Tom's Guide Verdict

With an emphasis on credit monitoring and scores, IdentityIQ falls short on identity protection areas, such as checking on investment accounts, home title changes as well as payday loans while being one of the most expensive plans available.

Pros

- +

Credit simulators

- +

Monthly 3-bureau credit reports

- +

Includes up to three children

- +

Inexpensive Bitdefender antivirus software

Cons

- -

Expensive

- -

Lacks 2FA

- -

No investment account or payday fraud monitoring

Why you can trust Tom's Guide

Monthly cost: $30

Yearly cost: $306

Family plan: Up to three children included

No. of bureau scores: 3

No. of bureaus monitored: 3

Frequency of credit reports: Monthly

Type of credit score: VantageScore 3.0

Credit-improvement simulator: Yes

Credit-lock/freeze button: No

Security software: No

Investment account monitoring: No

Max. ID-theft coverage: $1 million

Data Breach Alerts: Yes

Medical Records Monitoring: Yes

Payday loan monitoring: No

Sex Offender Alert: No

Title Change Alert: No

Two Factor Authentication (2FA): No

By focusing on credit monitoring, Identity IQ Secure Max provides the scores and reports from the top credit bureaus but falls short on things like investment account monitoring or checking on payday loans made in your name. The service’s credit simulators are a big help but none of Identity IQ plans have two factor authentication. The pay-off is for families because the top plan includes ID protection for children, making it the one to get for those with a large brood.

Our IdentityIQ Secure Max review will help you decide if this the best identity theft protection service for you or if you would be better off with a service that focuses more heavily on identity theft prevention as opposed to credit monitoring.

IdentityIQ Secure Max review: Costs and what’s covered

With three plans to choose from, IdentityIQ has a trial with a twist. You pay $1 to get started and then the full price comes into effect a week later to provide a taste of the service.

The big change from last year is the inclusion of an annual plan discount. With it, users save 15% if they sign up for a year at a time. For example, the already inexpensive $10 a month Secure Plus plan is a genuine bargain at $101.90 a year. It pairs single bureau credit scores and monitoring with $1 million in identity insurance to get your digital life back. The company not only keeps an eye on your Social Security number but specializes in thwarting synthetic identity theft where several factors are combined to reveal your identity.

The Secure Pro plan ups the credit bureau coverage and scores to all three major agencies. It adds full reports every six months. The $20 a month or $203.90 annual service adds alerts to crimes committed in your name as well as credit score change alerts.

IdentityIQ’s flagship plan is the $30 a month Secure Max subscription that I signed up for. It costs $305.90 yearly. Secure Max includes monthly credit reports from the top three bureaus and an extra $25,000 in insurance for other members of the family. The included credit score simulator can help solve what-if questions in terms of taking out new loans or paying off credit card balances.

All of IdentityIQ plans can be bolstered with the equivalent of Bitdefender Total Security for just a few dollars a month. It adds $2 a month for the Secure Pro and Plus plans or $3 for Secure Max. On its own, the software costs $160 a year.

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

A bonus for families is the ability to cover up to three children who are under 24 years old and live with the family. This service includes Social Security number monitoring and alerts for them.

The most recent report from the Better Business Bureau rates IdentityIQ’s parent company, Identity Intelligence Group with a B+ grade. That’s a step down from the top ratings, but more than adequate.

IdentityIQ Secure Max review: How we tested

In the late summer of 2022, I set up IdentityIQ’s Secure Max plan, paid for it myself and was reimbursed by Tom’s Guide. Over the next three months, I used IdentityIQ with the service’s web interface using a variety of systems as well as with the mobile app and my Samsung Galaxy S20 phone. I canceled the service after three months.

IdentityIQ Secure Max review: Credit scores and monitoring

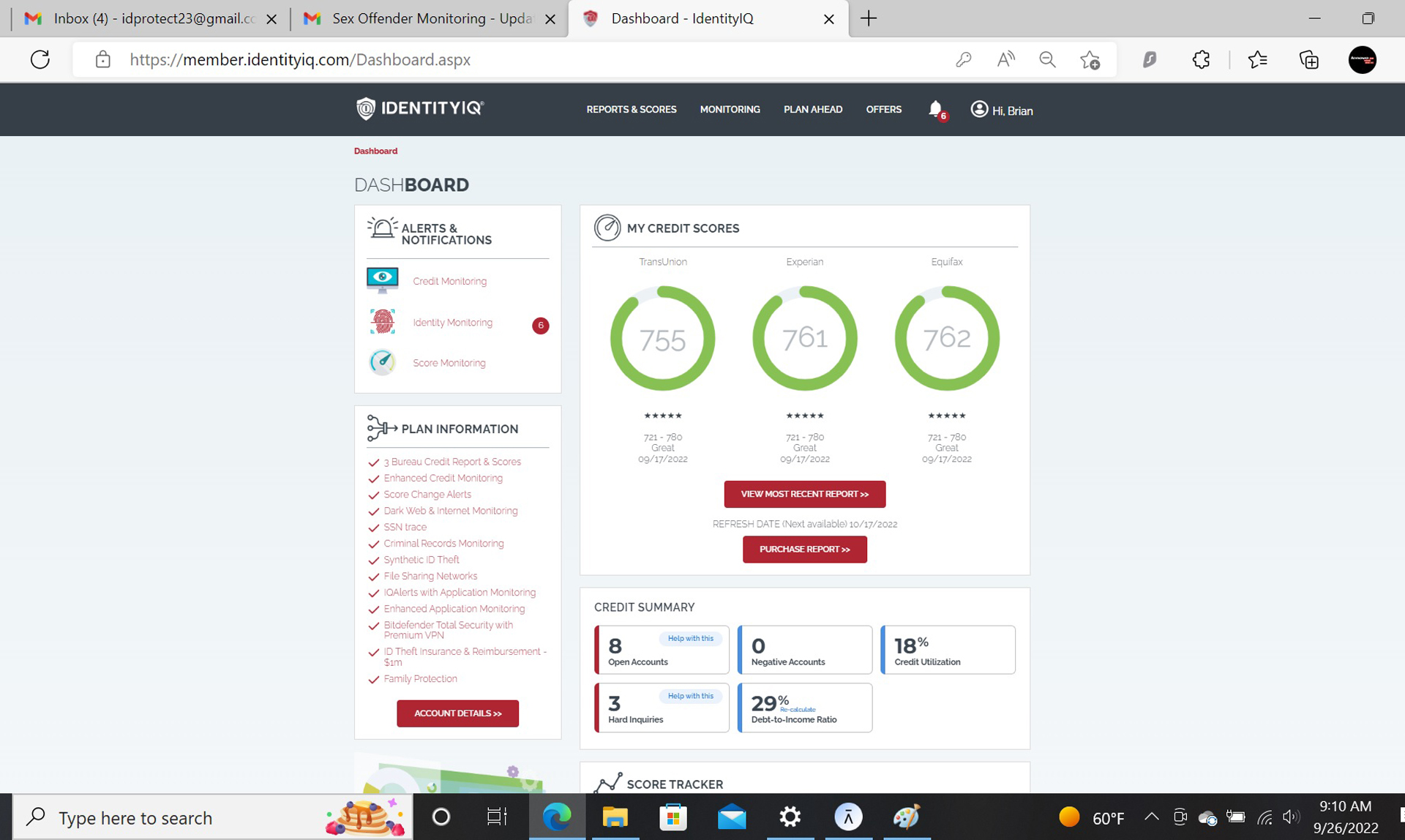

The Secure Max subscription delivers VantageScore 3.0 scores that are a good substitute for creditworthiness. If you want FICO scores, the company’s MyScoreIQ provides them with a variety of plans.

It also monitored my bank and credit card accounts looking for potentially fraudulent activity. My favorite is the overdraft alert that will, hopefully, get me to move extra money into the account to avoid a penalty. However, it isn’t complete protection because the Secure Max service wasn’t able to look at my retirement investments or my PayPal account for potential illegal activity.

None of the IdentityIQ products can freeze your credit with a click or tap. Instead, you would need to talk to one of the company’s agents to do so.

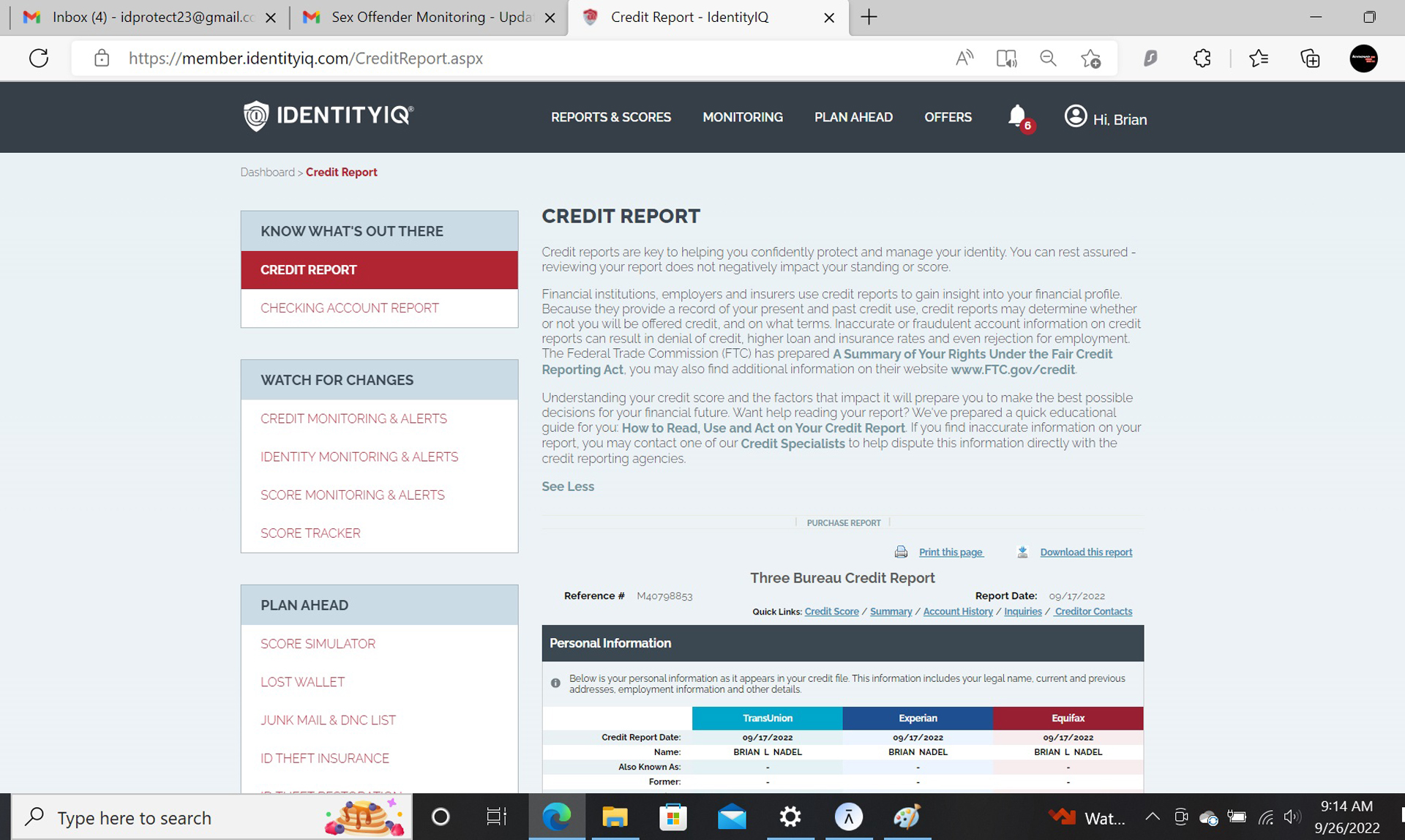

The Secure Max plan includes monthly access to the full credit reports. Others provide this valuable anti-fraud material on a quarterly or yearly basis or not at all. If you’re anxious about a particular alert or recent scam attempt, a $10 instant report is a click away.

In addition to tracking national and international crime databases, IDIQ monitors court records for your name in association with a criminal or bankruptcy proceeding. However, it lacks access to payday loan information but can search for your vital data on the dark web. The service is also unable to reach into data brokers’ databases for your personal information. Closer to home, Secure Max keeps an eye on the postal service for an address change in your name but can’t alert you to a title change for your property.

IdentityIQ has made an effort to identify and stop synthetic identity theft, where several small pieces of data (like incomplete Social Security numbers and addresses) are combined to reveal your data and open you to fraud or identity theft. Others ignore this rapidly growing aspect of ID theft.

IdentityIQ Secure Max review: Insurance and services

Underwritten by AIG, IdentityIQ’s insurance component covers the result of any identity theft or fraud. Regardless of which IdentityIQ plan you get, they all top out at $1 million, half what Bitdefender Ultimate Plus provides, although the Secure Max plan I used added $25,000 for extra family members.

It covers the gamut of identity theft responses to help you become whole again, from lawyers to consultants to investigators to accountants. The response can include granting them a Limited Power of Attorney for these activities so that you can concentrate on getting the rest of your life together.

The plan includes getting new documents, like a driver’s license, passport and Social Security card (and new number). There’s up to $1,500 a week for five weeks to cover lost wages if you need to miss work. It can also help if your wallet (or purse) has been lost or stolen.

IdentityIQ Secure Max review: Notifications and alerts

The alerts that IdentityIQ provide range from an overdraft warning for your checking account to signs of credit card fraud to if your personal information has been involved in a recent data breach. Unfortunately, there’s no sex offender alert that shows the offender’s location; others provide this.

Available via the company’s web interface or the mobile app, IdentityIQ’s alerts show up prominently. If you set it up when registering, IdentityIQ’s servers will send alerts via text messaging. Over my three months subscribed to the service, I received nine alerts. They were mostly about dark web breaches.

IdentityIQ Secure Max review: Setup

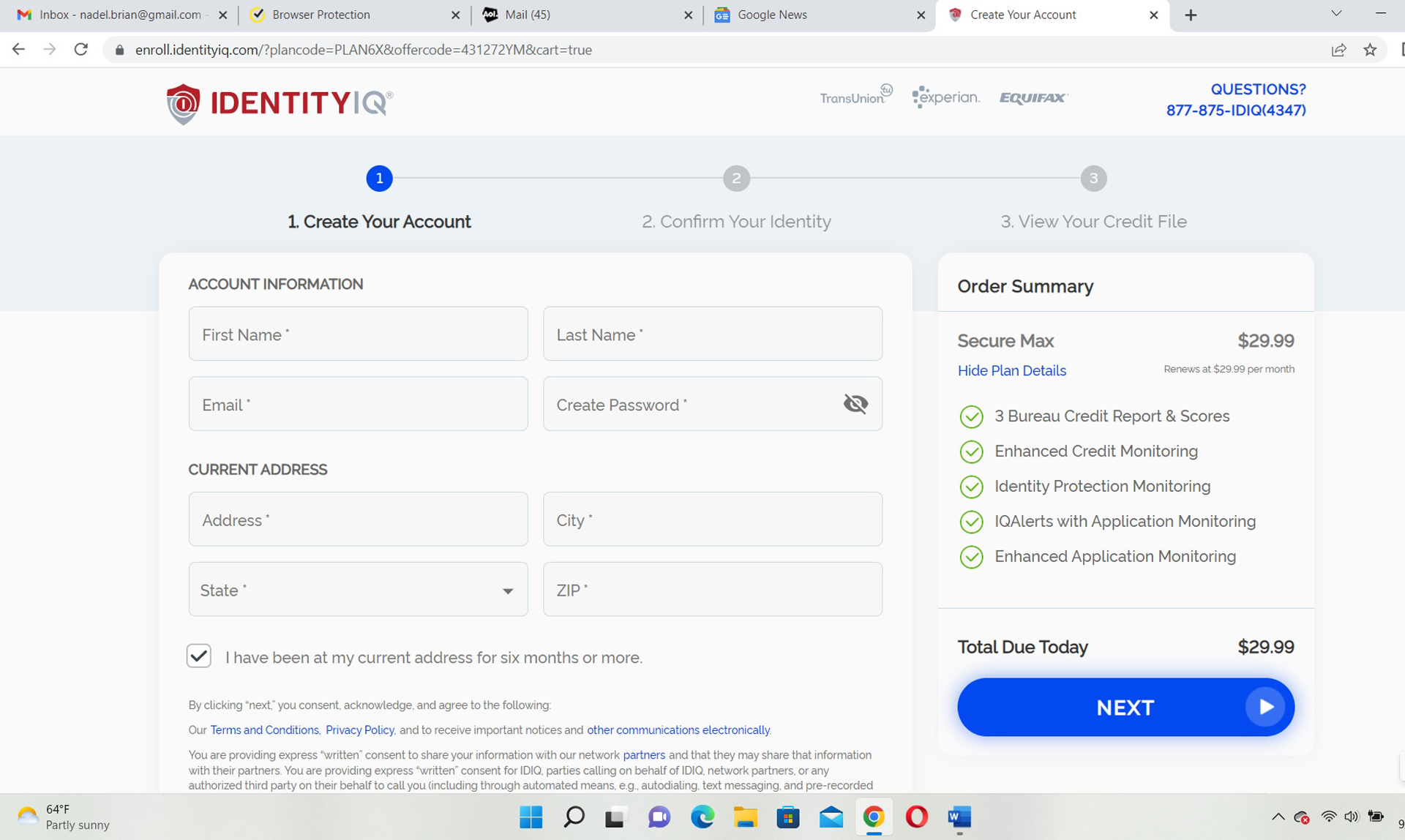

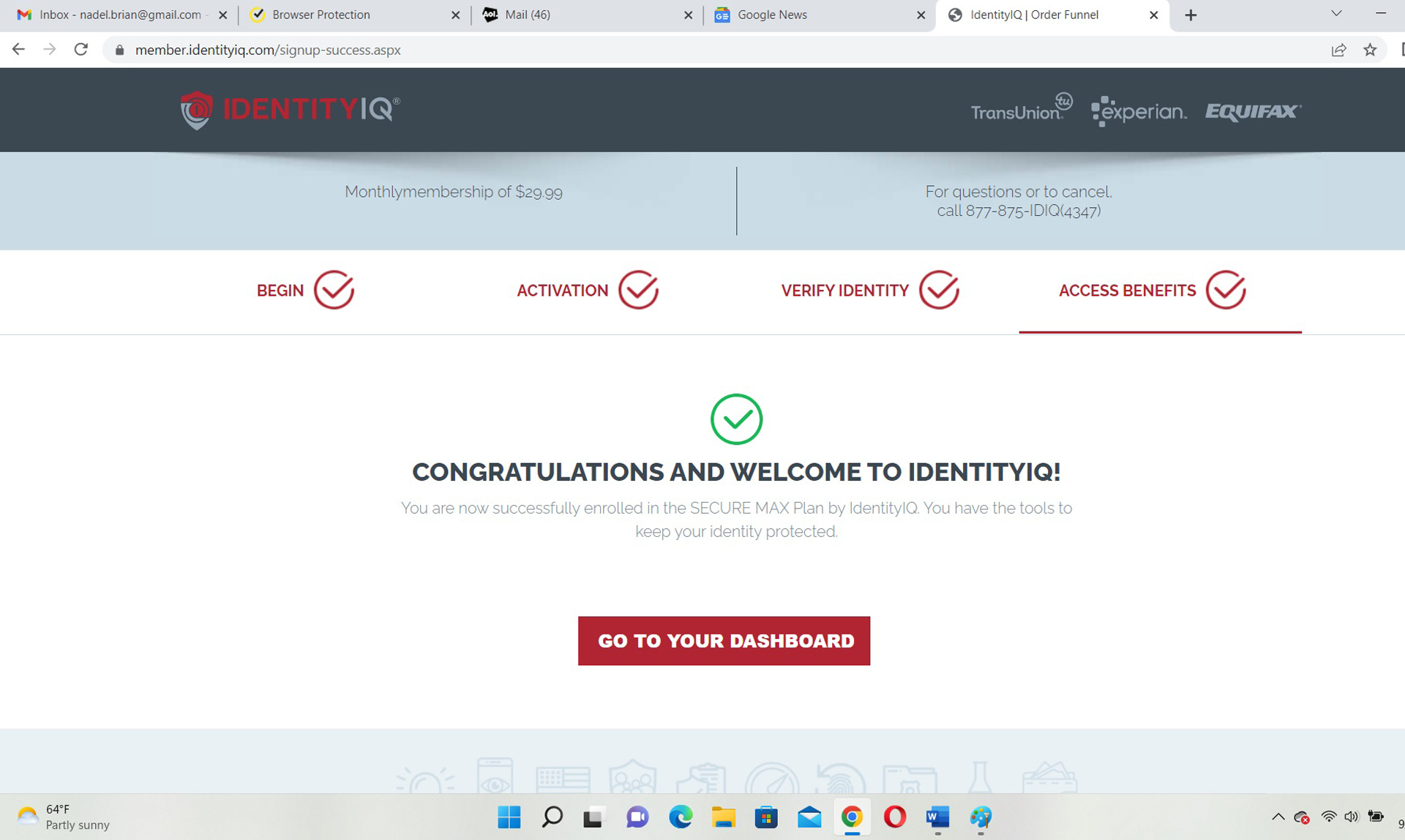

One of the easiest and quickest ways to protect your credit and identity, IdentityIQ took all of 7 minutes to create an account and start protecting my persona. It started with picking the Secure Max plan and clicking “Get Protected Now”.

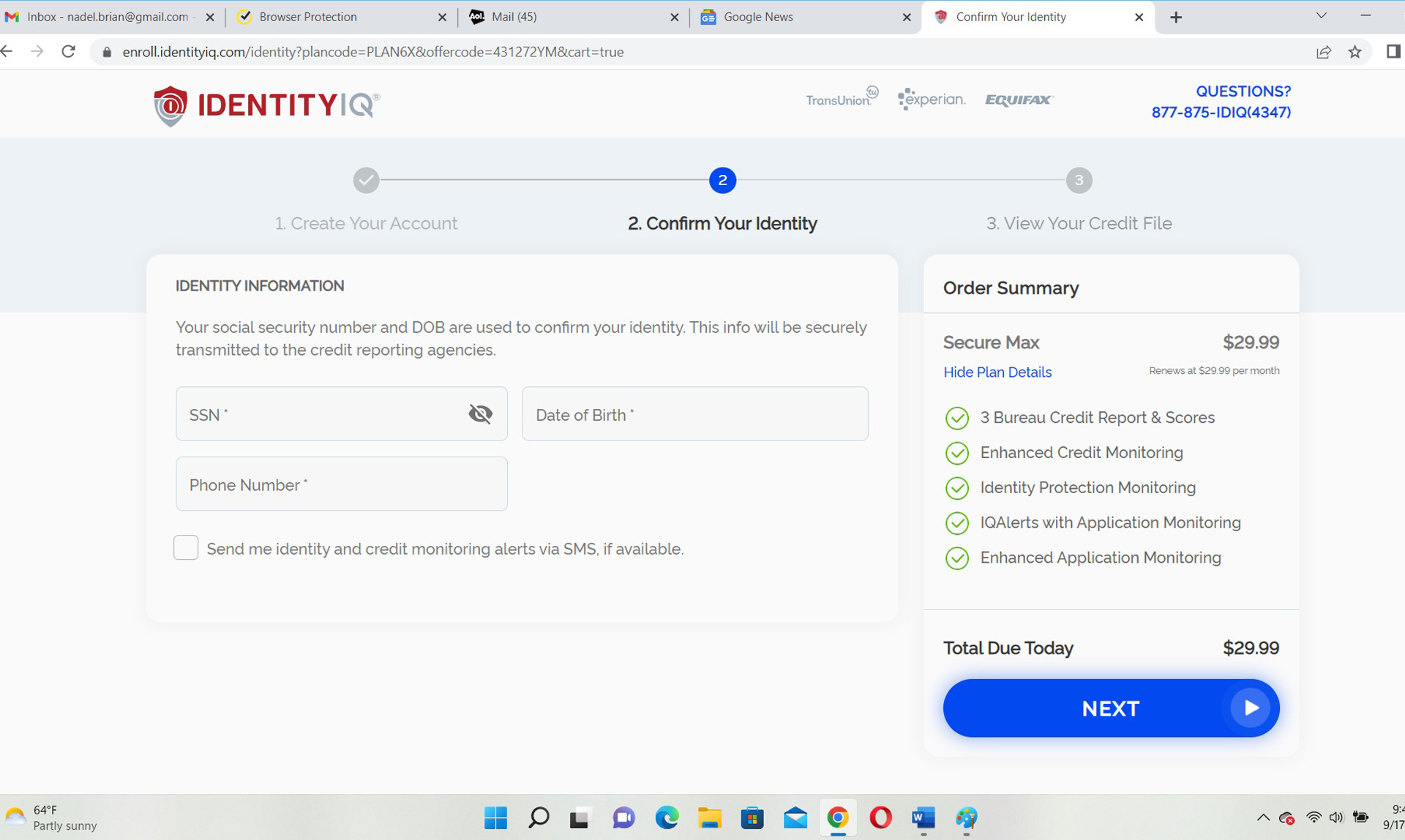

After creating an account and password, I checked the box that showed that I’ve lived at my current address for at least six months. Then, I entered my Social Security number, date of birth and phone number. A recent addition is the ability to have alerts sent via SMS text messaging, which I signed up for.

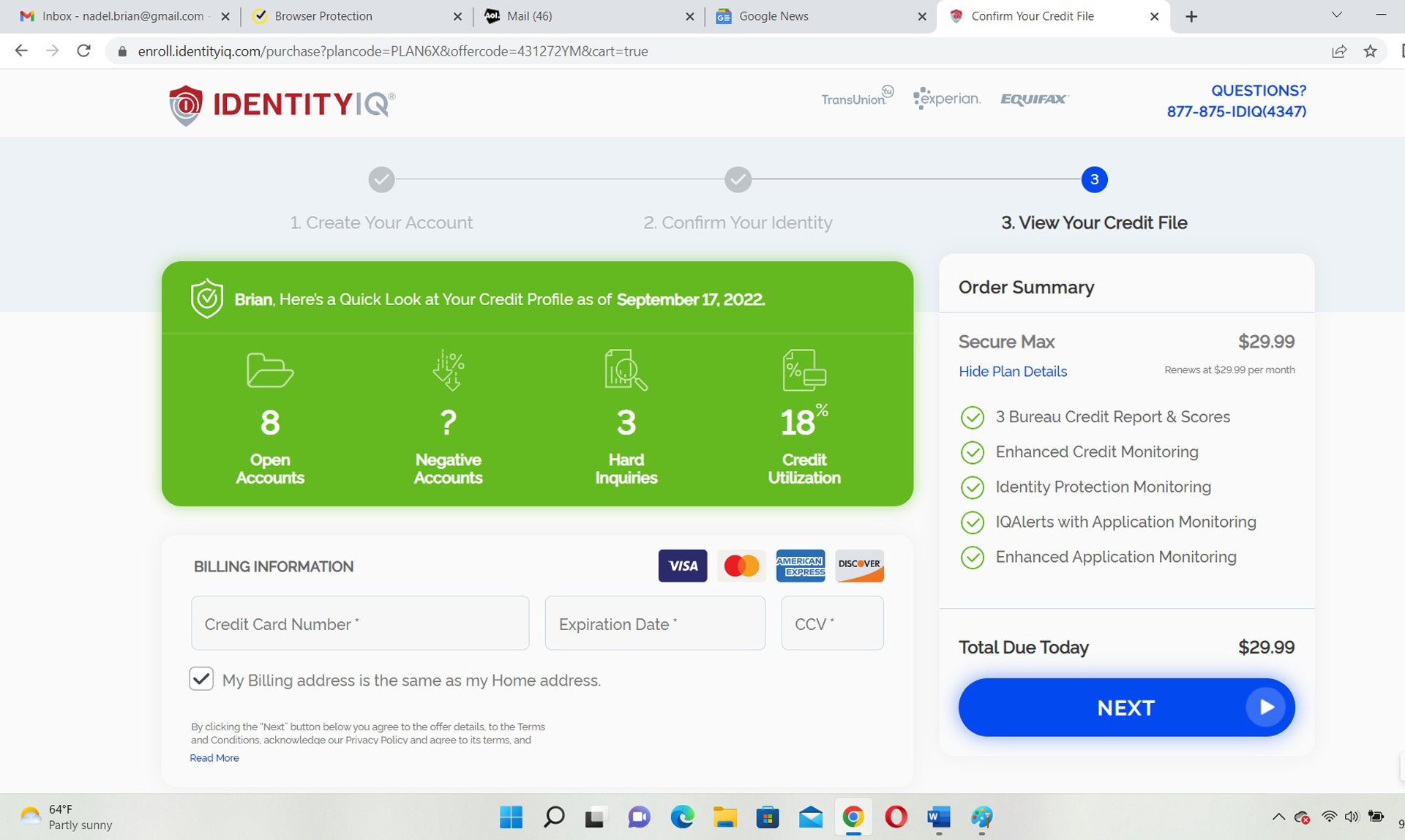

I paid with a credit card; IdentityIQ doesn’t take PayPal. After three challenge questions about car loans, mortgages and a previous address, I was in. I received a welcome email along with the plan’s major attributes and a dark web alert. The dashboard showed my three credit scores and a summary. My first log-in required my Social Security number’s last four digits.

Happily, the company has stopped sending ads and come-ons to clients that were annoying in the past. Everything they have on you is saved in encrypted form on IdentityIQ’s servers. Unlike some of its competitors, the company retains some of the metadata about you and your account in case you have an identity problem in the future.

The company uses the phone as its primary tech support portal and staffs its help desk from 7 a.m. to 7p.m. CT Monday through Friday and 8:30 a.m. to 5 p.m. on Saturdays. In the event of an emergency, they’re available 24/7. There is no dedicated customer-support section on the IdentityIQ web site. I did like the rundown on what’s in a credit report and the company’s FAQs though.

IdentityIQ Secure Max review: Interface and utilities

With a browser-based approach to notebook, desktop and mobile access, with IdentityIQ there’s nothing to load on your phone and both interfaces look alike. On the other hand, it requires some patience to use the service on mobile.

While the company doesn’t employ two factor authentication (2FA) to prove that you actually are you at log in, it does ask for the last four digits of your social security number.

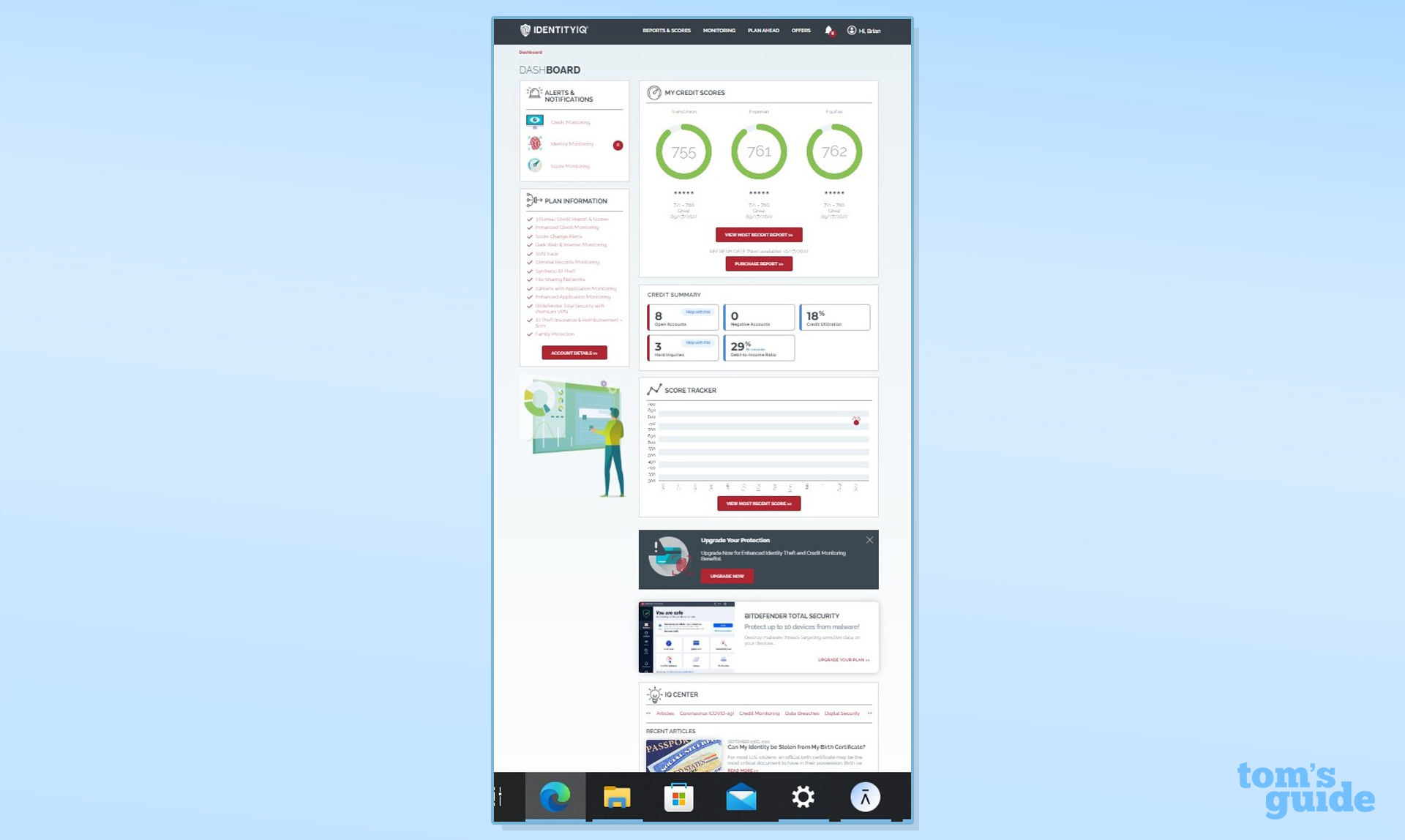

The Dashboard has a lot to offer but can appear crowded because it tries to do a lot. Like Bitdefender Ultimate Plus, it’s a long strip that requires zooming out to 25%. Setting it to 50% was comfortable for me to take in two of its six elements, like the credit scores and summary, at a time.

Up front are the Big Three credit scores and access to reports a level below the surface. In addition to showing the total number of accounts, the interface has a history of dings to your credit by each bureau and payment details for credit cards and loans.

At any time, I could buy an instant report to supplement and update this data. It costs $10 for a single agency or an economical $19 for all three.

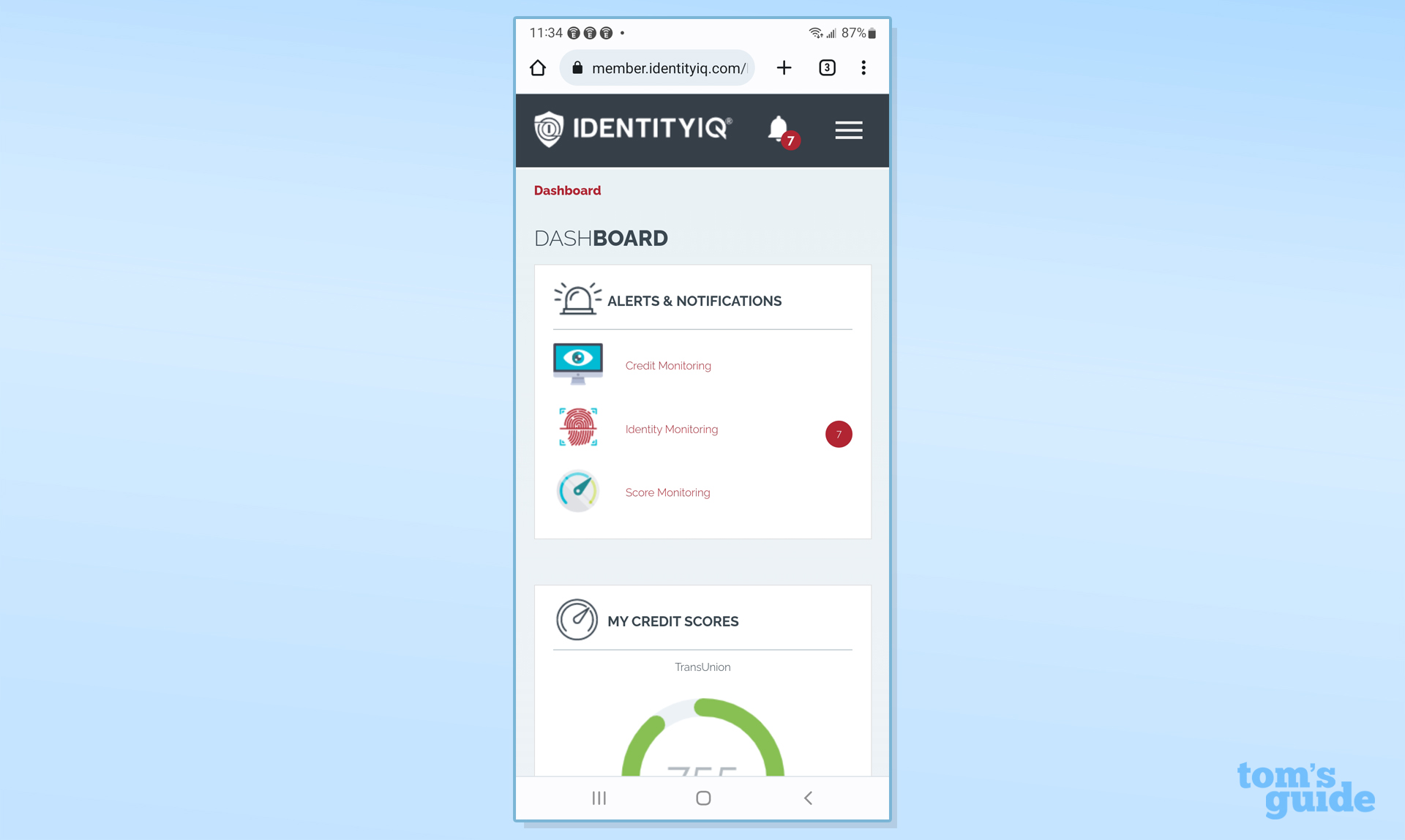

In addition to a side menu for major alerts (Credit Monitoring, Identity Monitoring and Score Monitoring), the interface has tabs for the service’s major functions, like Reports & Scores (the three bureau output), Monitoring (setting up and modifying notifications) and Plan Ahead (using the lost wallet, junk mail and insurance features). At any time, tap the IdentityIQ logo to go back to the dashboard.

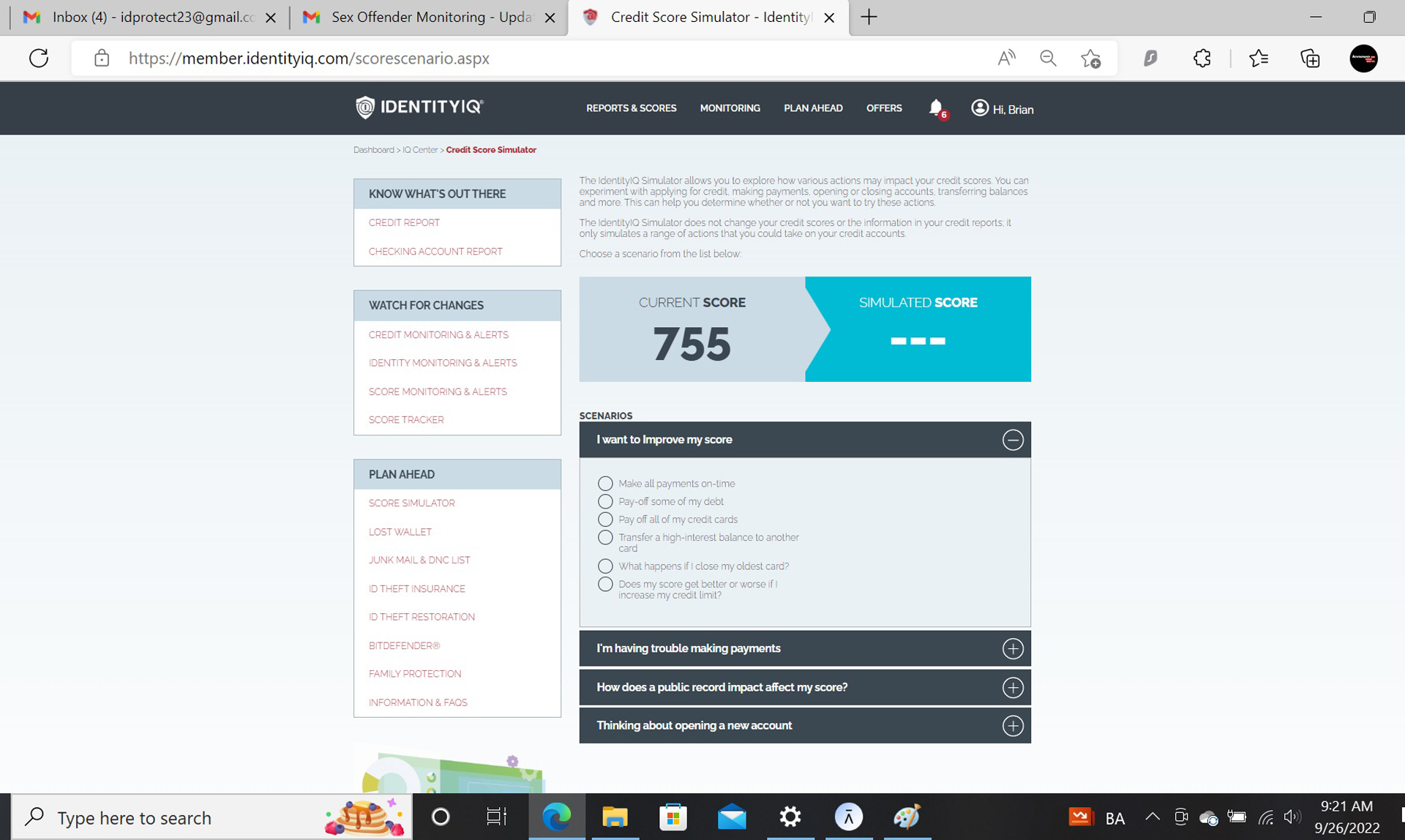

Most intriguing of all is IDIQ’s Secure Max Credit Simulator. Is it better to pay off your credit card debt or pile on more? All is revealed. There’s the choice among improving credit scores, handling payments better, opening a new account and how public records affect the scores.

The service provides articles on preventing identity theft and improving credit scores as well as more general topics. Most are fairly recent, but a few are two years old. My favorite was about criminals using a change of address form to scam loans and credit cards.

IdentityIQ on a phone is done through a browser as well, and it looks surprisingly good. The Dashboard’s layout is similar but set up as a long strip with the Alerts & Notifications at the top.

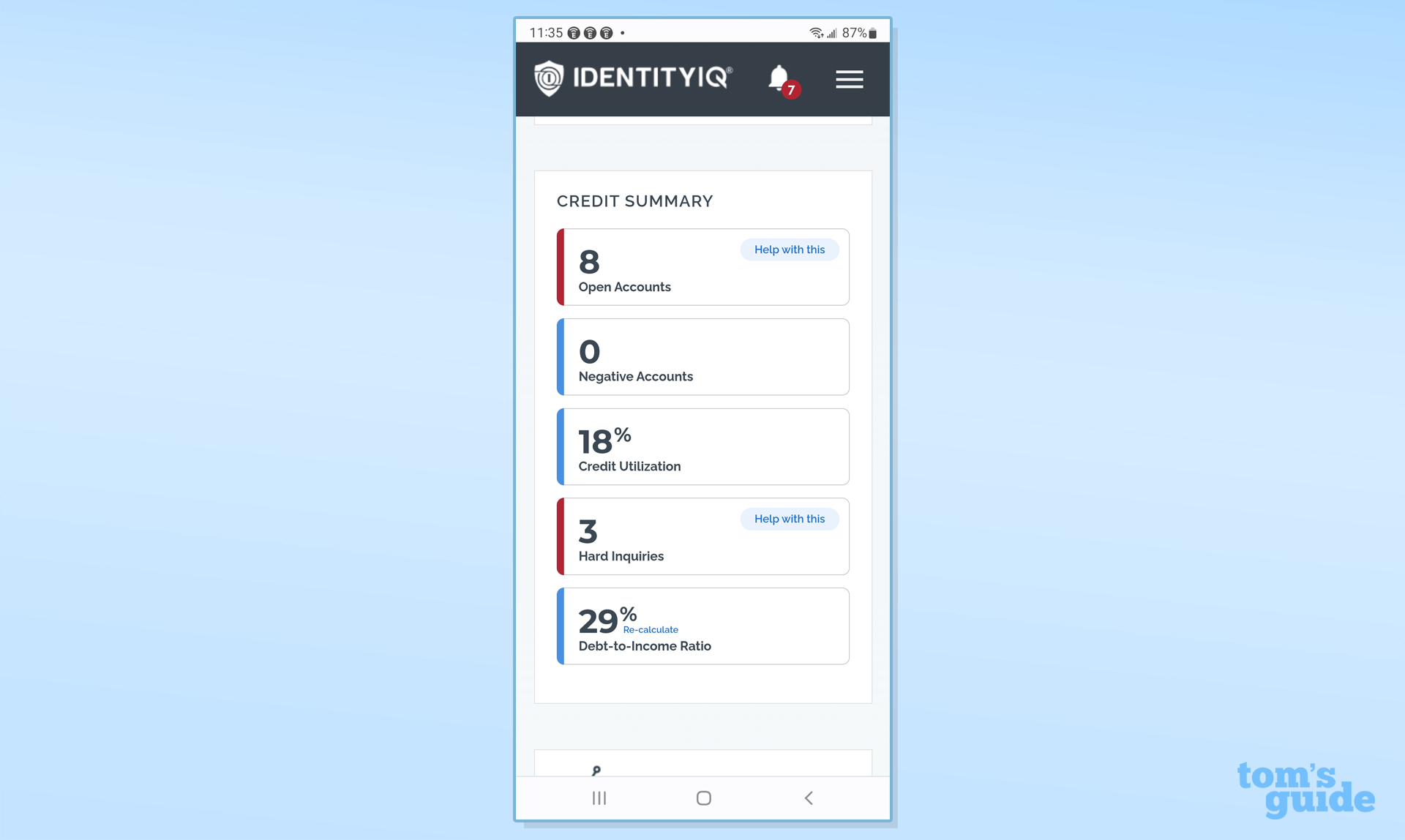

Below are the credit scores, followed by access to credit reports and a nice credit summary of open accounts, negative ratings, recent inquiries and a cool debt-to-income ratio.

IdentityIQ Secure Max review: Cancellation

There’s no way to cancel IdentityIQ’s service on the website or by email. I called their tech support line and had to wait several minutes before talking to a person. When I did, the operator recited all the plans benefits and tried out a special price that reduced the plan to $10 a month. Finally, after 10 minutes, the plan was canceled with a confirmation email received.

IdentityIQ Secure Max review: Bottom line

With the potential to inexpensively cover an entire family, IdentityIQ Secure Max includes protection for up to three children, something others charge for. The service starts with monthly three-bureau reports and scores but adds credit simulators and monitoring of bank accounts. Too bad it lacks the ability to keep any eye on investments, payday loan companies and two-factor authentication. Still, IdentityIQ provides a lot for the money for security-minded families.

Brian Nadel is a freelance writer and editor who specializes in technology reporting and reviewing. He works out of the suburban New York City area and has covered topics from nuclear power plants and Wi-Fi routers to cars and tablets. The former editor-in-chief of Mobile Computing and Communications, Nadel is the recipient of the TransPacific Writing Award.