Tom's Guide Verdict

Attractive pricing and included help from tax pros makes TaxAct a strong alternative to better-known programs, so long as you don’t need crypto guidance.

Pros

- +

Clear design

- +

Covers wider array of tax situations than most services

- +

Tax pro help is free at all tiers

Cons

- -

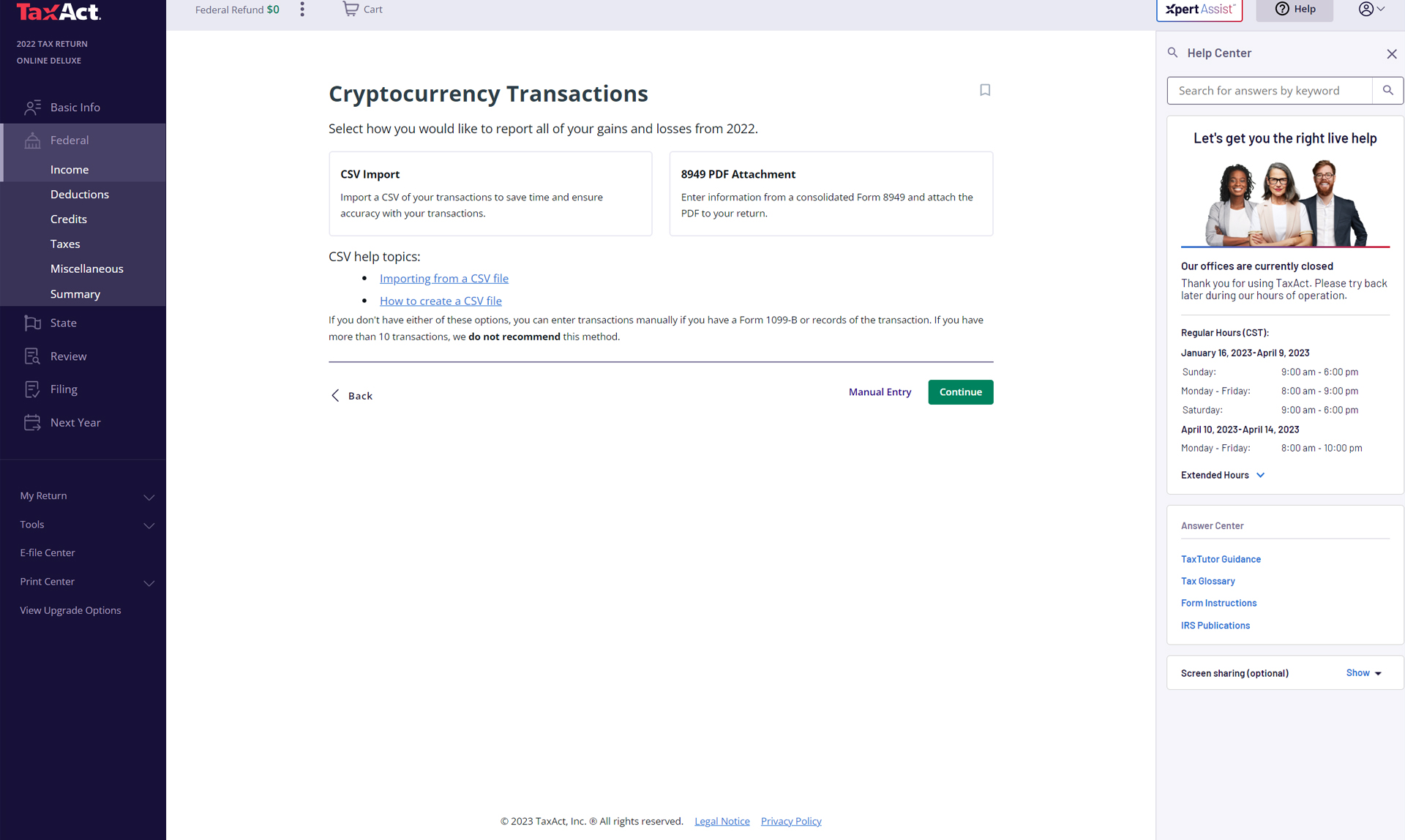

No clear cryptocurrency support or guidance

- -

Different interface entry points can get confusing

Why you can trust Tom's Guide

Mobile app: TaxAct Express iOS, Android

Online support: Screen sharing but not live chat

Phone support: Non-toll-free 8 a.m. to 9 p.m. CT weekdays, 9 a.m. to 6 p.m. CT weekends (longer during peak tax time)

Tax pro assistance: Included for all tiers

TaxAct Deluxe continues to offer one of the most comprehensive tax filing services we’ve seen, and remains a top contender for best tax software. Last year the service introduced free live assistance from tax experts at all tiers; this year, the Xpert Assist feature is only free until 3/20 (pricing after that wasn’t posted at this writing).

TaxAct with Xpert Assist is a competitive value considering that kind of assistance costs extra elsewhere. But TaxAct remains a step or three behind industry behemoth TurboTax. It discontinued its support for a full service tax pro completing your return (that feature was only introduced last year), and it is noticeably behind in cryptocurrency guidance (it now has a section for manually adding transactions or importing a .CSV file in TaxAct Premier).

TaxAct delivers its services at reasonable prices, and with a flowing, facile interface. The service’s design has less hand-holding and guidance than competing products, and caters to those who know what forms they need to complete their taxes.

Editor’s note: This review is of TaxAct Deluxe 2023, which covers the 2022 tax filing year.

TaxAct Deluxe review: Cost

TaxAct covers the widest swath of specific tax-filing situations with its web- and download-based options. Many of these situations — such as support for tax-exempt organizations, trusts, and estates and business options like partnership, C-corporation and S-corporation — are not addressed by either TurboTax or H&R Block. (TurboTax supports some of these through its new small business live product, and H&R Block’s Block Advisor’s product supports these business options, but only when filing with a tax pro through an in-person experience.) TaxAct markets bundles for individual and business tax filing, with up-front pricing that encompasses both situations plus the relevant state tax filing. The variety of options makes TaxAct the best do-it-yourself tax service for businesses or self-employed.

We laud TaxAct’s variety of options, but here will focus on the four core products in its online Federal portfolio. You have to pay for state returns separately.

The primary step-ups from TaxAct's free version have always closely followed the industry standards used by TurboTax and H&R Block, but at lower prices. This year, those prices continue to be lower than either of the behemoths: TaxAct Free, Deluxe ($46.95), Premier ($69.95), and TaxAct Self-Employed ($94.95).

As noted in the intro, Xpert Assist remains free across all tiers, but only until March 20. (Pricing thereafter is not published at this writing.). This service provides live answers from CPAs and other tax experts via phone and screen-share. The inclusion of Xpert Assist across all tiers is a big differentiator for Tax Act, but if you start your taxes later in the game, you might end up paying mightily.

All four of the aforementioned tiers are also available for download, but these prices went up year-over-year ($44.95 plus state return, and $139.95, $149.95, and $159.95, respectively including one state return).

TaxAct distinguishes itself by having TaxAct Estates & Trusts (Form 1041) ($124.95 online and download) for handling filing a return for an estate or trust. And it has TaxAct 2021 Tax-Exempt Organizations ($124.95 download) for those who run an organization subject to sections 501(a), 527 and 4947(a)(1).

In addition to these products, TaxAct has another four business-specific options: built around whether you have a Sole Proprietor (Form 1040C, Schedule C) ($94.95), Partnership (Form 1065) ($124.95), a C Corporation (Form 1120) or an S Corporation (Form 1120S) ($124.95). Each of these options has a downloadable version at a premium ($159.95 for the Sole Proprietor, $199.95 for the rest). TaxAct also offers business filers the chance to get bundles that include individual and business forms.

Audit defense through partner ProtectionPlus costs an extra $49.95 (up $5 from last year).

TaxAct Deluxe review: State filing

TaxAct Deluxe charges extra for state returns. State tax filing costs $39.95 with the free TaxAct service, and $54.95 (a $10 increase) per state on the other tiers of service, unless you're buying one of the home and business bundles or you've downloaded TaxAct. One state e-file per form is included free in bundled scenarios.

TaxAct Deluxe review: Features

As with other tax software, the amount you spend for TaxAct will determine the features and IRS forms support you get. For example, the free product includes access to multiple tax forms, including unemployment income and retirement income (not typically offered by other free products) and will handle the Earned Income Tax Credit and Child Tax Credits. But TaxAct's free version lacks basic interest income and student loan interest, both of which come with TurboTax's free product.

As you step up through the available tiers, you will gain access to additional tax forms; this is where having the expertise to know which forms you need helps (view the comparison chart). The Deluxe version adds a litany of additional forms, including adoption credits, student loans, and Health Savings Account, plus support for Schedule A itemized real-estate taxes and mortgage deductions, and Schedule SE self-employment taxes. Premier adds support for investments and cryptocurrency, sale of home, and K-1 income, while Self-Employed is required for supporting freelance and business income, and a Sole Proprietor version targets single-person business.

TaxAct Deluxe review: Available help

Xpert Assist lets you schedule a call back (only available in some states) or talk live to CPAs and other tax experts and get your tax questions answered for free. The service also supports screen sharing, but not live chat. Hours of operation are more limited than at TurboTax; this service – and technical support – is available from 8 a.m. to 9 p.m. CT weekdays, and 9 a.m. to 6 p.m. weekends (and later during peak tax season in mid-April).

TaxAct provides online support in the form of searchable resources on tax terms and guidance for filing your return. The interface is primitive, HTML; in other words, functional but not visually engaging.

Throughout the service’s interface, you get options for guided data entry; pop-up info boxes to explain specific entry points; and a searchable Help Center pane with links to resources and explanations on TaxAct's website (including tax calculators, and Tax Information hub that provides checklists, law changes, and other resources). That said, guidance and information on newer initiatives like the Child Tax Credit and crypto currency is thin, or non-existent.

TaxAct Deluxe review: Ease of use

Getting started with TaxAct is easy: Pick a product and sign up by entering your email address, waiting for an account verification code to be sent to you, and choosing your username and password. If you are a returning customer after a large gap, the service uses both phone and email to send verification codes. TaxAct lacks the detailed on-boarding questions of competitors like TurboTax.

Once signed in, we clicked the green get started button, and chose the Deluxe tier from the standard product page (or, you can start this way as a new customer). Next we were given the option of importing info from an existing return (which we skipped here) or starting from scratch with filling in basic info. The interface is largely the same as last year, with a few tweaks to the flow and guided data entry. The help pane stays in place along the right, with an Xpert Assist button on the top nav.

We found TaxAct's unfettered interface clear and its direct language appealing. The site is responsively designed to work on mobile and desktop, with a left-hand navigation pane and a main central screen that uses fonts and graphics to make the pages compelling and easy to read. TaxAct also has dedicated mobile apps for iOS and Android.

We could easily follow the prescribed order of topics for completing the Federal return, or choose to jump around by picking something different from the left navigation pane. Within each section, tabs along the top of the screen let you maneuver among the options for that section.

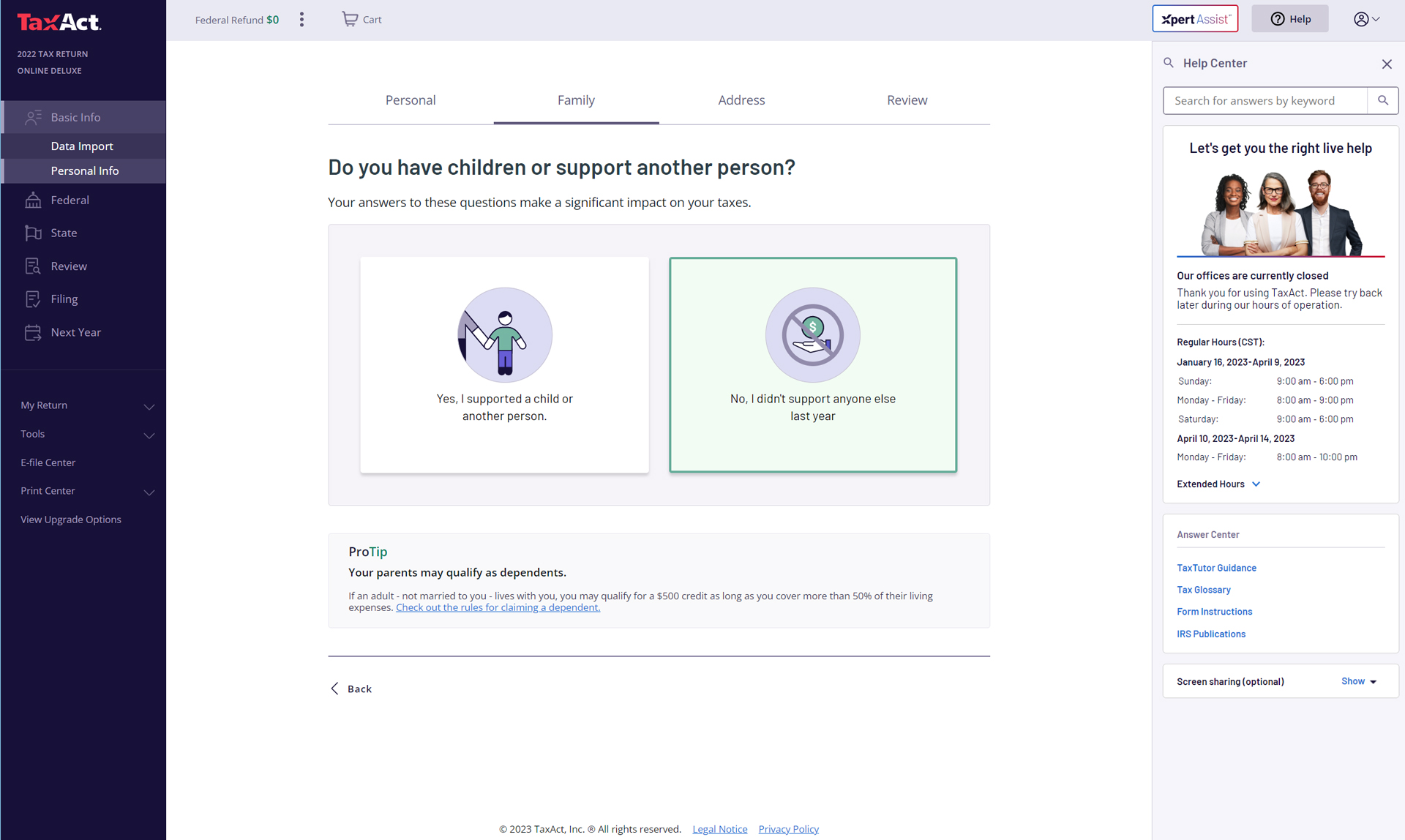

After completing basic information about yourself (personal information, relationship status, dependents, and residency address), you can move into the federal return.

This section is streamlined at the start, to get right to the meat of the matter creating your federal return. If you're unsure what something refers to or what to select, simply click on the information icon to the right of each entry. You'll get a pop-up overlay describing what the field requires.

The structure for entering federal return data is similar, with an option to choose step-by-step guidance that walks you through questions about income, investments, expenses, education expenses, and housing. TaxAct uses this info to find savings, but the company also asks for permission to share your return details with sister company TaxSmart Research LLC to get customized tax tips (you can opt out).

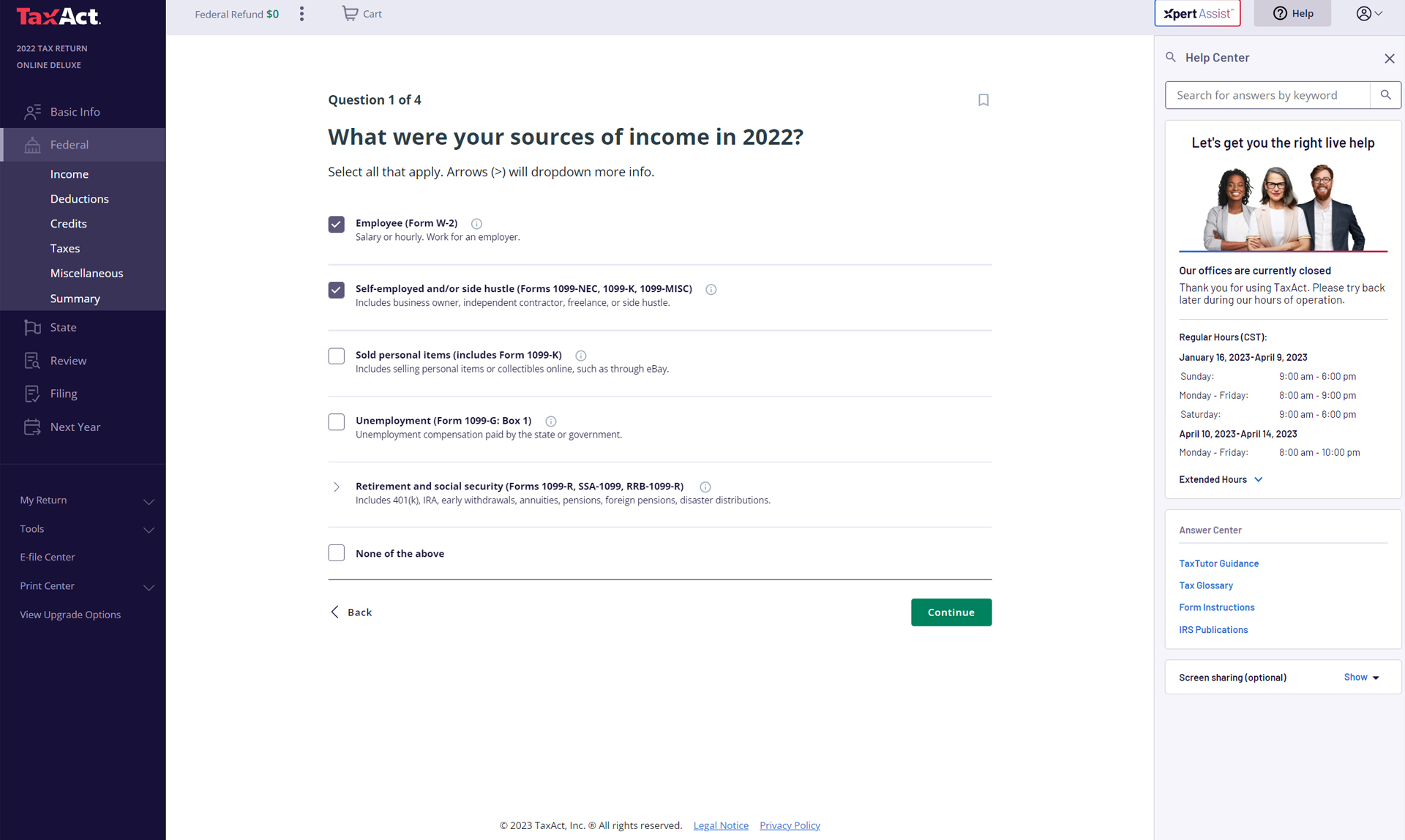

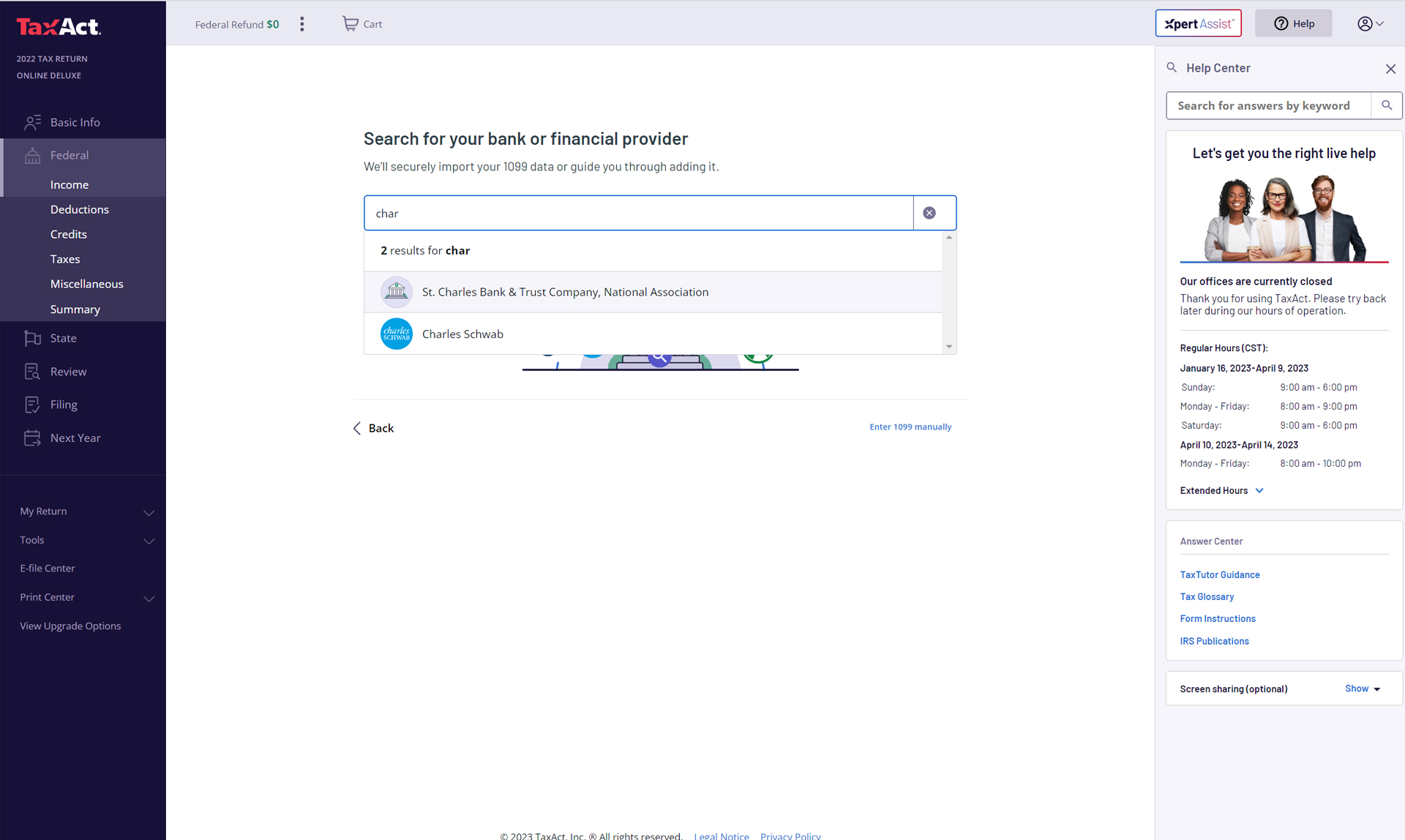

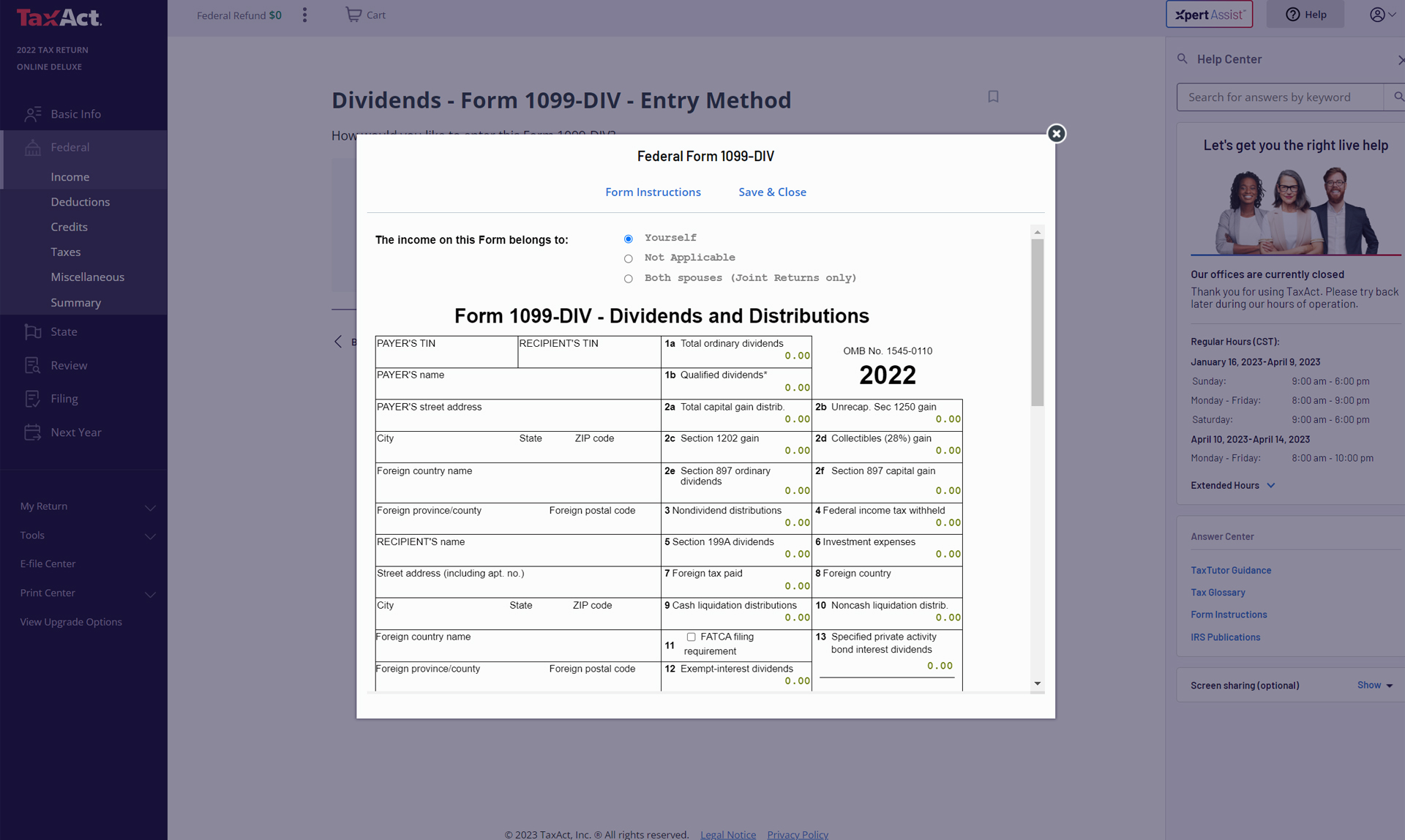

Next you’ll enter your income data. Once you know what you need to enter, you can either import the data manually using guided fields to input data, or you can import electronically from a support institution (info which is more buried and less visual this year as compared with last year).

We could next move through the many fields to fill out via the screen prompts, or navigate via the left navigation pane to move through the process of completing our taxes, navigating each section of the Federal form in sequence: Income, Deductions, Credits, Taxes, Miscellaneous, and then see a summary at the end. Each section was clearly presented and business-like in its approach. When we chose a form not supported by the Deluxe version we tested, TaxAct simply prompted us to upgrade.

That happened when we searched for crypto, too. However, in that example, we searched in the help pane for crypto, and selected the option for the service to jump us to the correct screen for crypto transactions; when we selected an option, we next got the upgrade path to Premier.

Ultimately, while we appreciated multiple ways of entering data, the more we moved around, the more we found the navigation got counter-intuitive (wait, how to get back to step-by-step guidance?) and extraneous (what purpose does the bookmark serve since you can’t see a list of sections bookmarked?).

Another annoyance: TaxAct looks for ways to upsell you, and the service intersperses such ad screens into the experience as you navigate through the product.

TaxAct Deluxe review: Verdict

With a wide swath of online products, clean presentation, and the addition of free interactive support with live tax professionals and a less expensive full service option, TaxAct Deluxe impresses across the board — whether your tax needs are simple, or complex.

If you need guidance in handling cryptocurrency transactions, you won’t find it here — for that, we recommend TurboTax Deluxe. But for most needs, TaxAct offers the best mix of value and assistance among this year’s tax contenders, without going with a free product like Cash App Taxes (formerly Credit Karma Tax) or FreeTaxUSA.

Melissa Perenson is a freelance writer. She has reviewed the best tax software for Tom's Guide for several years, and has also tested out fax software, among other things. She spent more than a decade at PC World and TechHive, and she has freelanced for numerous publications including Computer Shopper, TechRadar and Consumers Digest.