Tom's Guide Verdict

A new entry in the ID protection market, McAfee+ Ultimate’s is a bargain that includes ID theft insurance, monitoring of all three credit agency scores, the ability to lock credit and – of course – its namesake malware protection for an unlimited number of systems.

Pros

- +

Chromebook app

- +

Reasonably priced

- +

TransUnion credit freeze

- +

Three credit bureau scores and reports

- +

Malware protection for unlimited number of users

Cons

- -

No credit simulator

- -

No investment monitoring or credit simulator

Why you can trust Tom's Guide

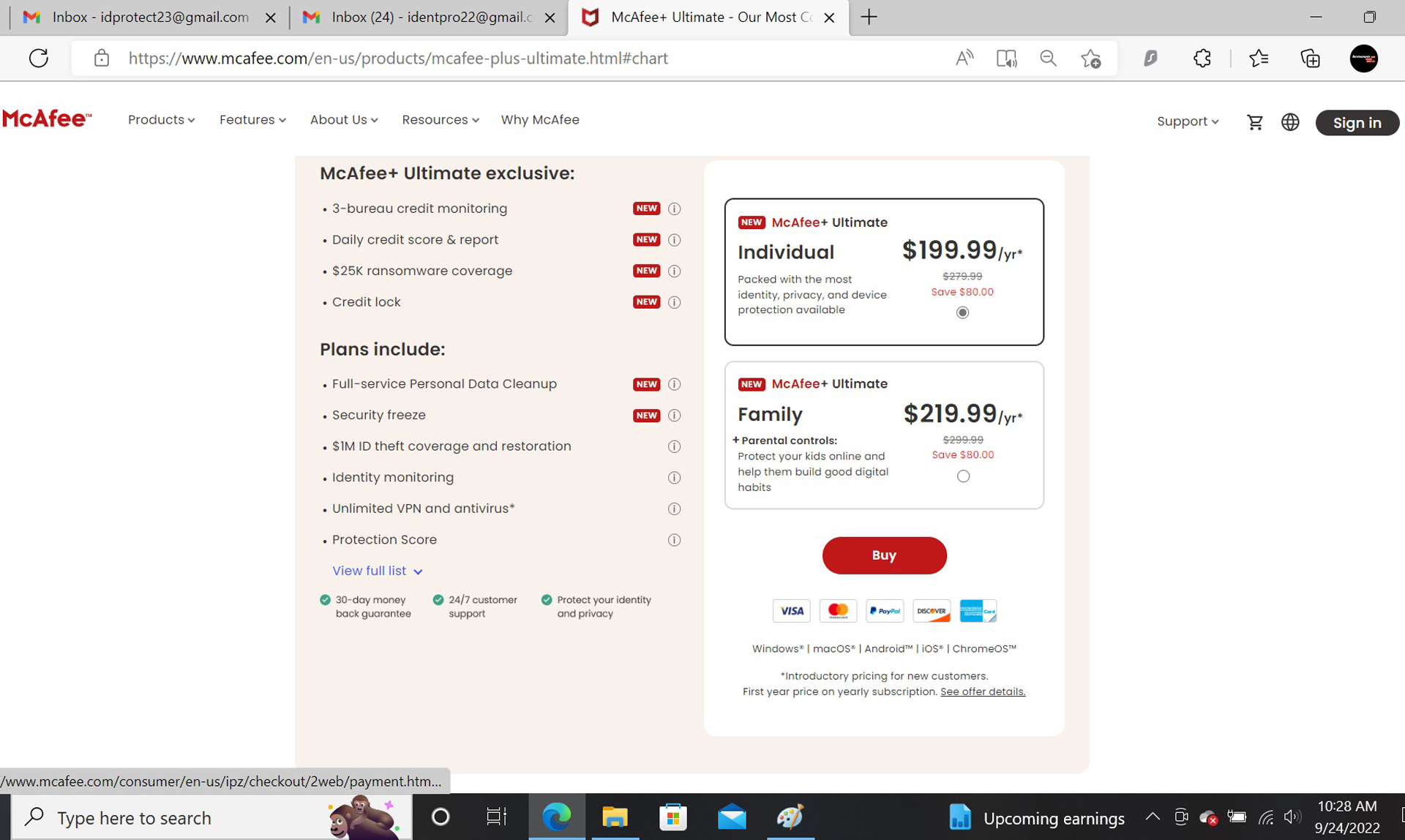

Monthly cost: No monthly plan

Yearly cost: $280

Family plan: $300/yr

No. of bureau scores: 3

No. of bureaus monitored: 3

Frequency of credit reports: Monthly

Type of credit score: VantageScore 3.0

Credit-improvement simulator: Yes

Credit-lock/freeze button: Yes

Security software: AV, VPN, PW manager

Investment account monitoring: No

Max. ID-theft coverage: $1 million

Data Breach Alerts: Yes

Medical Records Monitoring: Yes

Payday loan monitoring: Yes

Sex Offender Alert: No

Title Change Alert: Yes

Two Factor Authentication (2FA): Yes

By adding a variety of identity protection services and insurance to McAfee’s premier security offering, the McAfee+ Ultimate plan combines identity protection with malware defenses and an unlimited VPN. Reasonably priced, it provides the scores and reports from all three major credit agencies and an instant TransUnion credit freeze. Its breakthrough is the inclusion of a ChromeOS-based app, along with software for Windows, Mac, Android, iPhone and iPad, making it among the most comprehensive when it comes to the most-used computing platforms.

Still, it lacks several things we take for granted, like a credit simulator to see the effect of changes in spending and bill-paying as well as the need to set up auto renewal to get the plan’s VPN. There are no monthly plans available for those seeking a short-term relationship and the subscription lacks any investment account monitoring for fraud. Our McAfee+ Ultimate review will help you determine if this is one of the best identity theft protection services with built-in security.

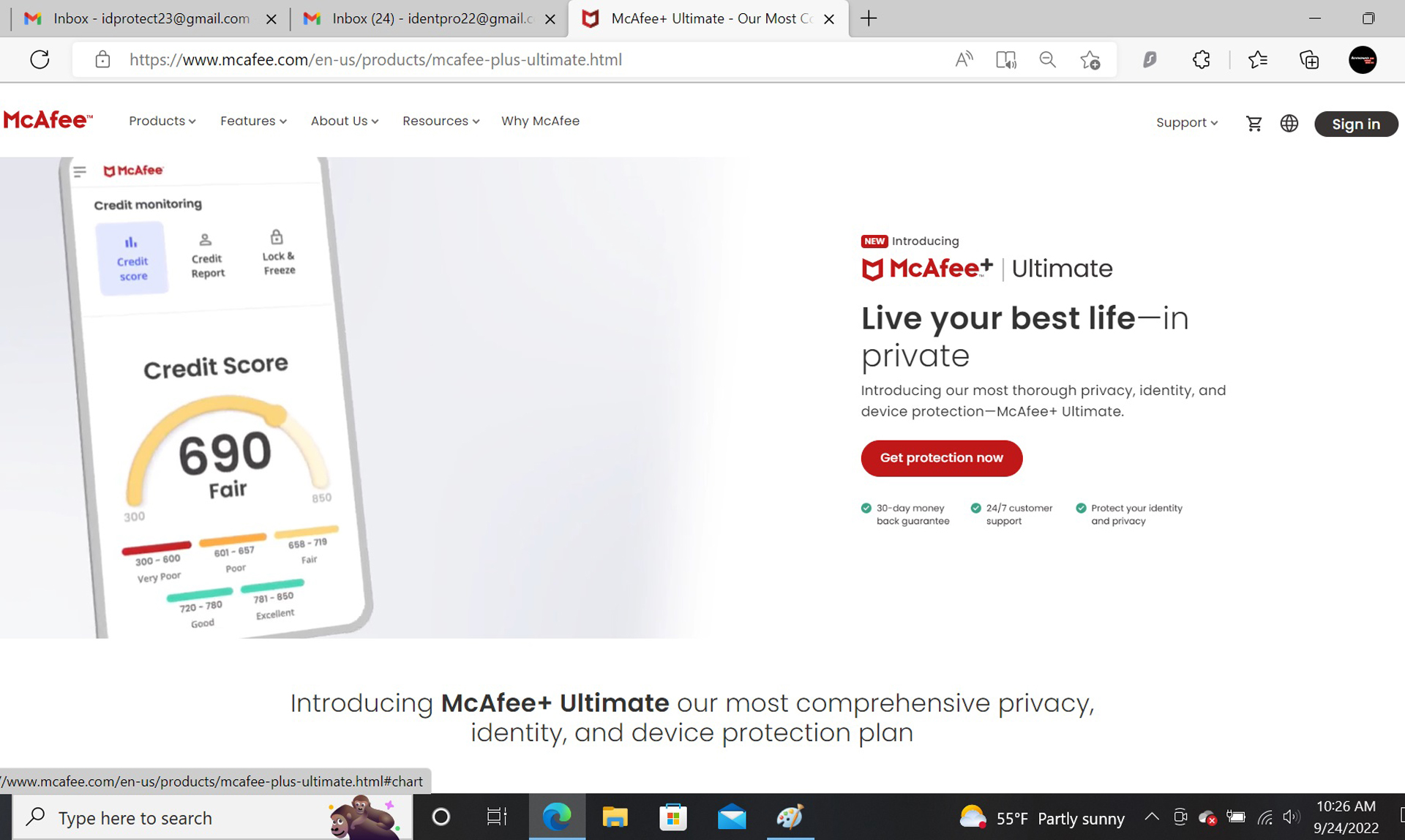

McAfee+ Ultimate review: Costs and what’s covered

There are three McAfee+ plans, starting with the Premium subscription for $140 per year that includes the company’s malware protection, unlimited VPN for five and the ability to scan the web for your personal data. Unlike others, it has support for Chromebooks.

The Advanced plan builds on this by including single bureau (TransUnion) credit monitoring and the power to freeze your account. In addition to helping you remove your personal data from the web, the plan has a $1 million insurance policy provided by TransUnion to help you get your money and life back. It costs $200 a year.

The Ultimate program that I used for several months goes even further. Not only does it add $25,000 to cover ransomware-related attacks, but it increases the credit monitoring, scores and reports to all three major US credit agencies. It also lets you lock your TransUnion account so that no loans or credit cards can be issued. The Ultimate plan costs $280 but can only be purchased on an annual basis.

McAfee got an A+ on the Better Business Bureau’s most recent survey. This makes it one of the most well thought of companies by its customers.

McAfee+ Ultimate review: How we tested

To get an in-depth look, I signed up for McAfee+ Ultimate in the late summer. I paid for it with my credit card and was reimbursed by Tom’s Guide.

Several times a week, I checked on my credit scores, new inquiries and data breaches. Over the three months I worked with the service, I used a variety of computers with the browser-based interface as well as the McAfee My Security app with my Samsung Galaxy Note 20 phone. I canceled it at the end of the period.

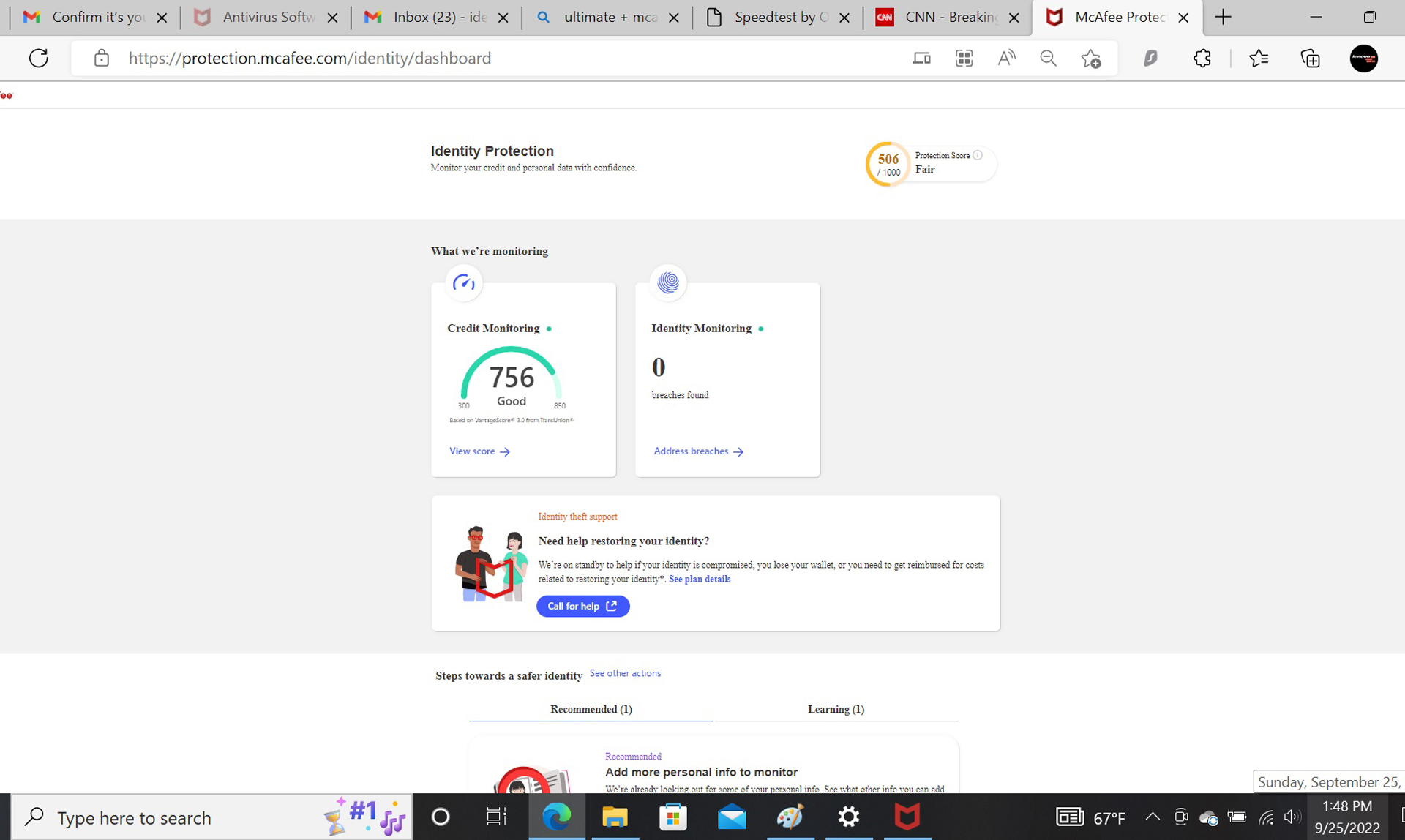

McAfee+ Ultimate review: Credit scores and identity monitoring

While its legacy is in malware protection, credit monitoring, scores and reports are at the center of the McAfee+ collection. The company’s Advanced plan includes single bureau scores and alerts and the Ultimate subscription that I signed up for covers all three. It also has a way to lock your TransUnion account, preventing any new financial activity.

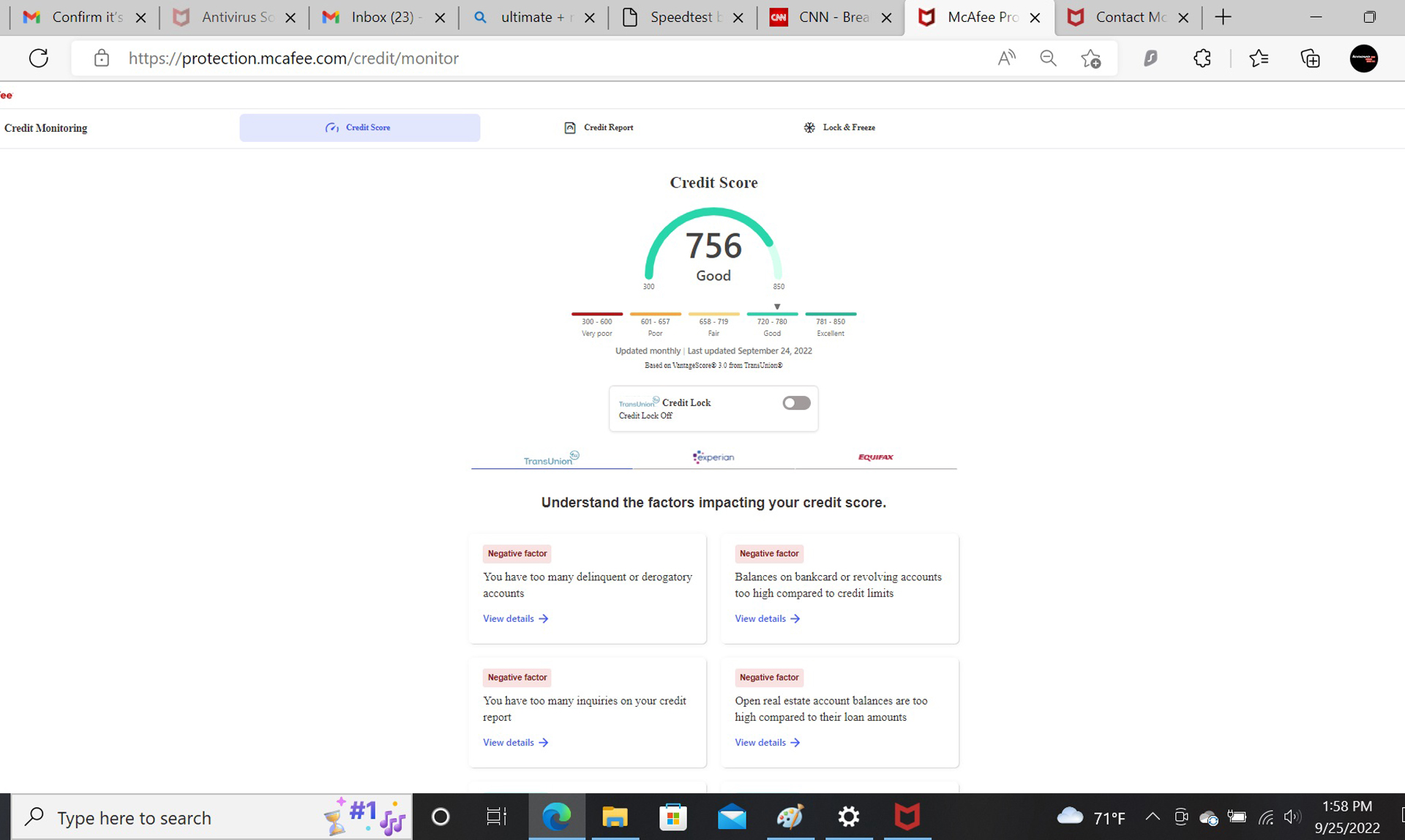

The plan includes access to the VantageScore 3.0 which is a good substitute for the more popular FICO score. It can tell you if you’re ready to apply for a loan or mortgage and potentially save a little embarrassment if you’re not.

As a new service, McAfee+ falls short of the best with no way to monitor changes to your home’s title. It also lacks any sex offender alerts, but the company plans to expand its coverage and features as time goes on.

There is McAfee’s Personal Data Cleanup feature that scans the top data brokers for instances of your personal information. While the Premium plan only tells you what’s there and provides contacts for clearing them, the McAfee+ Advanced and Ultimate subscriptions include a service for erasing the data. Others charge extra for this.

While the included McAfee’s WebAdvisor browser add-ons can help steer you clear of risky links, that’s it. Other ID protection services actively monitor your investment accounts for signs of hacking or identity take-overs, McAfee+ Ultimate does not.

McAfee+ Ultimate review: Insurance and services

Rather than self-insure (as Norton LifeLock does) or underwrite the protection with AIG (as many competitors do), McAfee has contracted the identity protection portion of its suite to TransUnion. It’s similar in approach to the relationship between Bitdefender and IdentityForce.

The coverage includes $1 million to pay for lawyers, accountants and identity restitution specialists to get you your life back. It covers lost funds due to fraud and will pay for lost wages and travel.

There is one goodie that the Ultimate plan has for those worried about being hit by a ransomware attack. The plan also has an extra $25,000 to help you get your data back or pay the ransom to get your data back. No other ID protection plan does that.

McAfee+ Ultimate review: Notifications and alerts

The plan has a slew of alerts and notifications available. They include credit score changes that can be an early warning of worse to come as well as notifications of things like balance changes and unusual activity. There are also data breach alerts if your data appears online.

These warnings can be set to arrive via text, email or just by looking at the interface’s top page. It’s subtle, but if something’s fishy, the bell icon swings back and forth to indicate something’s up. Others have a static icon or a number overlaid on it to show how many alerts are pending.

Neither of the McAfee identity protection services can keep an eye on your phone and SIM card for signs of hacking or abuse. Norton LifeLock recently added this valuable service. The service sent me five alerts over my three-month evaluation period that ranged from credit inquiries to data breaches.

McAfee+ Ultimate review: Setup

The first step in protecting my identity and systems was to go to the McAfee web site, find the Ultimate + plan and click on “Get protection now”. After entering my email address and password, I needed to pay with a credit card or PayPal.

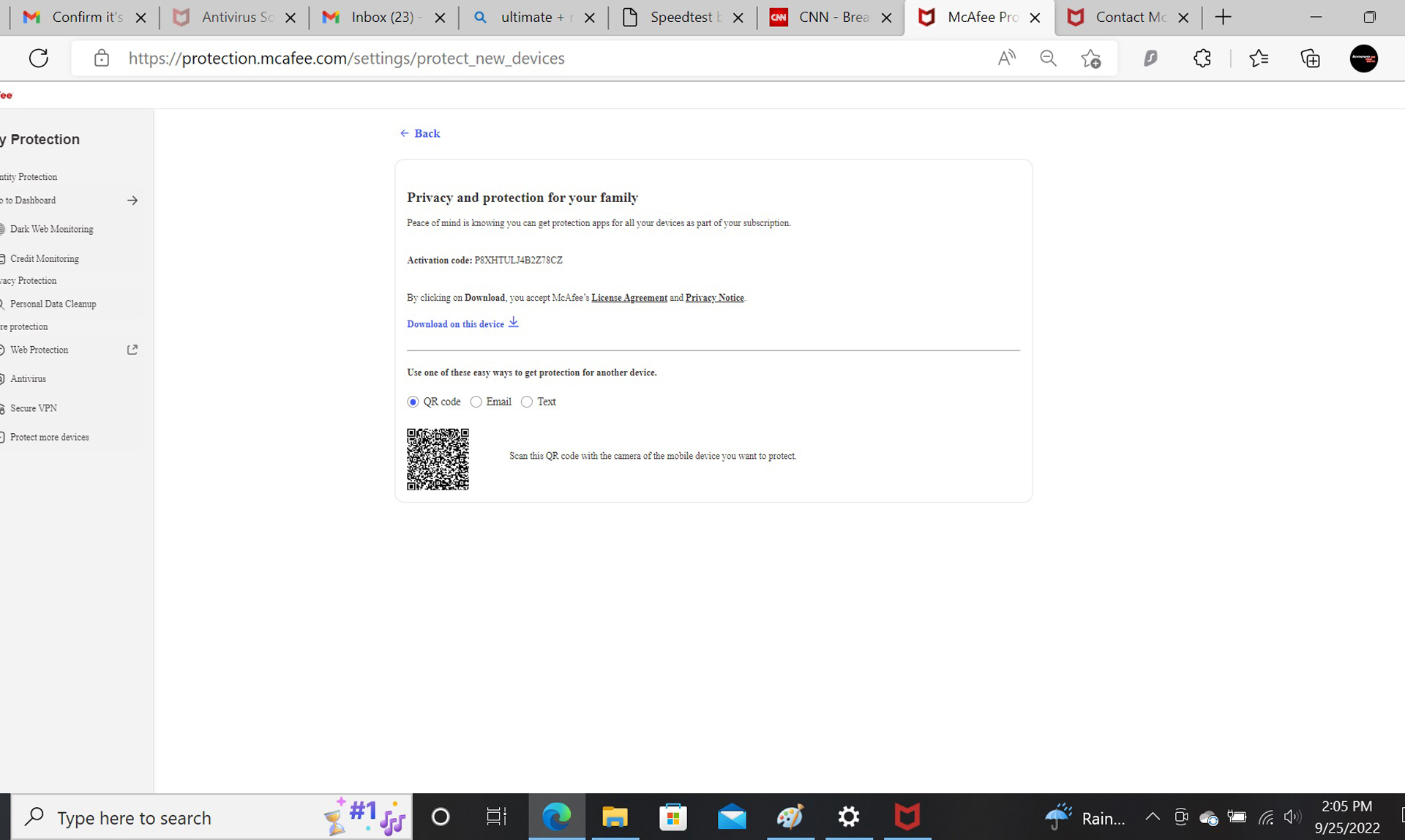

Showing McAfee’s malware first philosophy, I needed to choose between protecting the system I was using or a different one with McAfee’s Total Protection plan. This took a few minutes, followed by verifying my identity with an email.

A few seconds later I was able to log in to the Dashboard, but the meat of the protection is in McAfee’s app, although with a twist because its box for ID Protection leads to a web interface, making it needlessly complex. There I needed to enter my name, address, Social Security number, date of birth and a phone number to get my credit scores. Following a phone verification, I was shown my credit scores. All told, it took a little over 15 minutes.

Finally, I went to the Play Store and got the McAfee My Security app for my Note 20 and installed it. It added an extra minute.

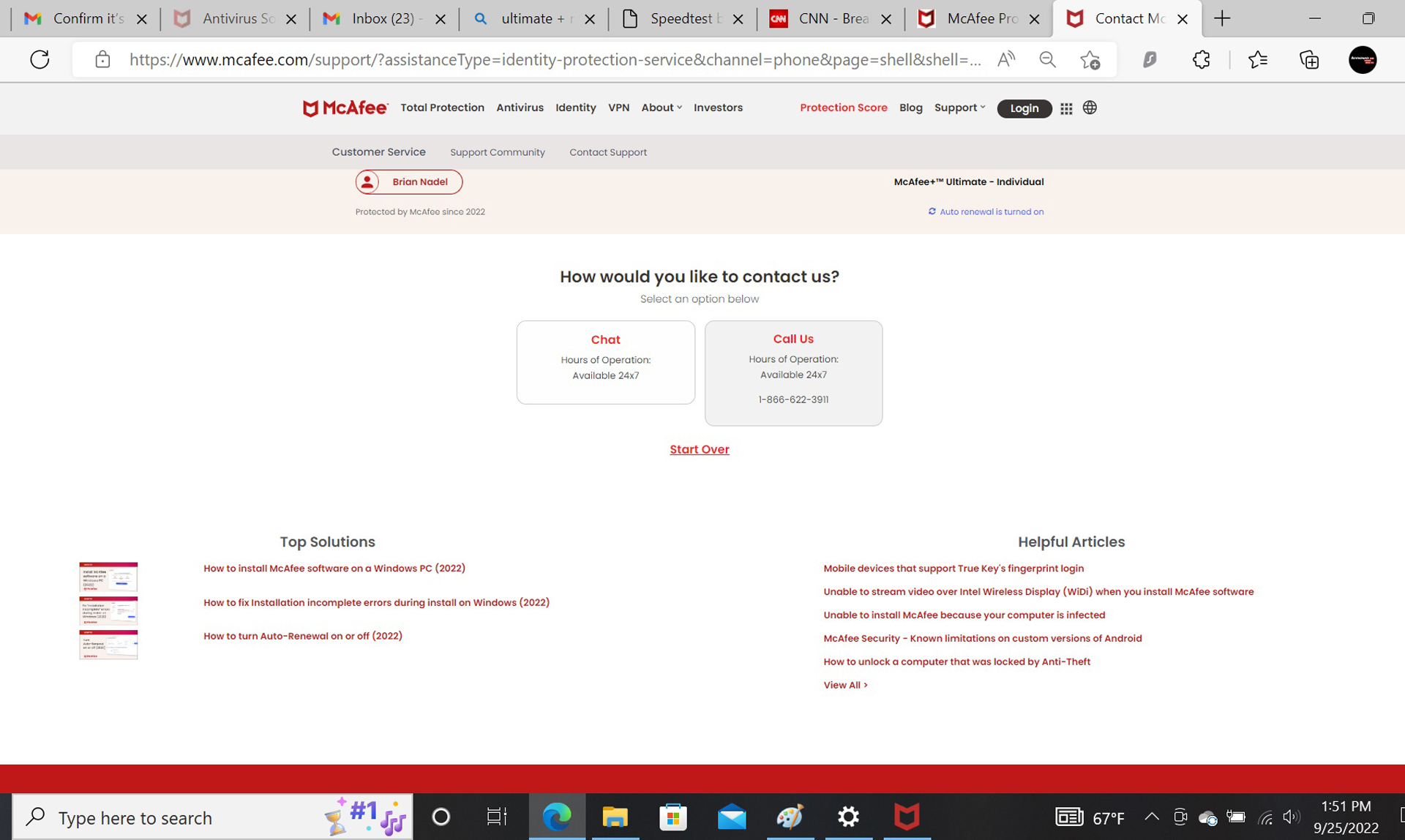

The tech support people at McAfee helped me out of a jam when at first, I couldn’t figure out how to log into my account. It’s a little convoluted but was made easier with their advice.

McAfee+ Ultimate review: Interface and utilities

Using McAfee+ Ultimate is different from the others, and that’s good and bad. The good part is while most competitors take a pure online approach to showing your identity issues, McAfee starts at the app and then transfers to the online ID protection portion, providing an extra entrance ramp. On the downside, due to the different providers, it can take upwards of 24 seconds to complete the two-step log on.

Although the browser interface makes a good attempt to copy the app’s design cues, it requires zooming the visuals out to about 50% to almost take it all in.

Below the surface is not only where the credit scores from all three bureaus are, but something I wish the others would add: in plain simple language, there are four of the most negative elements on a credit report, including delinquent payments, high balances, credit inquiries and too many real estate loan requests. It doesn’t show the actual items or have credit simulators for running what-if situations though.

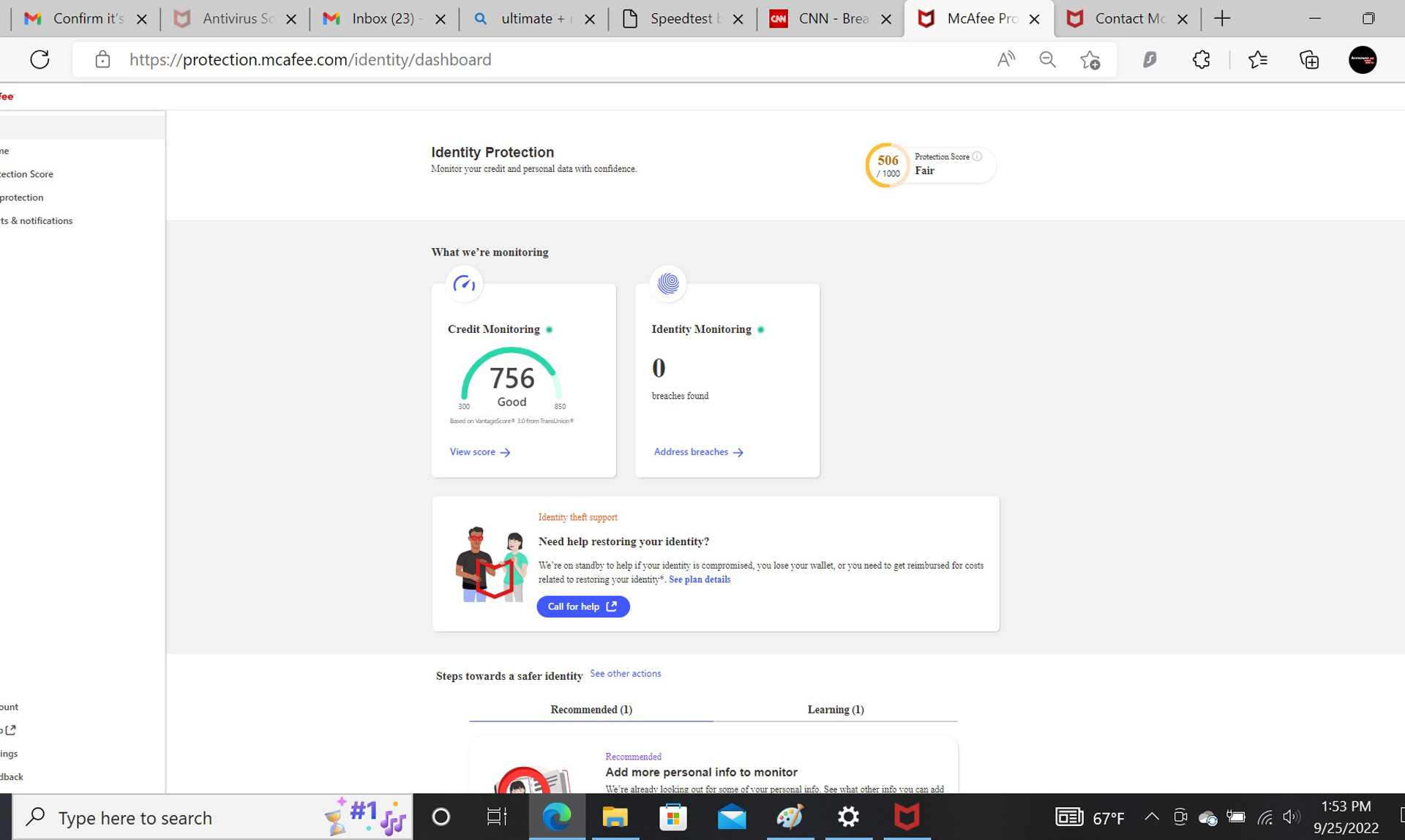

The current credit score is top and center with the number of recent breaches next to it. Below are instructions on getting help for identity theft. You will have to call them, however, but — thankfully — the number is there.

Along the left is a menu of the plan’s major elements, although the tiny icons are hard to figure out until hovering over them to get hints. They range from Home and Protection Score to My Protection and Alerts & Notifications. The last element’s bell icon swings back and forth when there’s something important. Below are administrative items like Account, Help and Feedback.

The four square icon slides out an extra level of tabs to take malware and ID protection in. It shows everything of value and can even create a QR code for a phone or notebook to scan.

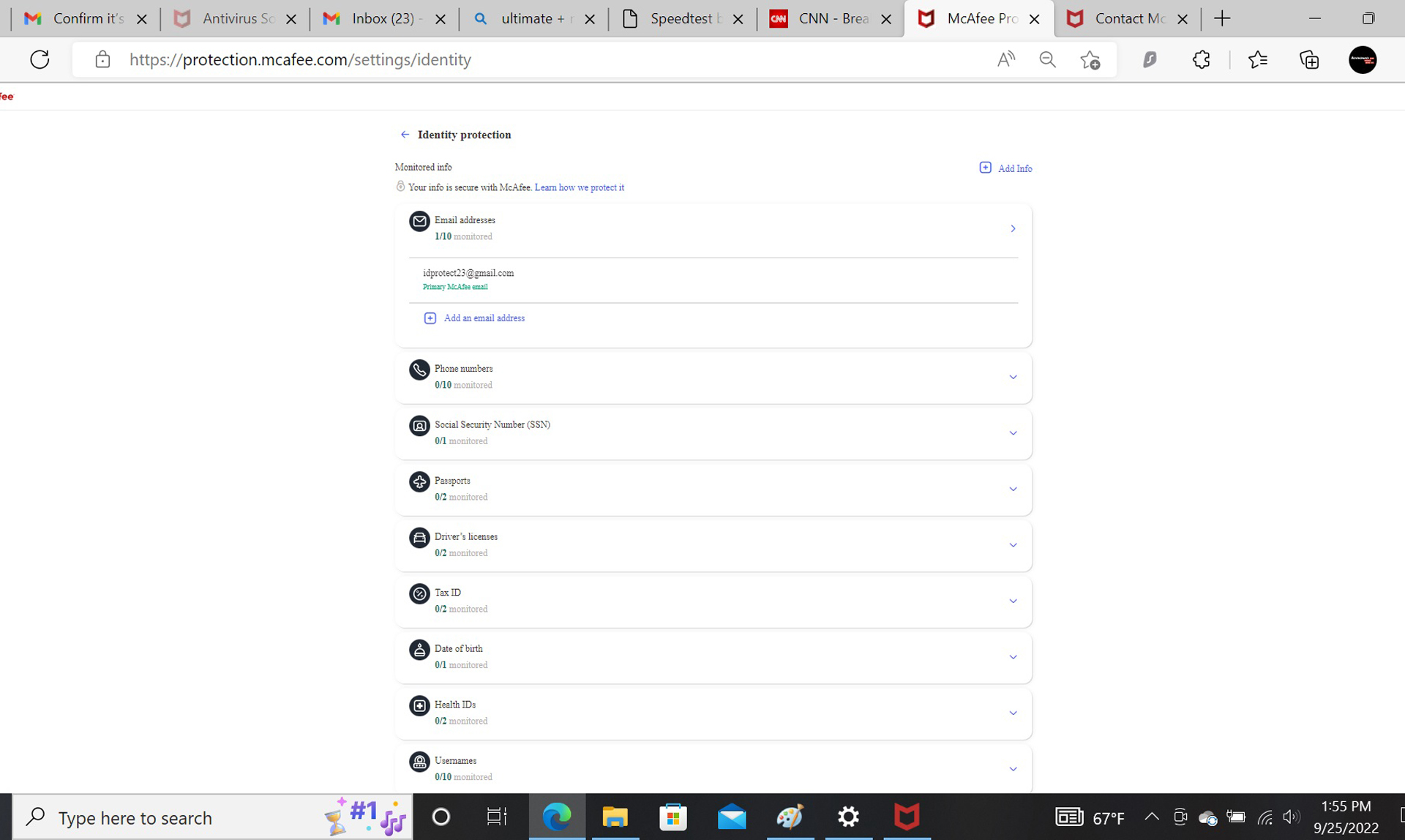

A link to Settings is there and it’s where you can see what aspects of your life are being monitored and add new information, like an extra email account, new phone number or social media presence.

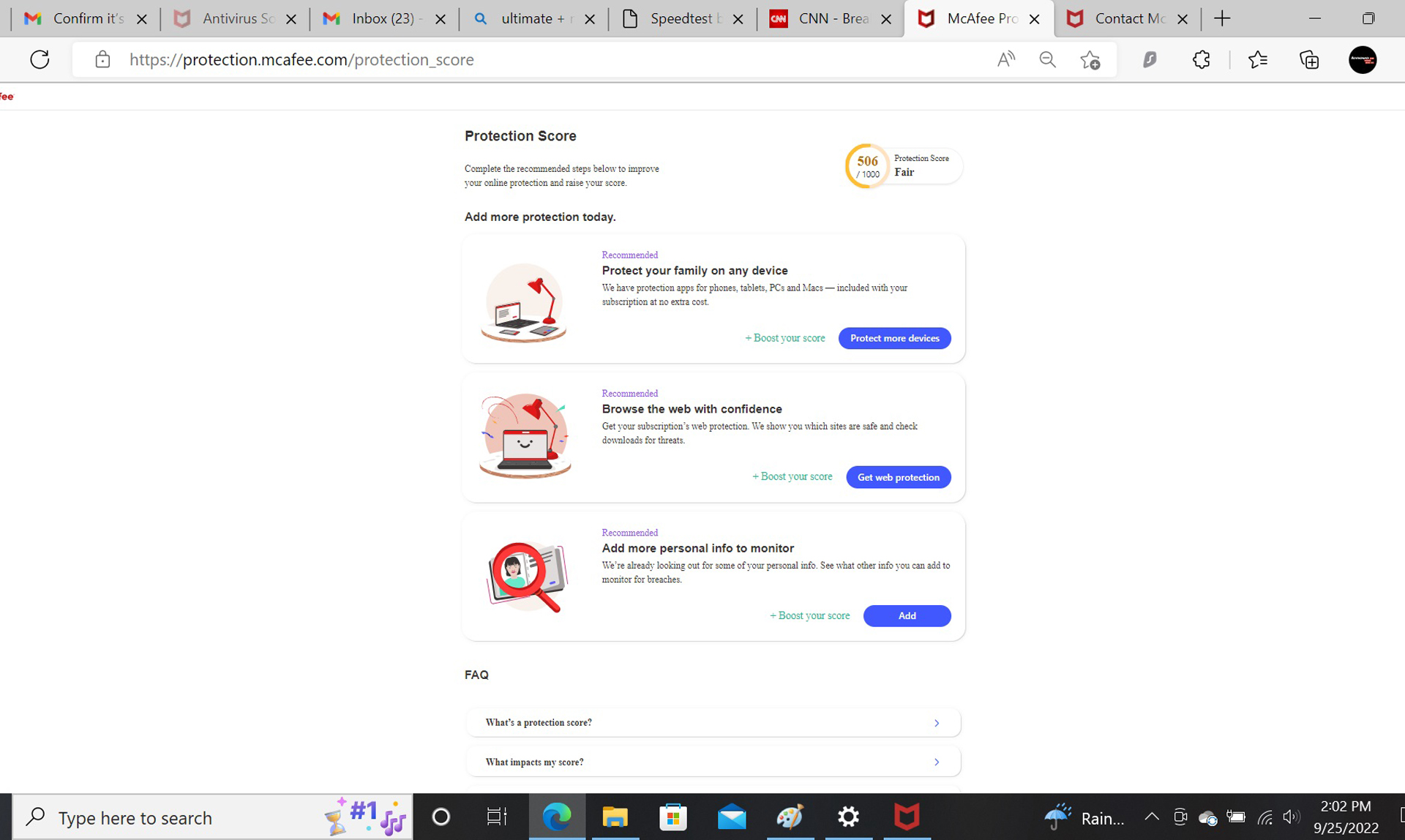

A main element that brings together all aspects of the Ultimate plan is McAfee’s Protection Score. It shows the current score as well as the elements that need to be added or changed to raise the score. It may seem like a game, but the payoff is better security.

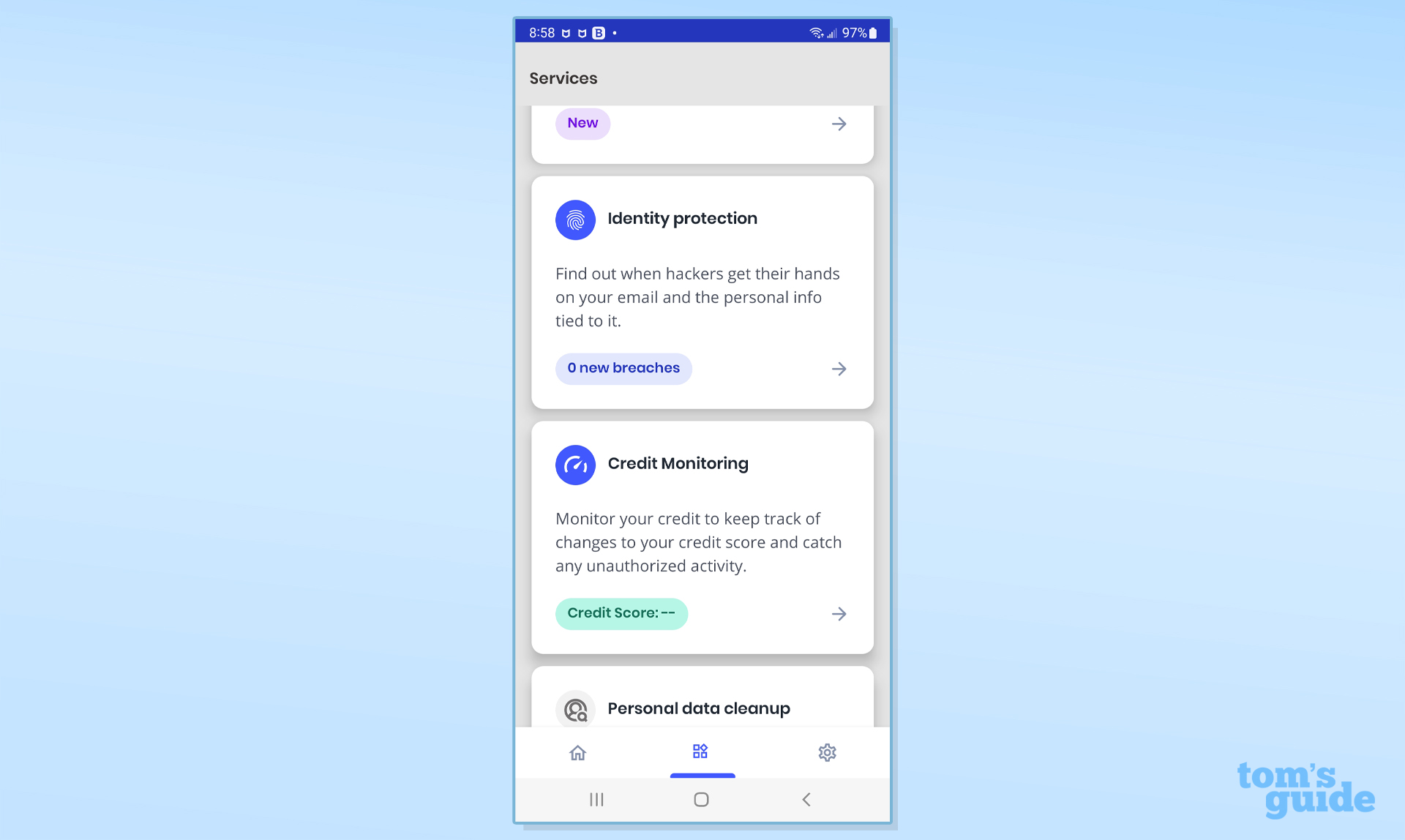

The Protection Score is also available via the app. Unlike many of the others that are focused on identity protection, the McAfee approach covers all the security bases with malware defenses, VPN access and the personal data cleanup. It’s all in one — very spread out — space. In fact, the Identity Protection and Credit Monitoring portions of the services are not at the top but roughly midway down the app’s list of eight functional boxes.

As is the case with Norton LifeLock, McAfee lacks articles on recent break-ins, data breaches and how to improve online hygiene. Some of this is contained in the section that urges you to boost your Protection Score though.

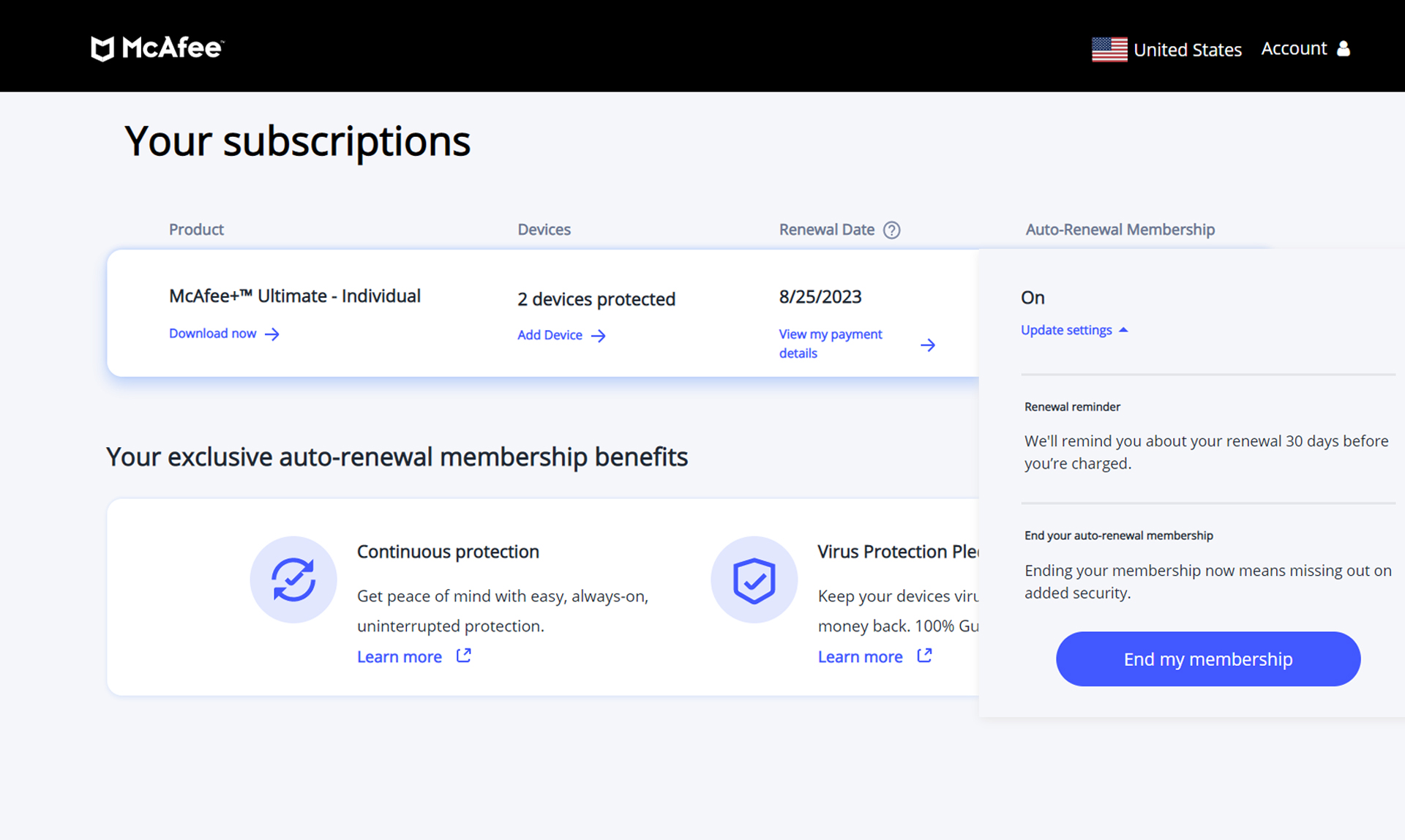

McAfee+ Ultimate review: Cancellation

There’s no way to cancel the McAfee service online, but I was able to stop the auto renewal process so nine months from now, I would be free of the service. It took a lot of digging, however, that started at the app’s Account, then Subscriptions and Update Settings.

There I clicked on “End my Membership”, although all I was doing was ending the auto renewal process. I had to fill out a survey and then I was done.

McAfee+ Ultimate review: Verdict

A newcomer to the crowded field of identity protection, McAfee+ Ultimate is a good first effort that puts together three bureau credit monitoring and the ability to quickly impose a freeze, but it lacks useful things like investment monitoring and credit simulators. The true gem is McAfee’s malware protection, VPN and other security defenses for an unlimited number of computers. On the downside, all the plans are annual only which means you need to truly commit to the service.

Brian Nadel is a freelance writer and editor who specializes in technology reporting and reviewing. He works out of the suburban New York City area and has covered topics from nuclear power plants and Wi-Fi routers to cars and tablets. The former editor-in-chief of Mobile Computing and Communications, Nadel is the recipient of the TransPacific Writing Award.