Tom's Guide Verdict

Aura does the basics of identity protection with monitoring, credit scores and malware protection but lacks credit simulators and limits full credit reports to annually, something you can get for free. Still, it’s a bargain.

Pros

- +

Good value

- +

Experian credit lock button

- +

Individual, couple or family protection

- +

Includes Avira malware protection and VPN

Cons

- -

Credit reports only once a year

- -

No calculators or credit simulators

Why you can trust Tom's Guide

No. of bureau scores: 3

No. of bureaus monitored: 3

Frequency of credit reports: Yearly

Type of credit score: VantageScore 3.0

Credit-improvement simulator: No

Credit-lock/freeze button: Yes

Security software: AV, PW manager, VPN, Safe Browsing extension, Anti-tracking, Ad Blocking

Investment account monitoring: Yes

Max. ID-theft coverage: $1 million

Data Breach Alerts: Yes

Medical Records Monitoring: No

Payday loan monitoring: No

Online Predator Alert: Yes

Title Change Alert: Yes

Two Factor Authentication (2FA): Yes

Aura may lack some of the creature comforts of ID protection, like a credit simulator, but it more than makes up for this with the most needed and used features to protect your identity. It includes a credit lock button for Experian but limits credit reports to yearly, which might be too infrequent for the credit anxious among us. In addition to $1 million in insurance, the Individual plan includes three credit bureau scores and monitoring as well as data breach alerts and notifications for a property title change.

The bonus with Aura is powerful malware protection, VPN access and a password manager. Its presentation and integration are among the best in the business and best of all, it’s reasonably priced even with all of its extra security goodies. Our Aura review will help you decide if this is the best identity theft protection service for your needs or if you’d be better off going with a service with a stronger focus on tracking and improving your credit scores.

Aura review: Costs and what’s covered

As opposed to others that have multiple plans, Aura has a single subscription that’s available for an Individual, Couple or Family. The Individual plan includes monthly three bureau credit monitoring and scores along with $1 million of identity theft insurance. The service has an Experian credit lock, monitors your bank and investment accounts for preset withdrawal limits and can use two-factor authentication. As of March 2025, Aura's Individual plan costs $12 a month (if billed monthly) or $108 a year (if billed annually) – less than the entry-level plans offered by its competitors – making it among the best bargain in ID protection.

The Couple plan adds coverage for a spouse for $20 a month (billed monthly) or $204 a year (billed annually) and ups the insurance coverage to $2 million ($1 million insurance per adult). The Family package allows up to 5 adults and unlimited children to be included and costs $30 a month (billed monthly) or $300 a year (billed annually). It includes a total of $5 million of identity insurance (again, $1 million in insurance per adult) and the monitoring of Social Security numbers for children. However, it also allows you to perform a child credit freeze with all three major credit bureaus.

Regardless of which plan you get, Aura has a slew of useful utilities and services, ranging from malware protection from Avira to VPN access for at least ten (and up to 50) devices. There’s a helpful password manager and Safe Browsing browser extensions.

The Family plan adds parental control software features like mobile device management, content blocking and filtering, screen time limits and internet usage tracking. It also comes with a safe gaming feature that adds cyber bulling and predator alerts, 24/7 in-game voice and text monitoring and a weekly gaming activity report which are nice features to have for older kids.

Aura received the top ranking that the Better Business Bureau provides: an A+. This puts it on the top shelf of identity services.

Aura review: How we tested

I signed up for the Aura Individual service in the summer of 2022 and paid for it with a credit card; Tom’s Guide reimbursed me after the fact. Several times a week, I checked in on my credit scores, alerts and warnings using Aura’s web interface with several computers as well as my Samsung Galaxy Note 20 phone. At the end of three months, I canceled the service.

Aura review: Credit scores and identity monitoring

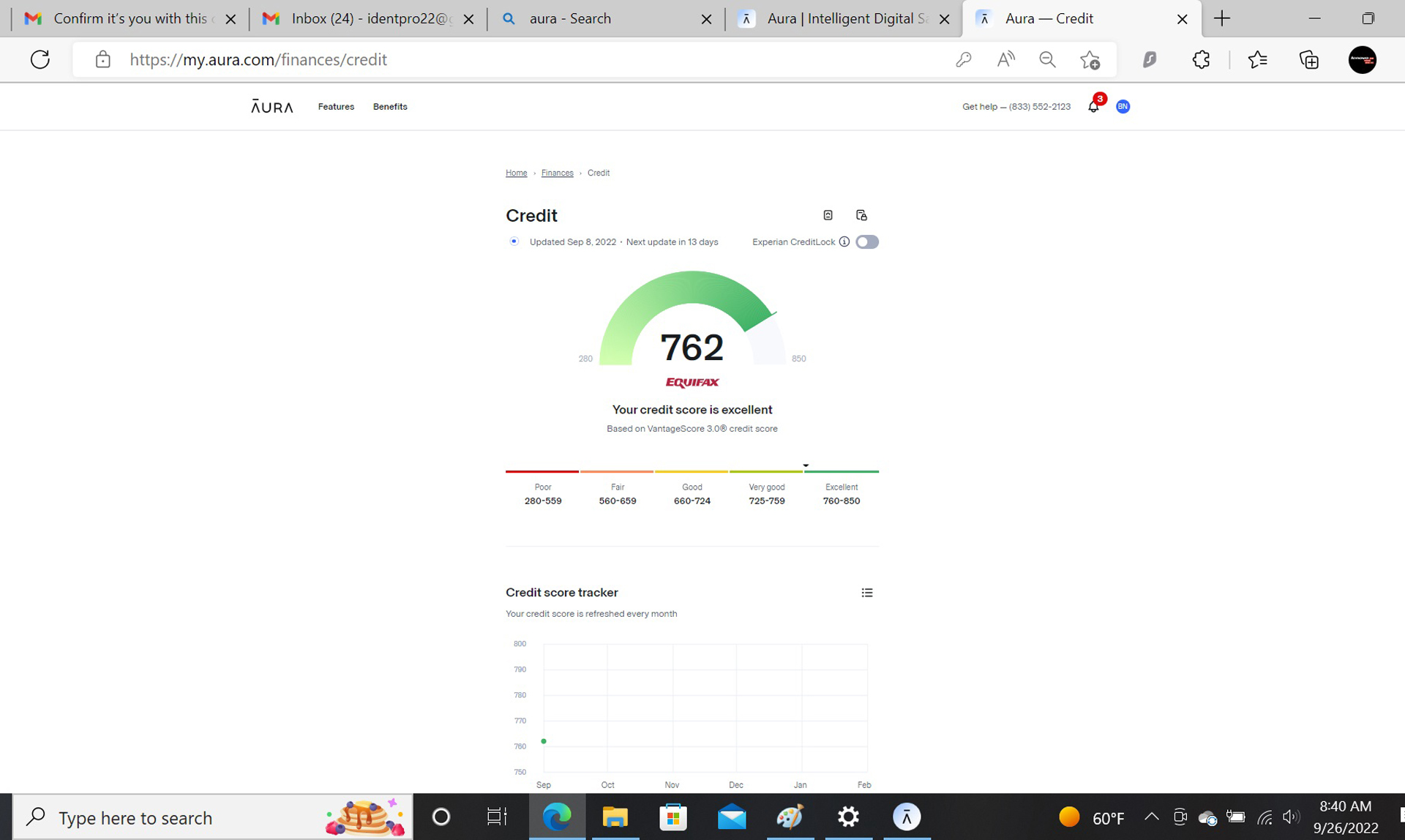

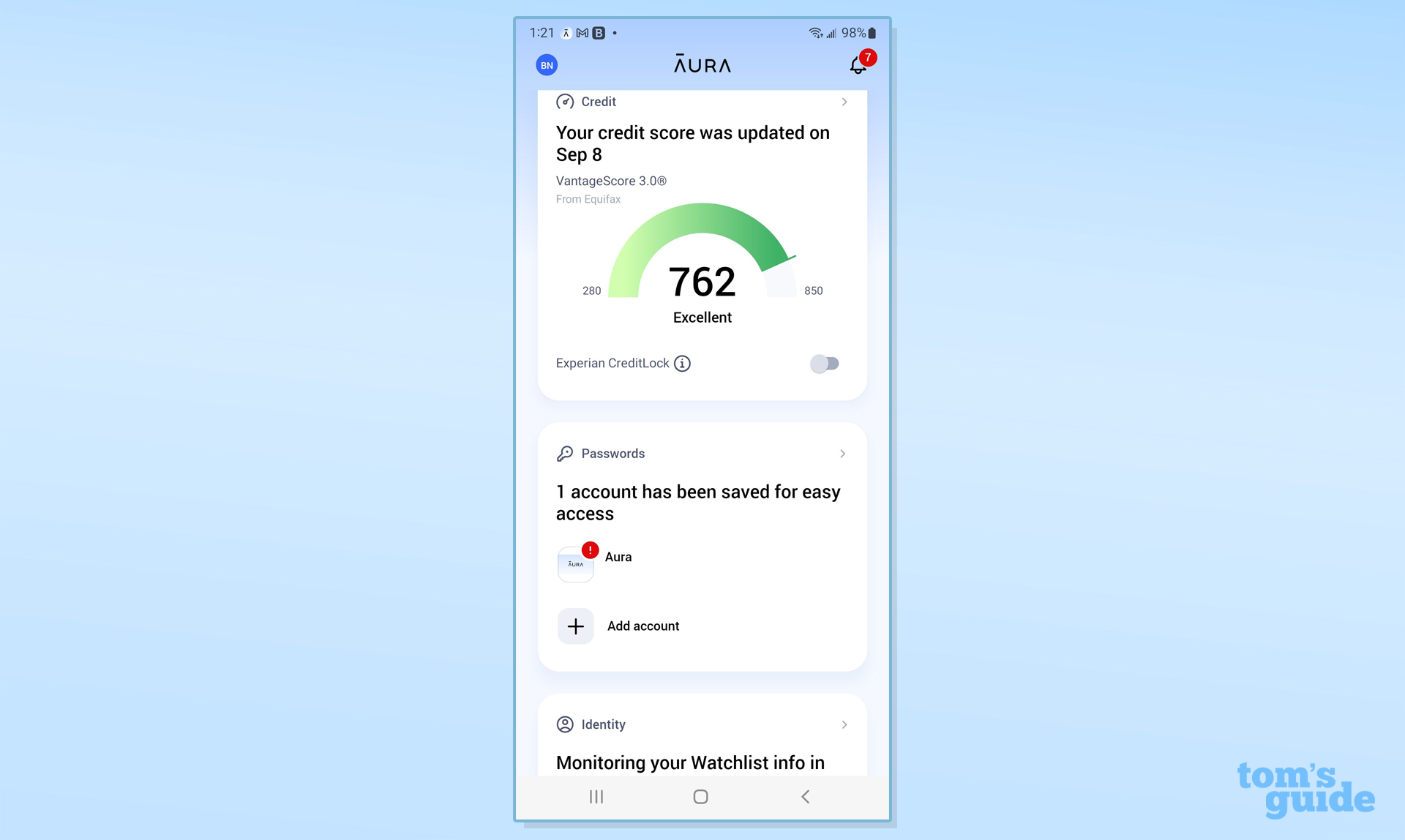

Like Identity Guard Ultra, which is also operated by Aura, the company’s Individual identity protection service provides three bureau monitoring and scores from Equifax, Experian and TransUnion. They are updated monthly and include a VantageScore 3.0 rating as a stand-in for the more popular FICO score.

While others like McAfee Ultimate or Bitdefender provide monthly or quarterly credit reports, Aura provides them annually, something that’s available for free. Plus, the service doesn’t include the ability to buy an instant credit report from any of the three agencies.

In addition to watching for duplicate credit card charges, Aura keeps an eye out for someone opening a bank account, starting a loan or entering bankruptcy proceedings. It monitors court records as well as home title and address changes.

Aura can monitor investment and bank accounts and it’s a snap to set a transaction limit for monitoring so as not to overwhelm you with alerts. Those with the Family plan can cover children’s Social Security numbers for basic monitoring. Unlike IdentityForce or IDShield it won't alert you when a sex offender moves in nearby.

Its dark web monitoring not only looks for your personal identifiers online but if it finds your password, the company’s password manager will change it with a single click. There’s even a special monitoring program for tax refund fraud. The service also keeps an eye on action at data brokers, junk mail and spam providers and can request for your data to be deleted. More to the point, the package’s Safe Browsing extension can help you surf the web under the radar.

Aura’s instant credit lock for Experian is useful during anxious moments; most competitors use TransUnion for a credit lock. It should work just as well at blocking your credit to prevent someone taking out a loan or credit card in your name.

Aura review: Insurance and services

Should you experience an identity crisis, Aura’s White Glove service uses trained professional resolution agents. They work with you over the phone and online to make you whole. They can also work with governmental organizations on your behalf.

The individual plan I used includes $1 million of theft insurance. That amount rises to $2 million for a Couple and up to $5 million for Family accounts. The plan is underwritten by AIG. That's similar to many of the other identity theft services we've tested including IdentityForce, IDShield and McAfee Ultimate though both Bitdefender and LifeLock offer higher amounts at $2 million and $3 million respectively.

It covers everything from lost money due to fraud or theft to the cost of specialists, like lawyers, accountants and investigators to help untangle the mess. It will even pay for lost work (up to $2,000 a week) and travel (up to $1,000).

Aura review: Notifications and alerts

Aura’s alerts and notifications are well balanced, and many are customizable. In addition to ones for leaks of personal data (like Social Security number, passport or other identifiers), the service will let you know if someone changed your address or is trying to modify your home’s property title. It can alert you to a change in your Medicare or medical insurance number and if a payday loan has been taken out in your name.

There are notifications for bank transactions that are adjustable to keep from getting overwhelmed by them. The service will also let you know if you get a duplicate credit card transaction. The interface shows active alerts, which can be sent to an email address or via text message to a phone.

The alerts I received provided a check box at the bottom to let Aura know if this was fraud or something I did. In three months, I got 12 alerts, including for larger money transfers. That's the second most of all the identity theft services we tested, just behind the startling 32 alerts we received from MyFICO, which fortunately, can also be adjusted.

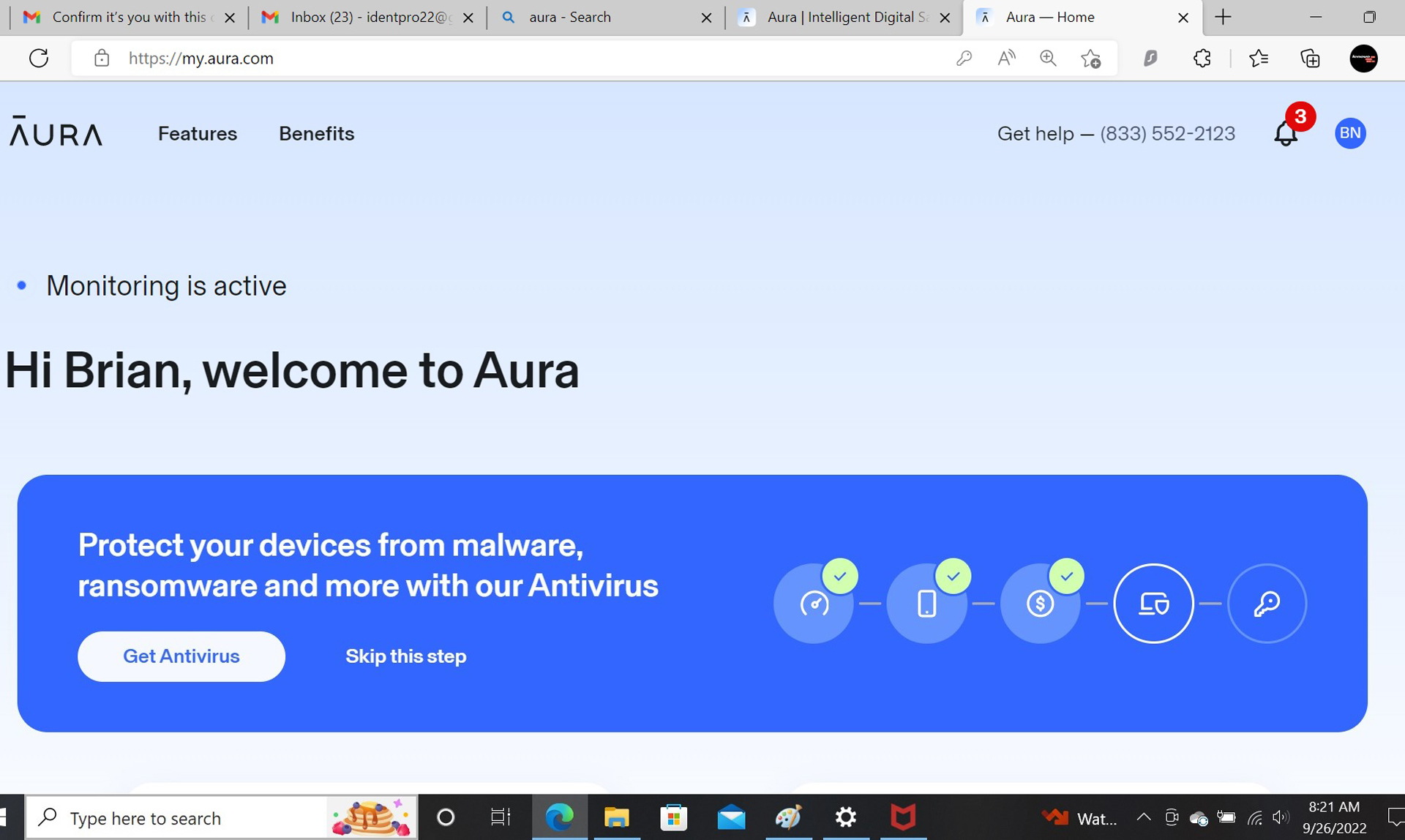

Aura review: Setup

To get Aura’s identity protection, I started at the company’s website and clicked on “Start your Free Trial”. The service includes a 14-day free trial after which I was billed on a monthly basis. There’s a 60-day money back guarantee.

After picking the Individual plan, I typed my email address, name and address, followed by my phone number, Social Security number and date of birth. I paid with a credit card; PayPal is also accepted.

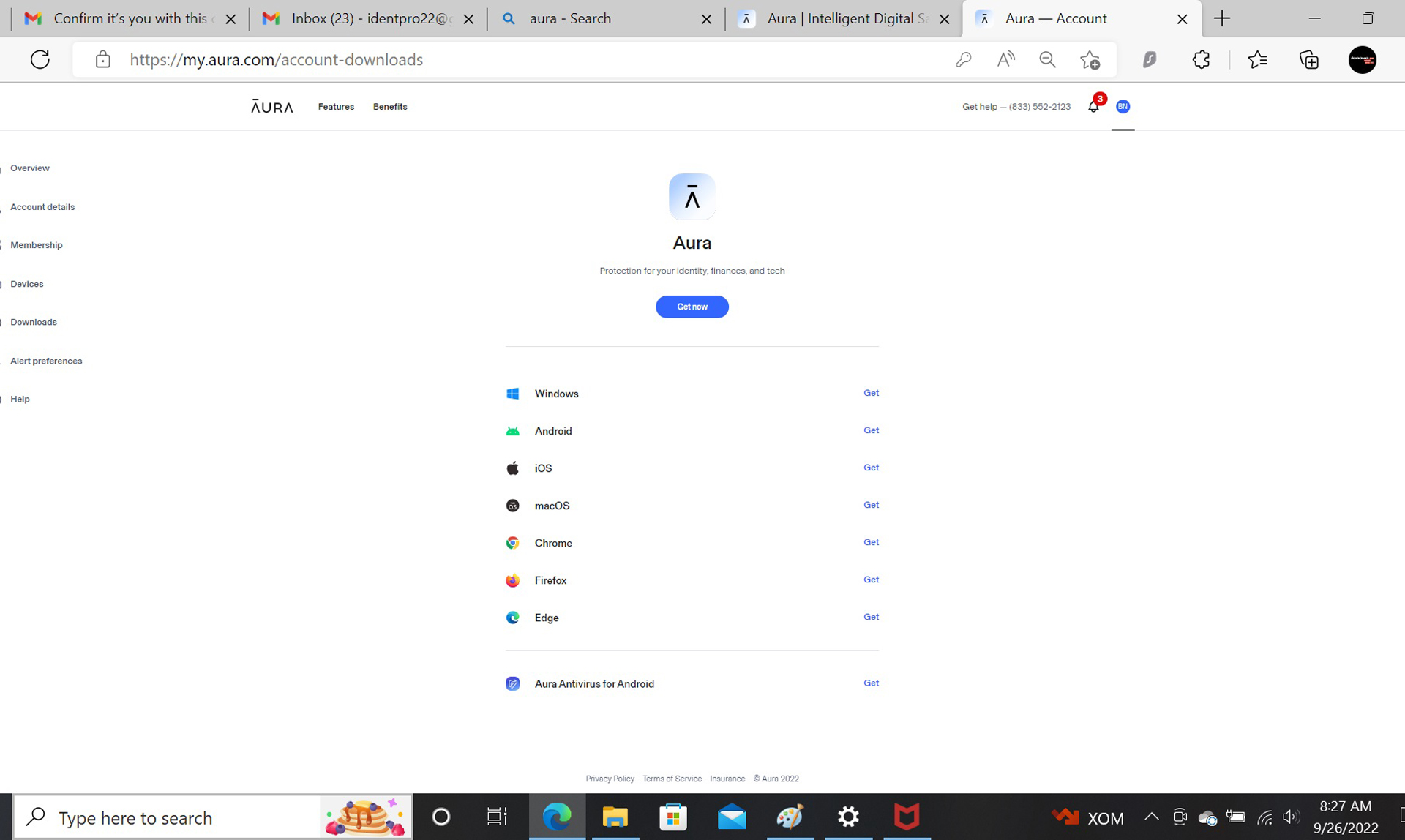

I added my account password and verified my email address with an SMS code. Next, I answered a series of challenge questions about mortgages and previous addresses that focused on where I lived 35 years ago. Finally, I was able to add bank accounts, download the antivirus software and load the password manager.

Later, I loaded the Aura mobile app onto my Galaxy Note 20 through the Google Play Store but it took a few minutes to find the right app because Aura is used for so many products; hint: get “Aura: Your Digital Security”. I set up the phone’s fingerprint scanner to log in. All told, it took nine and a half minutes.

Technical support is limited to 8 a.m. to 11 p.m. ET, Monday through Friday, and 9 a.m. to 6 p.m. on Saturdays but there are representatives available 24/7 for identity emergencies. The support portion of Aura’s site has everything from assistance in getting started to the terminology and what to do if you get an alert.

I sent the help desk an email asking about a feature that Aura lacks and a cheerful tech support person called me back a few minutes later to tell me the company would consider adding it. Every page has the phone number to call if you suspect your identity has been stolen.

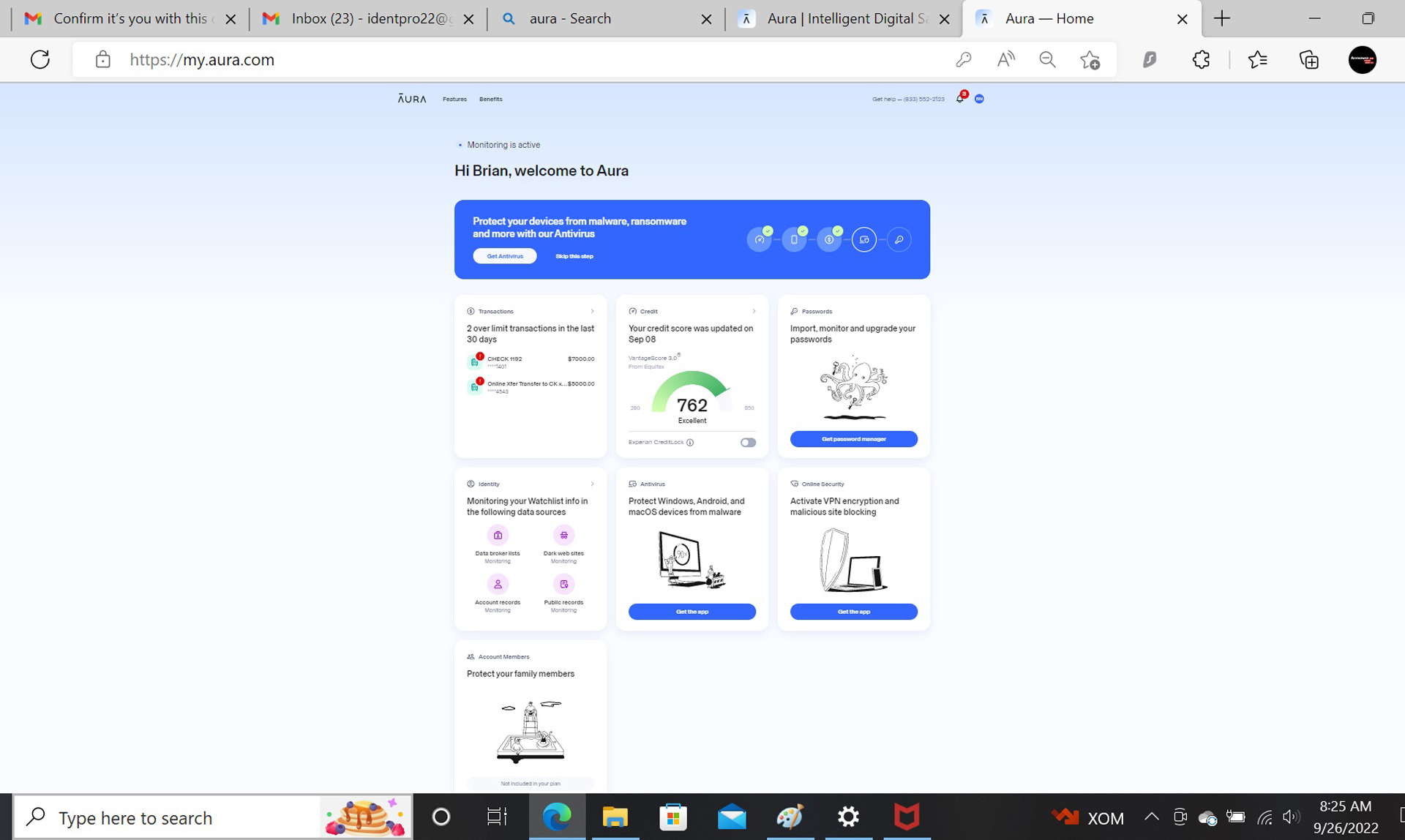

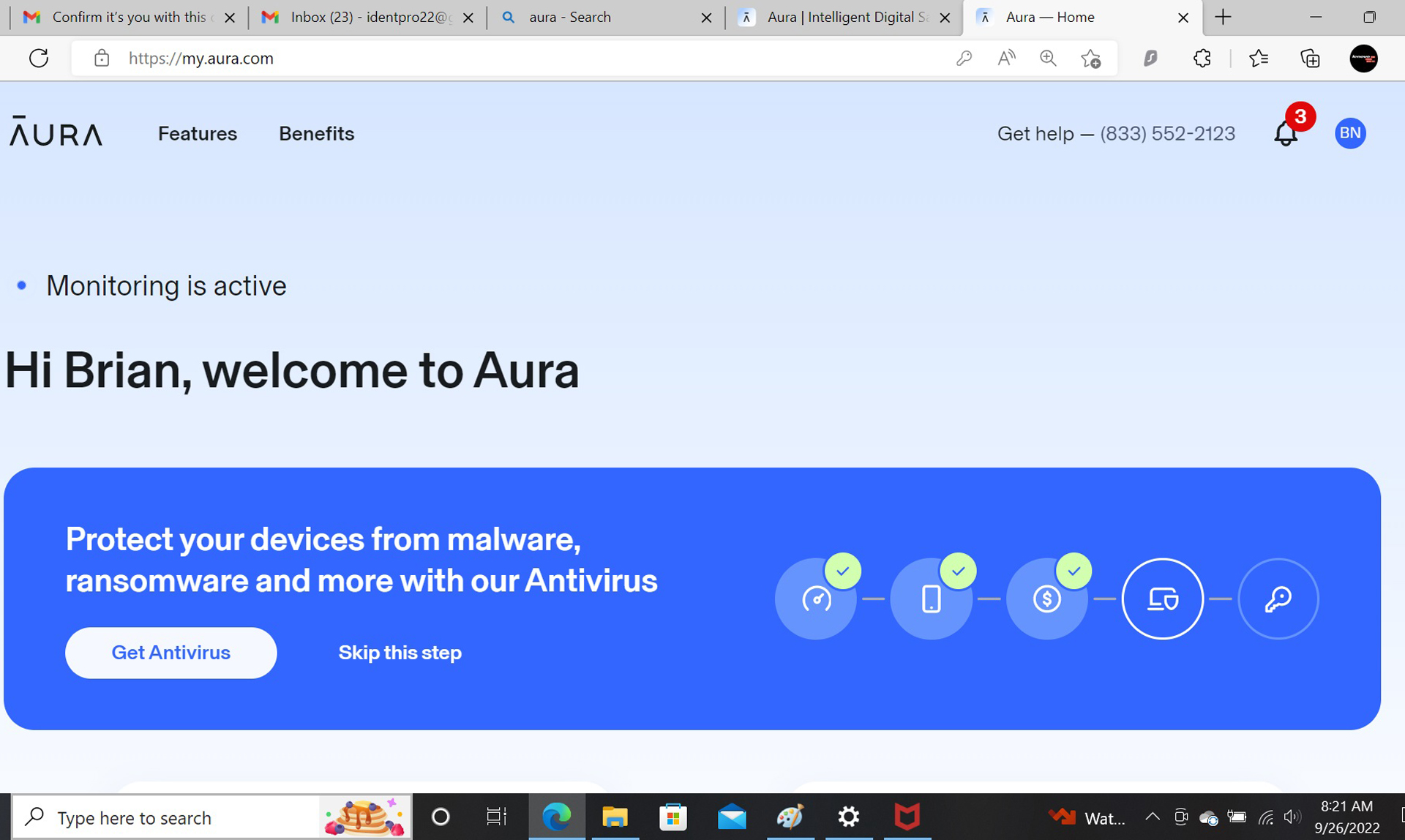

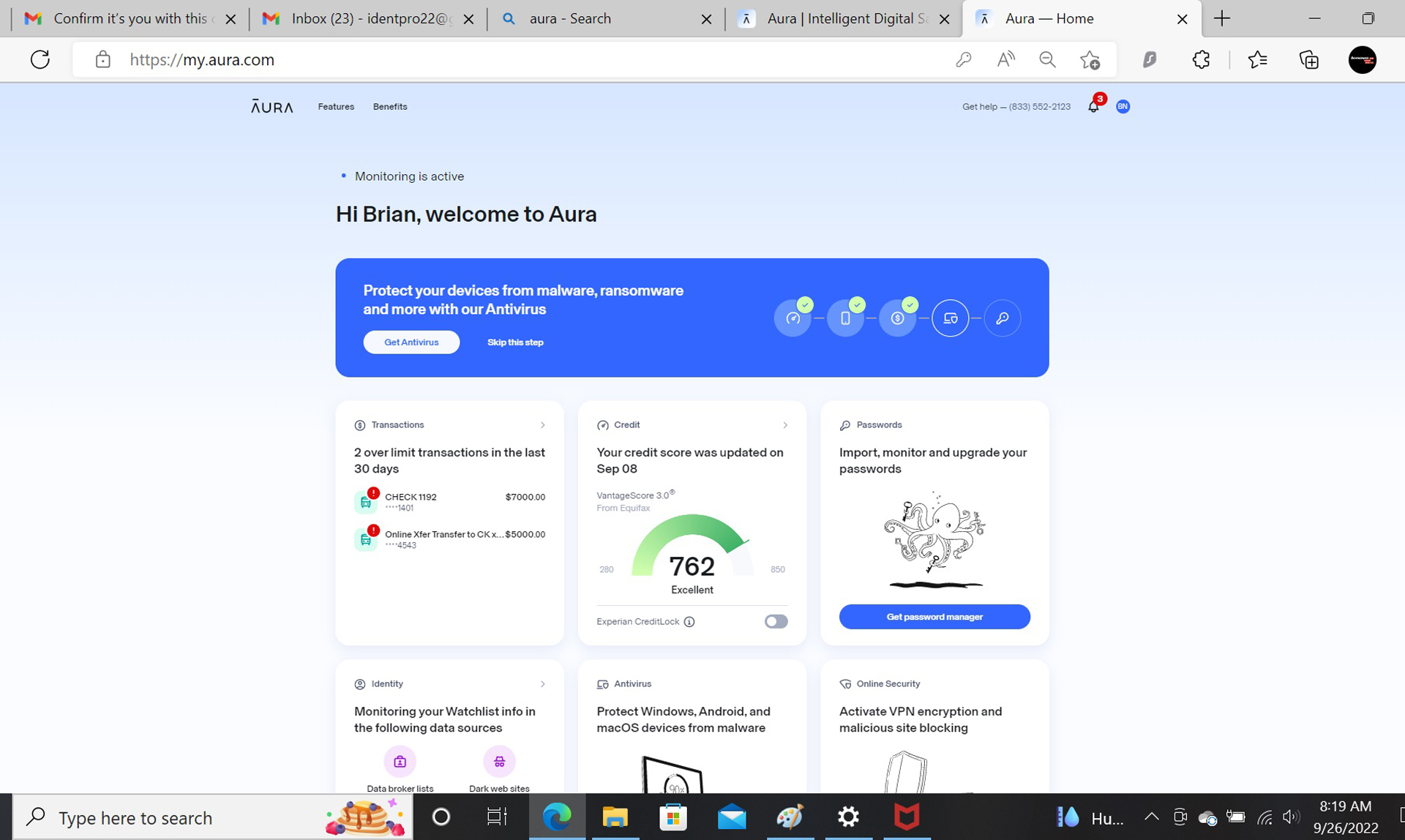

Aura review: Interface and utilities

Aura does a good job of putting necessary data in your face quickly and looking more like an app than a web-based interface. However, taking it all in requires zooming out to 33 or 50%. To work with its seven boxed elements required a zoom level of 67% and some scrolling.

A simple approach that makes others look needlessly complex, topmost is an indication that everything is on and running. The Alert bell in the corner has a number for how many alerts await. For emergencies, the company’s phone number is at the top.

There are boxes for the password manager, malware protection and access to the VPN. To the right is my personal account information. A nice touch is the quick link to support or a restoration agent. To the right is the current VantageScore 3.0. Below is an instant Experian credit lock.

Go a level below to see a monthly VantageScore tracker and tips on improving credit, but they lack specifics and there’s no credit simulator.

A blue bar stands as a horizontal checklist to remind you which elements of the service need activating or information. Finally, if you have a Couple or Family account, the others are listed at the bottom.

There’s another level to the Aura interface. At the top, there are links for Features (for Transactions, Credit, Passwords and Identity) and Benefits (what the plan includes). Aura also covers your computers, phones and tablets locally with malware protection from Avira for 10 systems, more than most of the competition, although McAfee provides unlimited licenses.

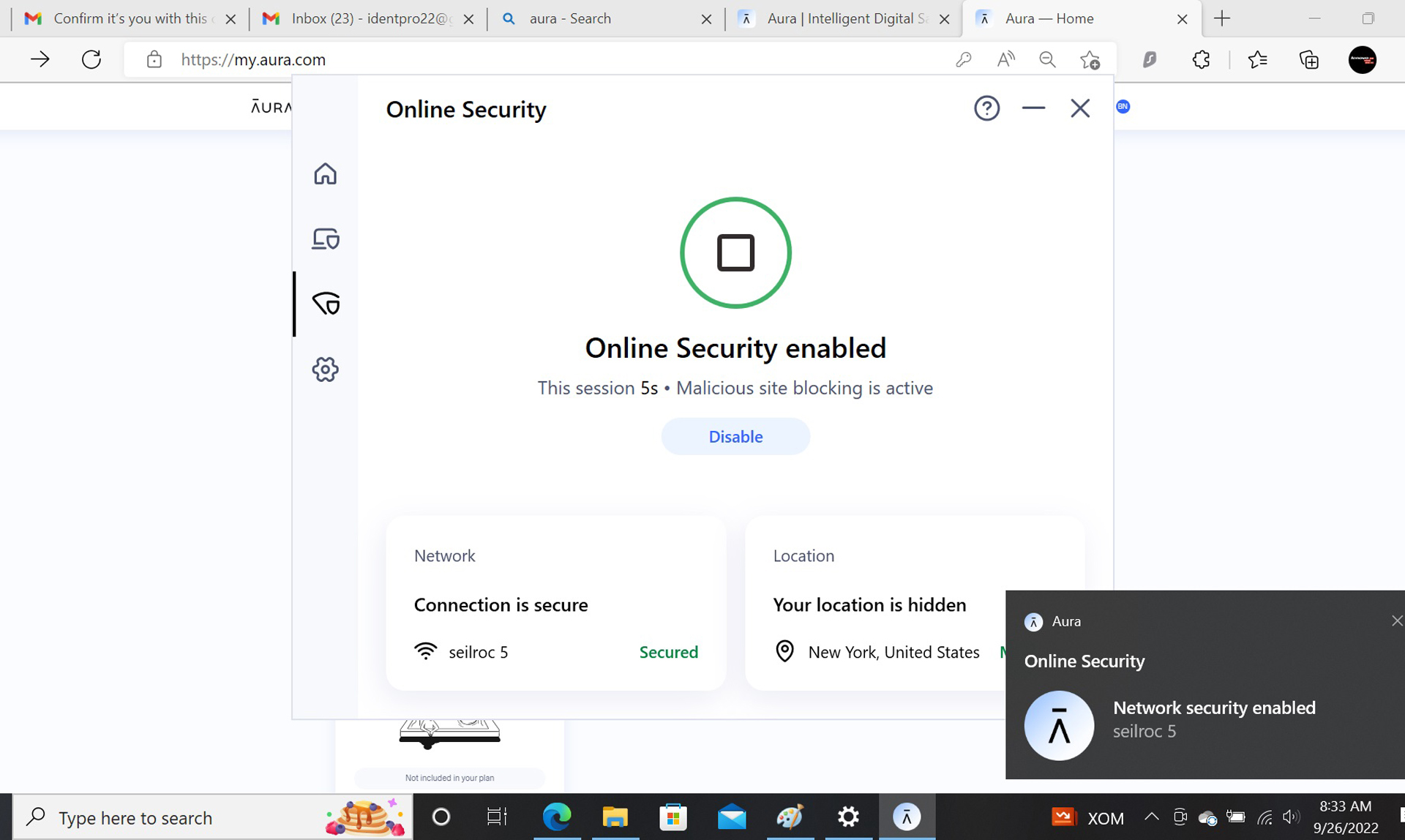

On the downside, the protection phase of Aura has its own interface. There are sections for malware defenses and the global VPN. The VPN supports up to 10 systems per adult covered; i.e., 10 for the individual account I set up. The Aura plans come with the company’s Safe Browsing extension that rates websites by their reputation for providing malware and it blocks the dangerous ones. It works with Chrome, Firefox and Edge and stops advertisements and trackers.

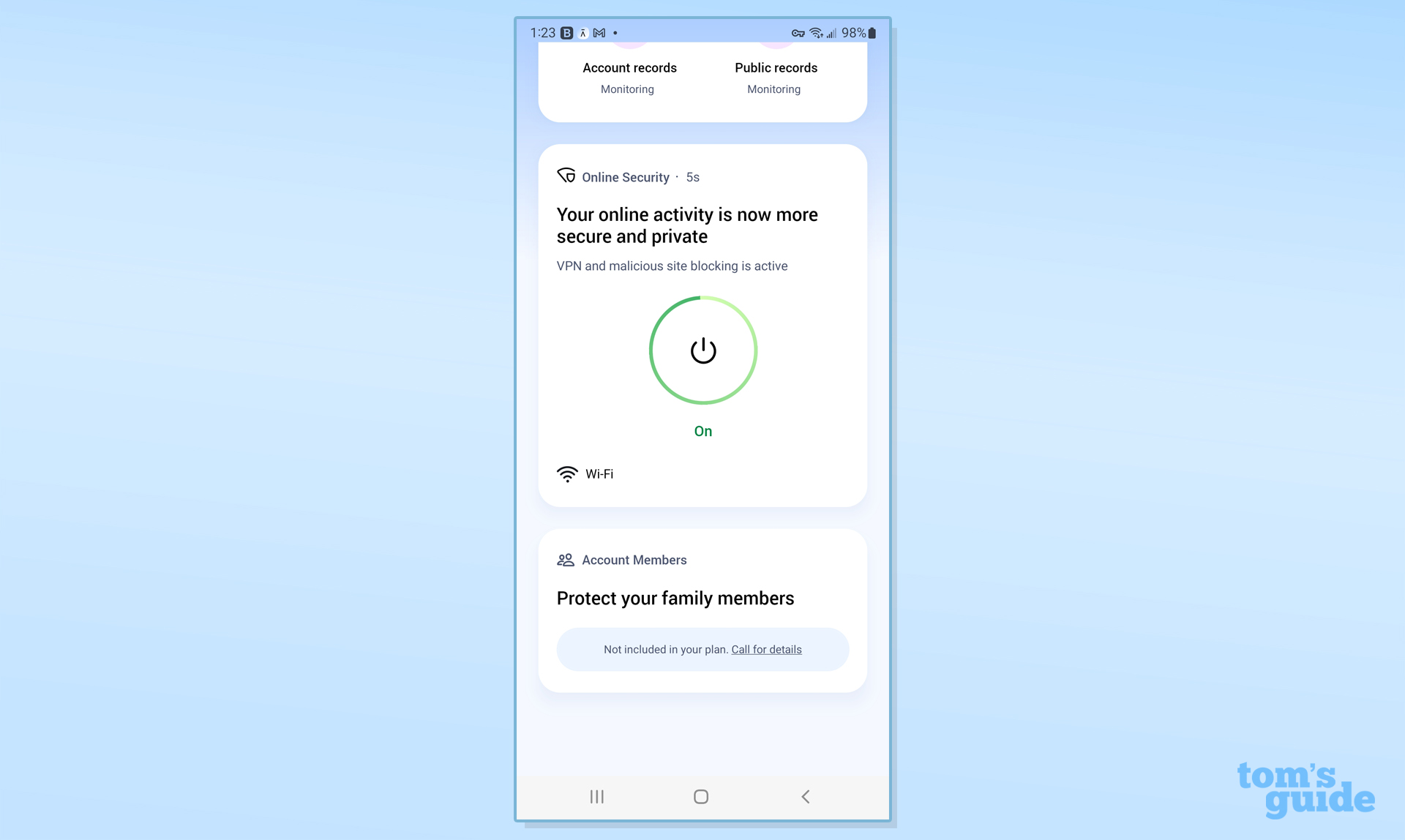

The mobile app is similar in design to the web interface. It’s formatted in a long narrow strip that requires a lot of scrolling up and down. Up top are the alerts and transactions followed by the credit score and the Experian CreditLock button.

In addition to access to the password manager, the app allowed me to turn the VPN on or off. It took a few seconds but didn’t allow me to pick the location of the connection point.

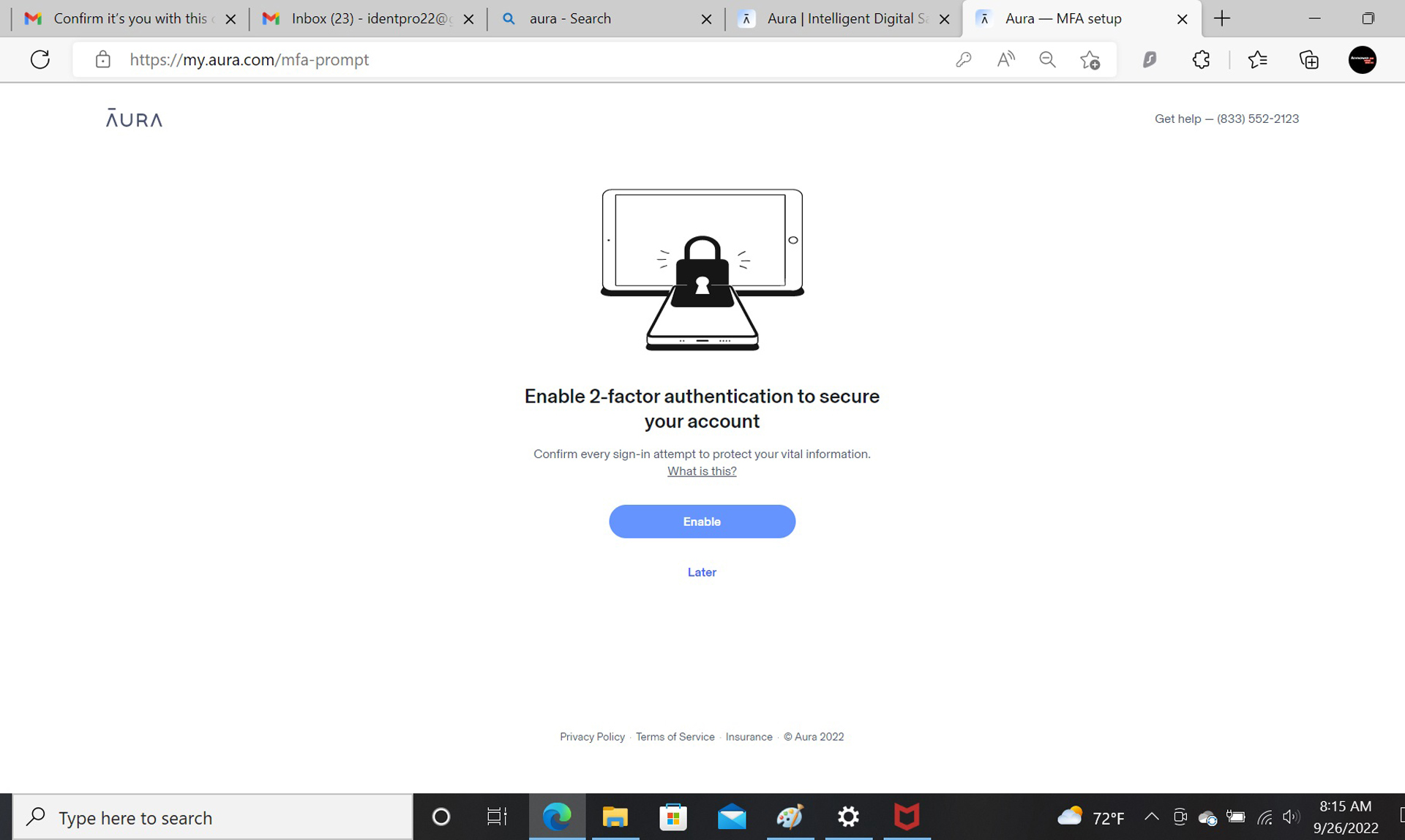

Regardless of which way you access your data, Aura can be protected with two-factor authentication, but you need to set it up manually.

The apps include parental controls for all mobile devices including Chromebooks to stop objectionable content from being viewed. It also lets adults limit time spent online and which apps kids can use.

Aura review: Cancellation

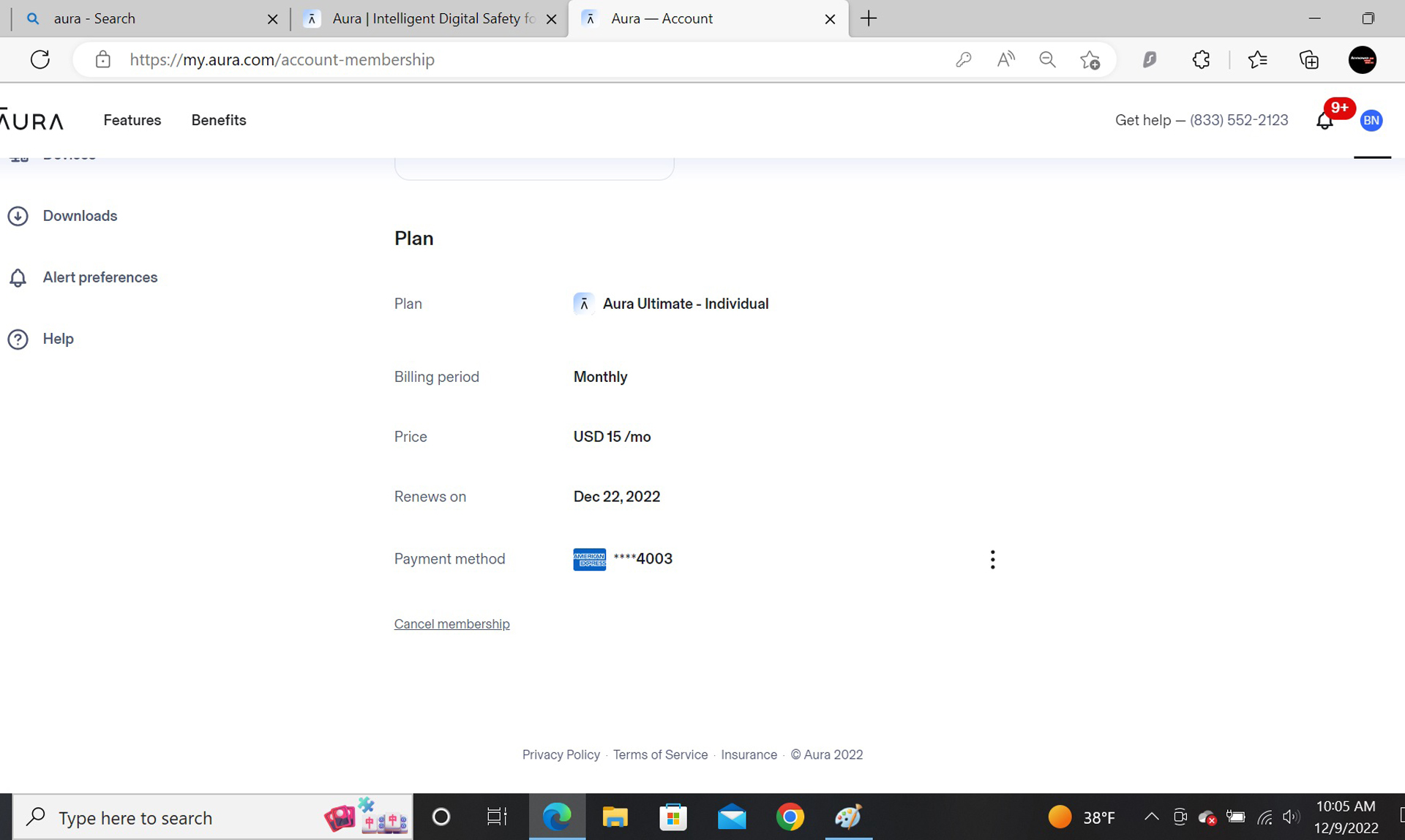

The service provides two ways to cancel: via a phone call or online. I picked the latter which started by going to the Membership section of my Aura Account. There, I clicked “cancel membership” and chose to do it online.

Next came an offer to cut the price by 40%, which I ignored. A screen came up that said they were sad to see me go. A minute later I got an email confirmation.

Aura review: Verdict

With one of the best interfaces in the identity protection world, Aura can not only protect your identity and warn you of problems but provides insurance, just in case. Its social media monitoring is augmented with Avira antivirus protection and access to a global VPN. The chink in its ID protection armor is that credit reports are only available once a year and there are no credit simulators or calculators.

Still, Aura has the most important and most used features to protect your identity online. At $15 a month or $144 a year, it’s a bargain that can monitor and defend your name from the worst of the web.

Brian Nadel is a freelance writer and editor who specializes in technology reporting and reviewing. He works out of the suburban New York City area and has covered topics from nuclear power plants and Wi-Fi routers to cars and tablets. The former editor-in-chief of Mobile Computing and Communications, Nadel is the recipient of the TransPacific Writing Award.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.