Samsung and Apple have won the smart phone war — and we have lost

Samsung and Apple dominance is a real threat to phone innovation. Here’s why

The smartphone market in the U.S. basically boils down to three companies — Apple, Samsung and everyone else. And everyone else could be about to shrink.

Recently, a report claimed that LG might exit the smartphone business, citing years of losses for that division of the electronics giant. That the report surfaced shortly after LG made a splash at this year's CES showing off a rollable phone suggests how hard it is for smartphone makers not named Apple and Samsung to capture sustained interest from U.S. phone buyers.

- Samsung Galaxy S21 vs. iPhone 12: Which phone wins?

- Galaxy S21 tips: Enable these nine features first

- Plus: It just got easier to compare RTX 30 laptops — here's how

The ups and downs of device makers would normally be of little interest to those of us who just want to find the best phone out there. Who cares if Phone Maker X is struggling to break through so long as I can pick up a new iPhone or Galaxy S model every so often?

But even companies with the track records of Apple and Samsung need rivals to push them forward. And you could argue that the two-horse show that is the U.S. smartphone market these days is allowing a feeling of sameness to creep into the latest flagship devices.

Take Apple's decision a few years back to stop placing a headphone jack in its new iPhones. Samsung resisted that move with its own flagships — until it didn't. Now, you won't find a Galaxy S or Galaxy Note model with a headphone jack. The recent Galaxy S21 models all shipped without microSD card slots, something Apple's always left out of its iPhones. And after mocking Apple's decision to not include a charger with the iPhone 12, Samsung did exactly the same thing with the Galaxy S21.

To be sure, you're not going to confuse the iPhone 12 with the Galaxy S21 any time soon. But some of the differentiating factors between the two smartphones brands are starting to disappear.

The Apple-Samsung duopoly by the numbers

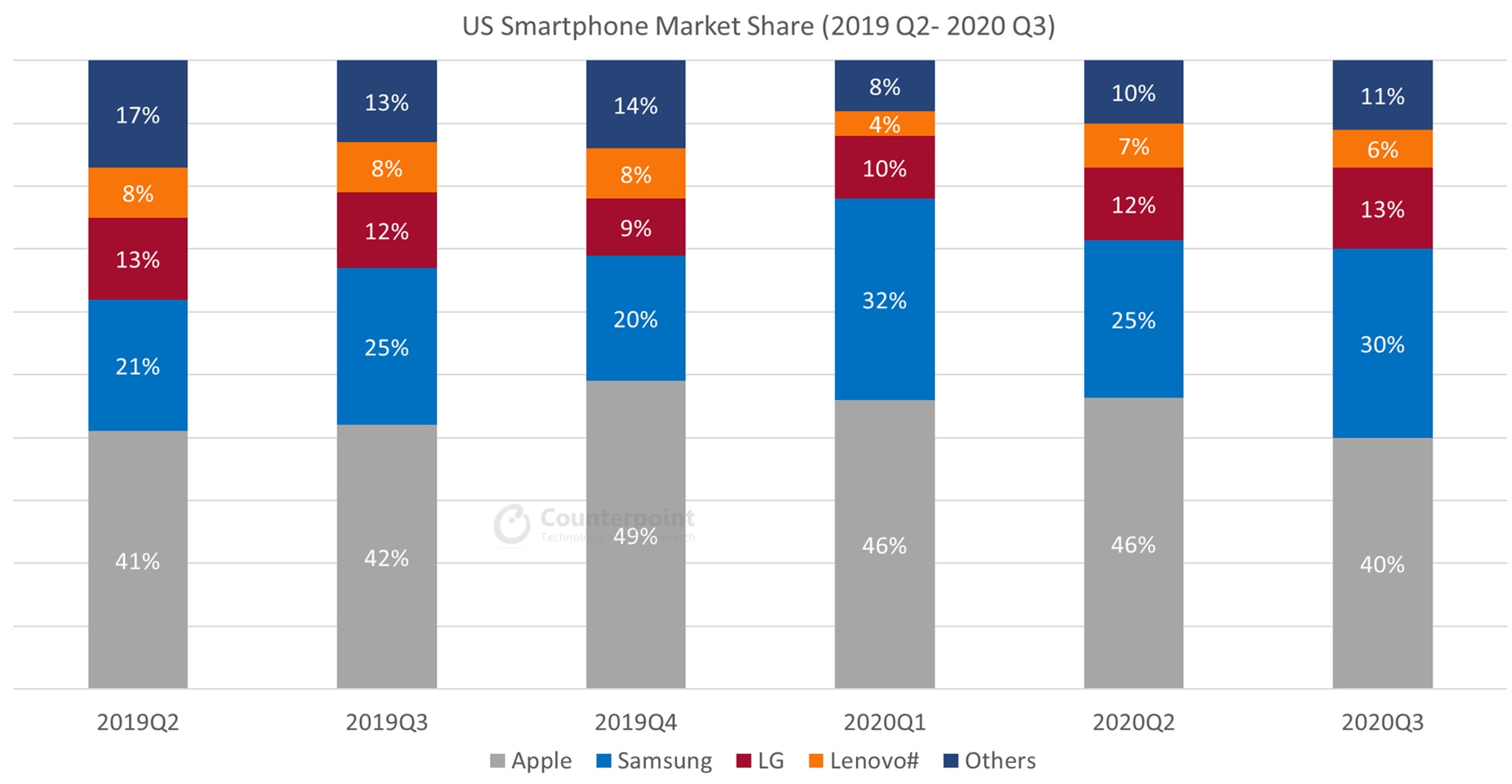

No one would dispute the fact that Apple and Samsung are the leading phone makers in the U.S. According to numbers from Counterpoint Research, in the third quarter of 2020, Apple enjoyed a 40% market share to Samsung's 30%. The next biggest player was LG, with a 13% share, while other phone makers made up 11% of the market.

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

We don't have fourth quarter numbers yet, but you'd figure that Apple's share would only grow, given that the company enjoyed record phone sales the last three months of the year fueled by the iPhone 12's release.

"Smartphones are a mature product category, and the U.S. market has been in a duopoly with Apple and Samsung for years," said Avi Greengart, founder and lead analyst for Techsponential. "This is not ideal for consumers, but both companies are under considerable competitive pressure in markets outside the U.S., and that helps protect consumers from stagnation."

Handset OEMs compete on a global scale, and competition remains healthy.

— Tuong Nguyen, Gartner

Indeed, when you take the entire world into account, Huawei is the second largest phone maker, wedged between Samsung and Apple. And other companies combine to hold the largest slice of the global market, according to numbers from research firm IDC. "The bigger picture is that handset OEMs compete on a global scale, and competition remains healthy," said Tuong Nguyen, a senior principal analyst with Gartner.

There's another factor hanging over the U.S. phone market, where a lot of people still buy their devices through the phone carriers providing their wireless service as opposed to picking up the best unlocked phones. "U.S. carriers also play a strong gatekeeper role; as much as they would like alternatives to Apple and Samsung, they have also been unwilling to open up their shelves to the churn of Chinese vendors," Greengart said.

Competition among budget phones

Apple and Samsung may command the lion's share of attention for people looking for flagship phones, but there's one segment of the market where they're overshadowed by other players. Midrange phones have been lively in recent years, as phone makers try to attract budget-minded shoppers.

"We are seeing more options at lower price points," Greengart said. The iPhone SE is Apple’s cheapest device at $399, but Apple hasn’t gone any lower with prices, Greengart added while “vendors like TCL, OnePlus, and Google are trying to expand the market for mid-tier devices."

Motorola and Google have been especially successful at making waves. Motorola's affordable G Series of phones have drawn a lot of interest from consumers by focusing on specific features like battery life in the case of the Moto G Power. Google's Pixel flagships had failed to attract much of an audience until the company rolled out A series phones — first the Pixel 3a, then the Pixel 4a — that delivered high-end camera performance at a lower price.

That's been the secret for phone makers looking to escape the long shadow cast by Apple and Samsung. Just how many premium features can you squeeze into a phone while keeping the overall price competitive to what the market leaders charge? OnePlus' entire business model seems designed around this entire point, both with its flagships but especially with the affordable OnePlus Nord phones it started rolling out last year.

Can phone makers still innovate?

That's a sign that there's room for phone makers to establish their own devices, even if the iPhone and Galaxy flagships consume a lot of oxygen in the smartphone space. And it may just push Apple and Samsung to keep finding new features and enhancements for their phones, even if the smartphone market is a pretty mature one at this point.

Neither company wants to be labeled as showing incremental improvement from their previous models, nor be a step or two behind the competition.

— Ramon Llamas, IDC

"Both [Apple and Samsung] repeatedly highlight how much faster their processors are, how much bigger and brighter their screens are, and how much more developed their cameras are," said Ramon Llamas, research director for mobile devices and AR/VR at IDC. "Neither company wants to be labeled as showing incremental improvement from their previous models, nor be a step or two behind the competition."

Phone displays are a good example of where the market leaders have kept trying to elevate the user experience, especially in the case of Samsung. Last year's Galaxy S20 introduced 120Hz refresh rates to Samsung's flagship lineup and subsequent releases have seen the company add dynamic refresh that adjust depending on what task you're performing.

Faster refreshing displays mean smoother scrolling and a better overall experience, which is pressuring Apple to respond in kind. Indeed, fast-refreshing displays are reportedly on the feature list for the iPhone 13 slated for release later this year.

Phone makers have also been trying to leave their mark with cameras. Recent Galaxy phones have seen Samsung up the megapixel rating on its main sensor — the Galaxy S21 Ultra features a 108MP camera as its primary shooter — while also upping the zoom capabilities of its camera phones. Apple, in turn, has put an emphasis on software improvements, introducing and enhancing features like Smart HDR, which enhances shots you take even in challenging lighting, and Deep Fusion, which calls out the finer details of photos.

Of course, you could make the case that the camera improvements in the iPhones and Galaxy devices might not have come as rapidly without Google applying the pressure to Apple and Samsung. While the Pixel phones may not enjoy a big slice of market share, they've undoubtedly introduced plenty of new capabilities to mobile photography, with the latest Pixels ranking among the best camera phones. Apple and Samsung would certainly be motivated to upgrade their cameras every year without the Pixel, but the extra competition certainly doesn't hurt.

The outlook for smartphone competition

That's why consumers can be forgiven if they're a little bit worried that the dominance of Apple and Samsung might slow the pace of innovation in the smartphone market. Advances will still happen, but it's a question of how rapidly they'll come without the threat of extensive competition.

"We’ve reached a point in this market where the innovations have been coming incrementally," Gartner's Nguyen said. "The next big use case/application is what will change this dynamic — much in the same way that smartphones changed the mobile phone market in a substantial way. The million dollar question is what the application or combination of applications will be."

Philip Michaels is a Managing Editor at Tom's Guide. He's been covering personal technology since 1999 and was in the building when Steve Jobs showed off the iPhone for the first time. He's been evaluating smartphones since that first iPhone debuted in 2007, and he's been following phone carriers and smartphone plans since 2015. He has strong opinions about Apple, the Oakland Athletics, old movies and proper butchery techniques. Follow him at @PhilipMichaels.

Club Benefits

Club Benefits