Google Pay: Everything you need to know

Google Pay offers contactless payments but also rewards and insights into your spending

The new, redesigned Google Pay app arrived on the scene in late 2020 and could be a life-changer in a couple of ways. For those who prioritize convenience in their finances, Google Pay could replace Venmo, Quicken, Splitwise and your plastic credit cards – handling and understanding your everyday financial transactions just got simpler and safer.

And for those who have some concerns about this one tech behemoth knowing as much about your money as they do your search habits? Google Pay could be the thing that has you finally throwing your phone in a lake and heading to a bunker.

Before you fully commit to either option, we’ll tell you everything you need to know to use Google Pay — and of course, we’ll give you the concrete steps you can take to get Google Pay working for you.

What is Google Pay?

No surprise here — Google Pay is kind of everything. As the latest player in the online wallet game, Google Pay really does replace the contents of that tattered billfold, moving everything to the one item we never leave behind: Our phones.

Google Pay is a quick way to:

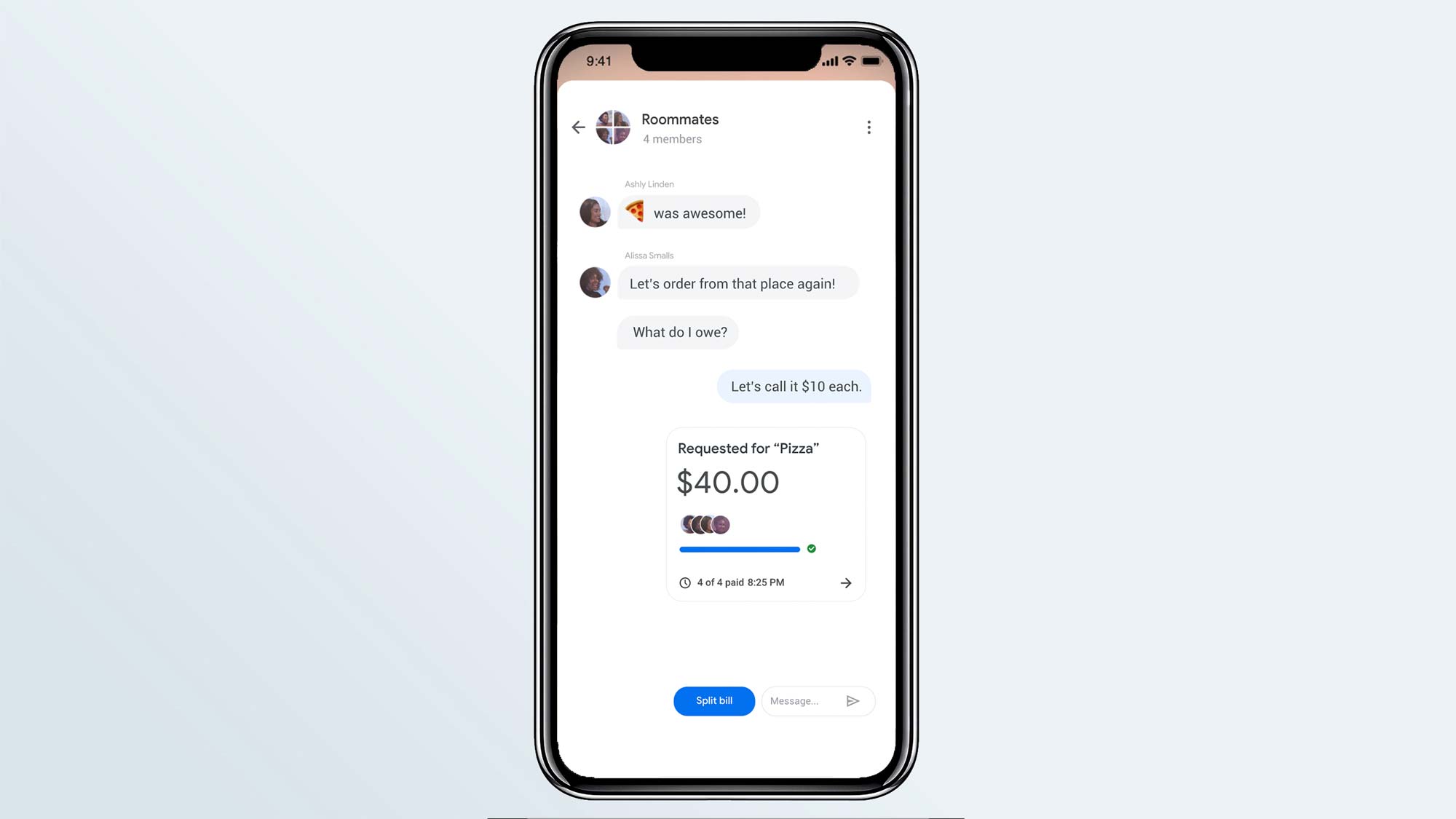

- Make Payments. Google Pay offers the features you need to pay your friends or service providers (just as with PayPal, Venmo, or Zelle), divide the check (as with Splitwise or Splittr) and buy stuff at larger businesses (at either a physical counter or an online checkout).

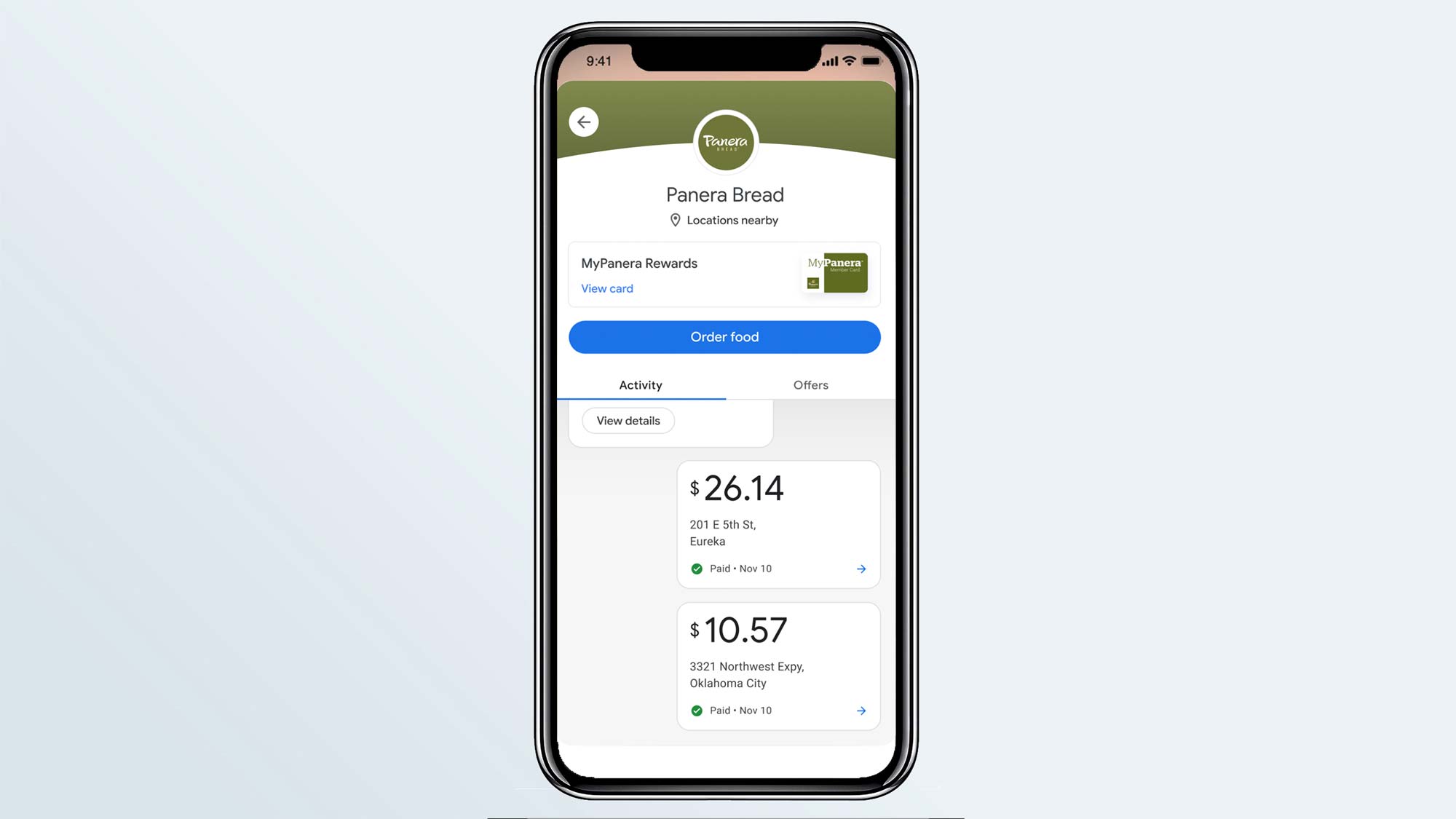

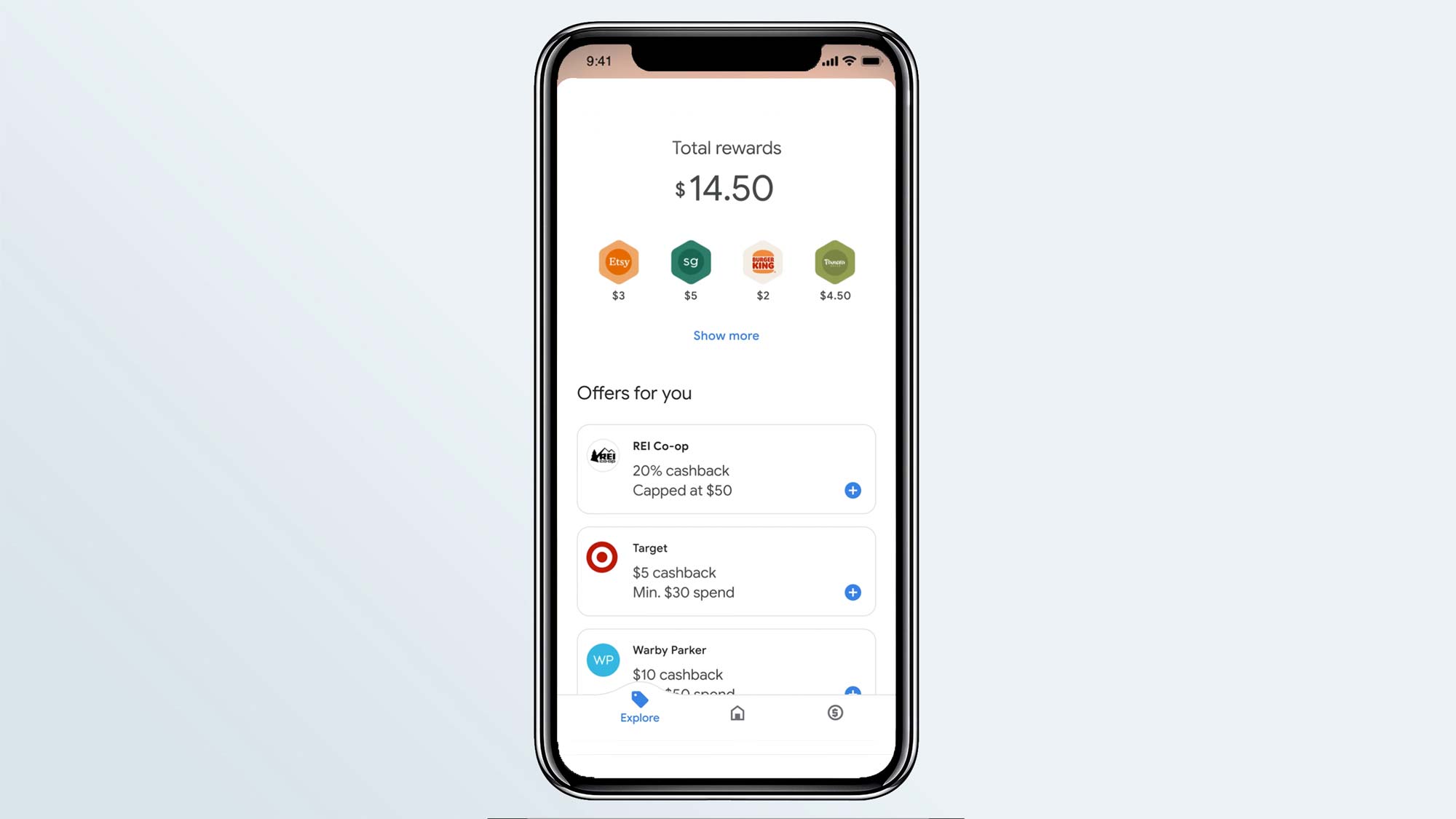

- Save and earn money. Google Pay consolidates and facilitates the rewards programs you already have and offers a new rewards program as incentive to use Google Pay.

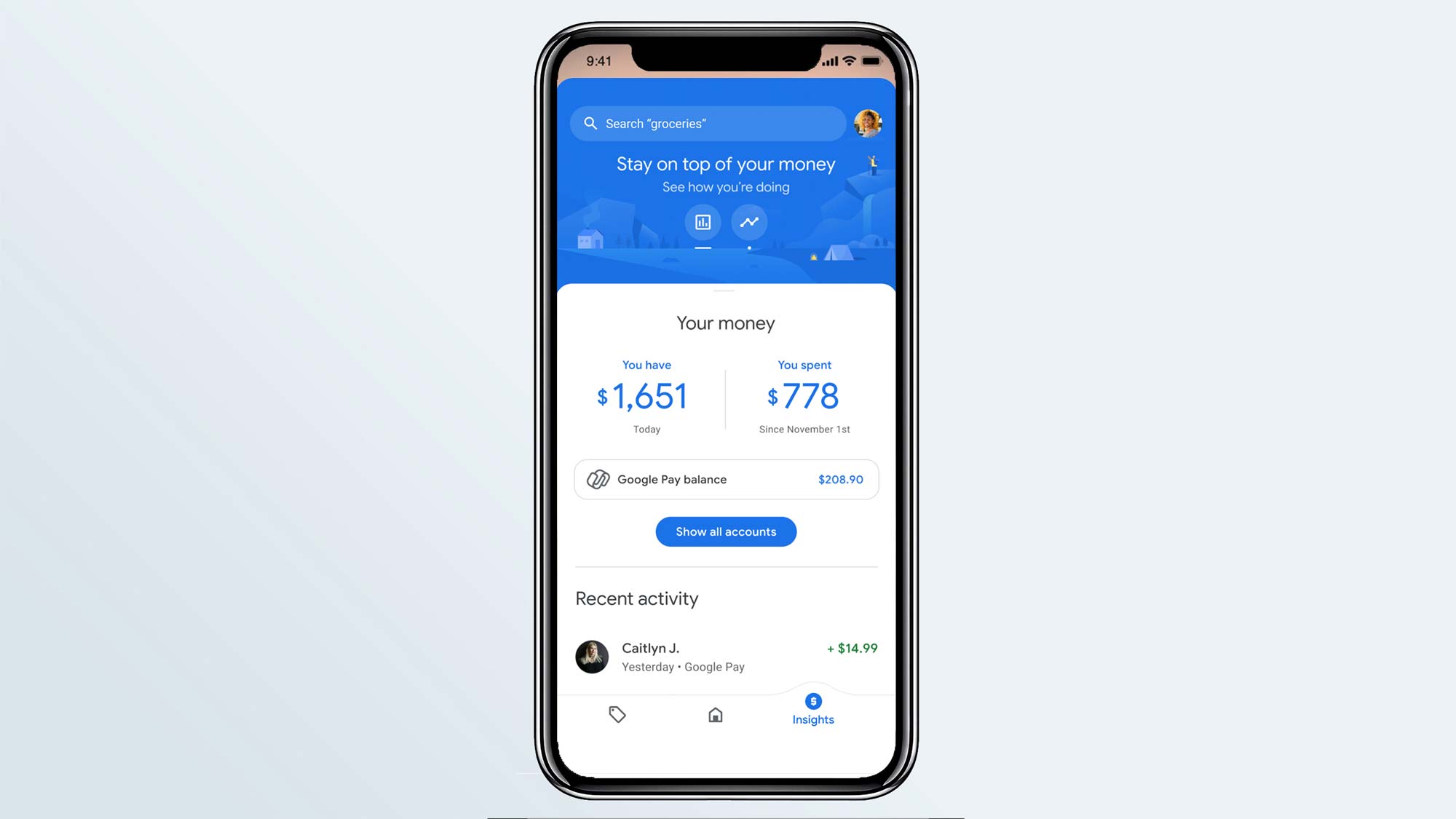

- Get insights. Google Pay lets you slice and dice your spending so that you can make smarter decisions about it.

Who accepts Google Pay?

People and services in the U.S. and India: Interpersonal payments are, as of this writing, available in the U.S. and India.

Online retailers at “participating websites” in most countries in the world.

Sign up to get the BEST of Tom's Guide direct to your inbox.

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

Point-of-purchase payments for those with Android phones (see below) at over a million stores in the U.S., U.K., and other countries. Wherever you see the contactless payment icon – you can use Google Pay.

Does Google Pay work on iPhone?

Yes, but not fully. Google is jumping OSes with Google Pay, a sure sign that the company is gunning for full-on ubiquity in the financial space. Currently, payment of friends and family is available for both Apple and Android users, but point-of-purchase payment is currently possible only for those with Android phones.

So, any U.S.-based Android user is well positioned to take full advantage of the Google Pay ecosystem. For anyone else, Google’s made it easy to check feature-by-feature availability.

Google Pay account: How do you set it up?

Getting up and running takes just a couple of steps:

- Go to wherever get your Android or iOS apps, and download Google Pay. (In the Apple Store, choose the pre-redesigned version still exists and is marked “old app”. Look for "Google Pay: Save, Pay, Manage" to get the new app.)

- Once you have the app, you’ll need to connect a bank or a credit card. Then, press “Payment” at the bottom of the app screen. The app will walk you through setup, and will ensure you verify your identity.

Note: You can get going with payments with just one financial connection – your bank or PayPal login, or a credit card. But for real spending insights, eventually you’ll want to take the time to tell Google Pay about all the credit cards you use.

Is Google Pay safe?

The common theme for all e-wallets is that they’re safer than actual wallets. How?

For starters, there’s fewer physical parts to lose. But going a bit deeper, an e-wallet like Google Pay is also safer than swiping your card, because Google Pay never provides a retailer with your credit-card number. Rather, it provides the retailer with a token containing your bank information. So if that retailer gets hacked, none of your info will be at risk.

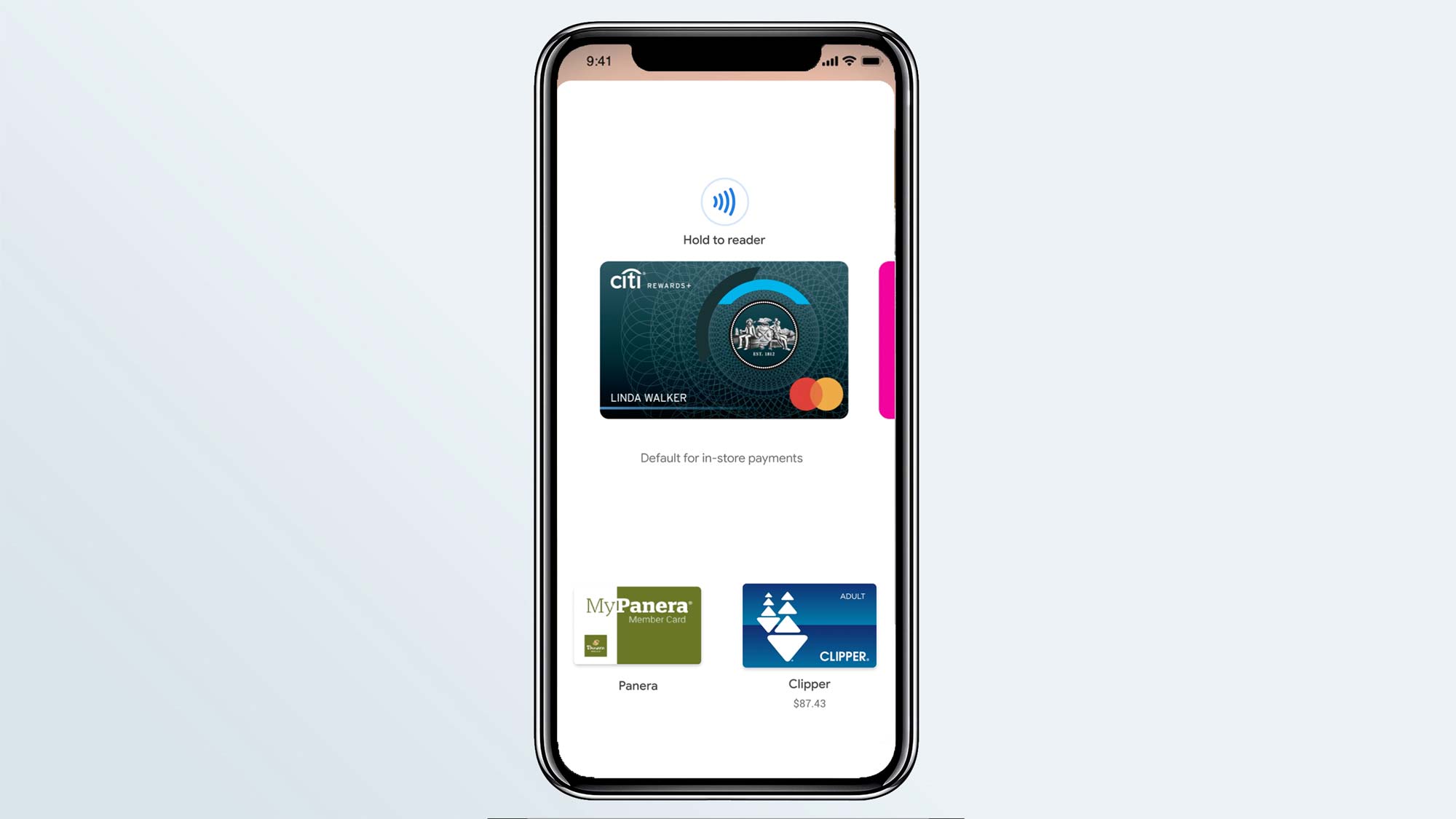

At point of purchase, Google Pay works with “near-field communication” (NFC) technology – the same technology that powers contactless payments worldwide, which is why you can use Google Pay wherever you see the contactless symbol. Just like with an online purchase, NFC doesn’t pass your card info along – just encrypted tokens.

And for those who think of safety not just in terms of data transmission, but also about germs? It’s worth noting that Google Pay at point of purchase is 100% contactless – no cards changing hands, and no machines to touch but the one that is already yours.

All this security might cost some convenience for some: You’ll need to have your automatic screen lock turned on to use Google Pay.

What is Google Pay Rewards?

Google Pay Rewards is, for now anyway, the huge carrot with which Google looks to be growing its user base. Google has teamed up with hundreds of businesses and is reaching into its own deep pockets to provide you a financial incentive for using Google Pay and for getting others signed up.

Once I was in the system, reward opportunities just kept coming at me – in the app whenever I opened it, in my Gmail account, and of course, a whole new set of ads when I’m just consuming news online.

How does Google Pay help with saving and spending?

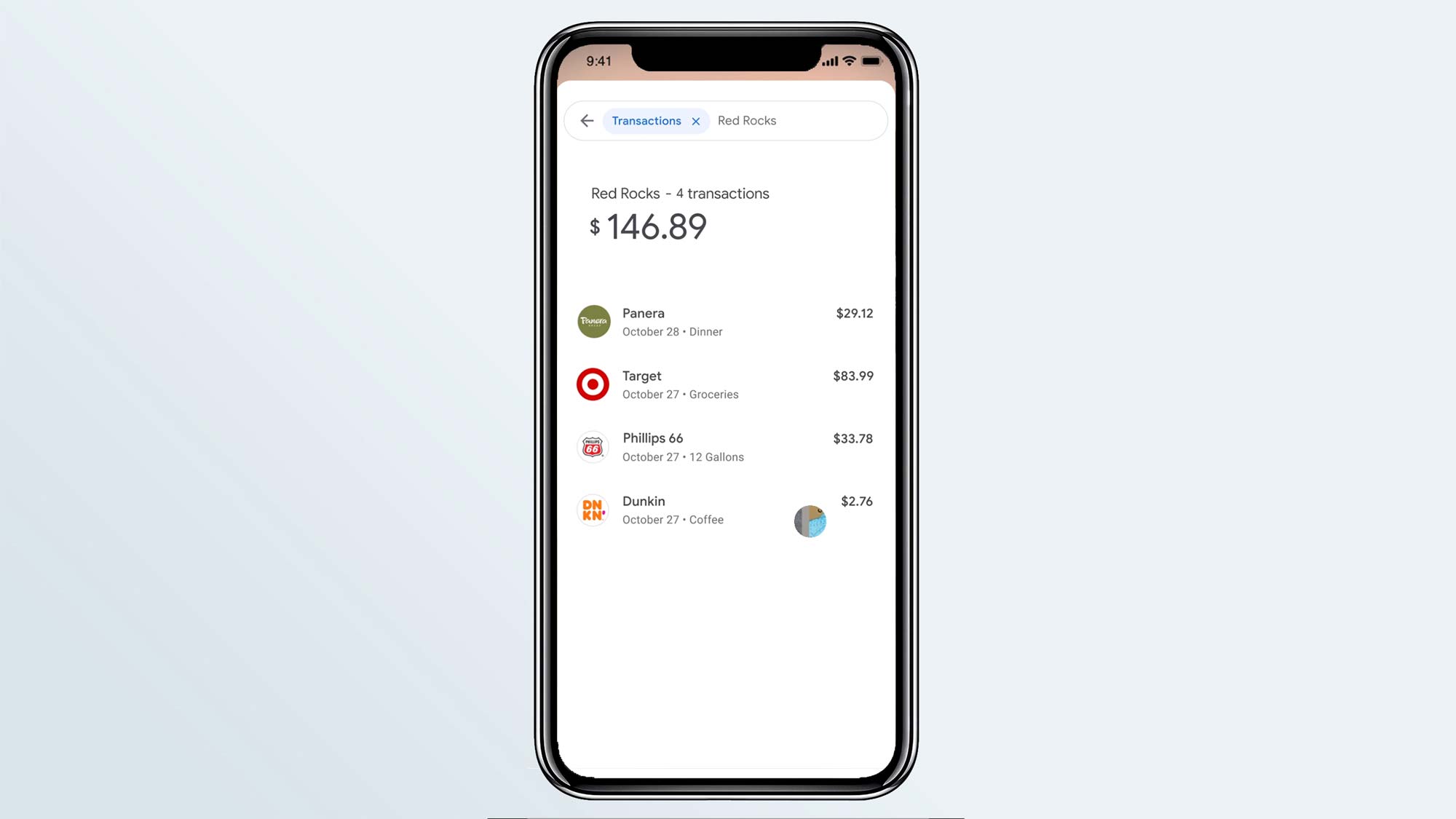

Google Pay might be just the ticket for anyone who’d like to understand their spending but doesn’t want to go full Mint/Quicken with the best personal finance software. Google Pay shapes its insights by payee (“How much have I paid on my student loan so far this year? How much do I spend at my local pub?”) as well as by category.

Google Pay is also flexible. Your question “What did I spend on food last month?” can pivot on food overall, giving you the info about grocery stores, restaurants and any other obvious food item that shows up on a credit-card bill, or just show what you spend dining out.

How do you send and receive money with Google Pay?

Just tap the Send button at the bottom of the screen. The app will ask whether you want to pay or receive money, and you’ll follow the simple instructions from there to enter the person (by phone number, email address, or contact) and amount.

Google makes a big show of insisting someone doesn’t need to use Google Pay in order to receive money, and technically, it’s right. However, when I tried to send using the Payment button, the app created a sales-pitch text to send to the contact. The trick to sending without recruiting is to hit the “Send” button – not the “Payment” one. It’s a frustrating hiccup in an otherwise glossy user experience.

Should you use Google Pay?

To consolidate everything you use to spend your money, earn rewards while doing it and gain actionable insights around your behaviors, Google Pay really is a one-stop financial shop, replacing myriad existing applets. But only you can determine how you feel about Google knowing even more about you.

What did I decide? I’m going to keep using Google Pay for three months. At that point, the app has promised to ask again whether I want it to provide the insights for which it needs to look deep inside my data; I might or might not say yes.

Margot Page is an editor and writer covering personal finance based in Seattle, Washington. She led the product management team for both Microsoft Money and MSN Money.