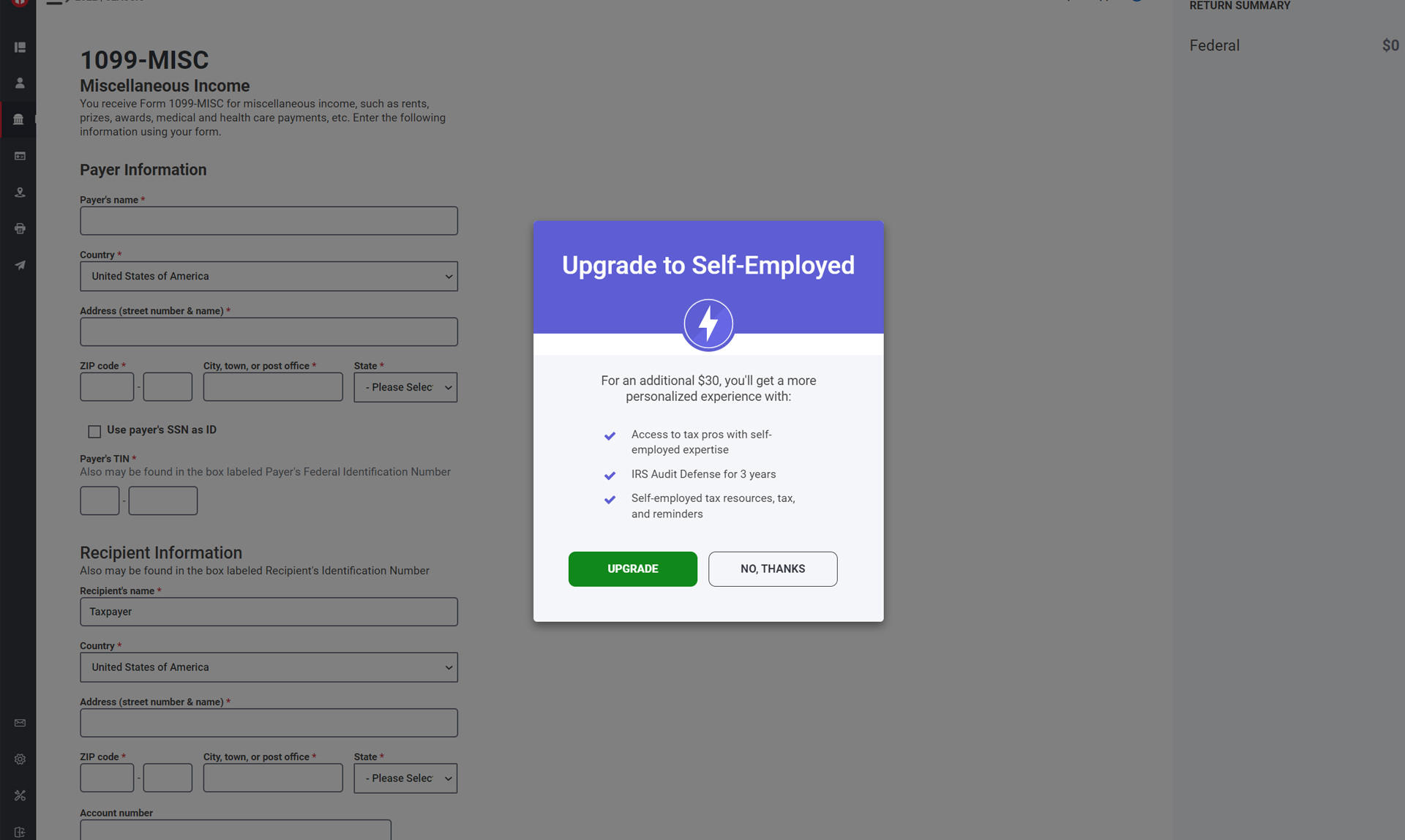

In Quick File, prompts to ask whether you want guided navigation (where you answer questions about your tax situation), or to choose forms from a list. The guided navigation isn’t as extensive as on TurboTax or H&R Block, but it’s more than the free tax services offer. The service first walks you through the Income Guide, where the questions aim to account for all possible forms of income. You can upload a PDF of your W-2 or enter the data manually, but you can’t enter it by taking a photo of the document unless you’re on mobile. Ditto for other forms, like 1099-INT or 1099-MISC (we could enter these in the Classic version, but also got an upsell note indicating for $30 more, we could get the self-employed version, with greater support for such scenarios). Income from investments falls under this guide, including Form 1099-B.

At all price tiers, TaxSlayer lacks strong support for investors, including those with cryptocurrency transactions. You have to import all info manually, although there is an option for uploading a .CSV file. The service is light on guidance of how to handle crypto, pointing you instead to the IRS’ own crypto form.

Overall, we liked navigating TaxSlayer, though the interface is not without the occasional oddity. For example, the cancel button didn’t consistently take us back to the previously completed screen, but rather moved us forward to the next screen. And the guided navigation didn’t always seem consistent when we bounced among different screens.

TaxSlayer’s responsive design makes the service usable across desktop and mobile web. The service also has a dedicated mobile app. We did like the detailed menu on the left nav pane, which lets you navigate at will through different sections of the return; better still was its ability to tuck away to save screen real estate.

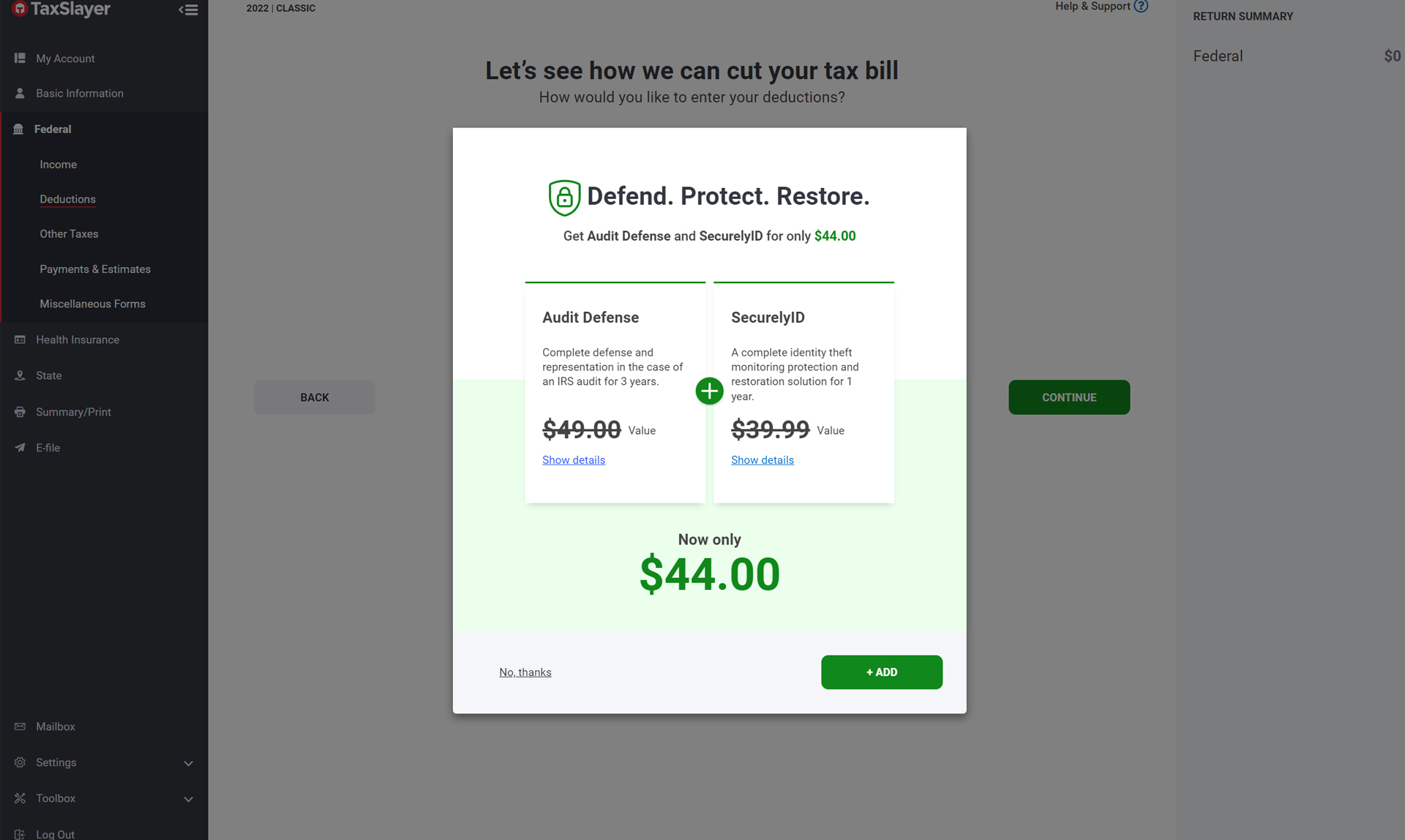

Beware the ongoing upsell. In fact, dismissing the ads quickly got tiresome. As noted earlier, we got an upsell when entering form 1099-MISC; in the guided deductions section, an upsell appeared for adding audit defense and identity theft monitoring for $44.

Still, at the Classic level, you get support for a wider swath of tax forms than with most competitors–including Schedule C business expenses.That alone might be worth the cost of entry and occasional hassles of TaxSlayer.

TaxSlayer Classic 2023 review: Verdict

TaxSlayer Classic is the best tax software if you’re on a budget because it gets the job done for numerous tax situations–including self-employment–in a reasonably efficient manner. And it does so at the lowest price of any paid tax software.

However, TaxSlayer’s help guidance still lacks depth, and its interface lacks the breadth of expert support, visual design and friendly language of our best tax software pick TurboTax Deluxe. If you can spare the extra dollars, we’d suggest springing for one of its competitors, but if you’re on a budget — and don’t mind a bunch of upsells — then TaxSlayer is worth a look.

Melissa Perenson is a freelance writer. She has reviewed the best tax software for Tom's Guide for several years, and has also tested out fax software, among other things. She spent more than a decade at PC World and TechHive, and she has freelanced for numerous publications including Computer Shopper, TechRadar and Consumers Digest.