How Nvidia buying ARM could change mobile tech forever

Here’s what Nvidia's ARM acquisition means for the tech you know and love

Nvidia is buying chip designer giant Arm for $40 billion from its owner SoftBank. In the world of chips that’s a big deal, and not just in monetary terms.

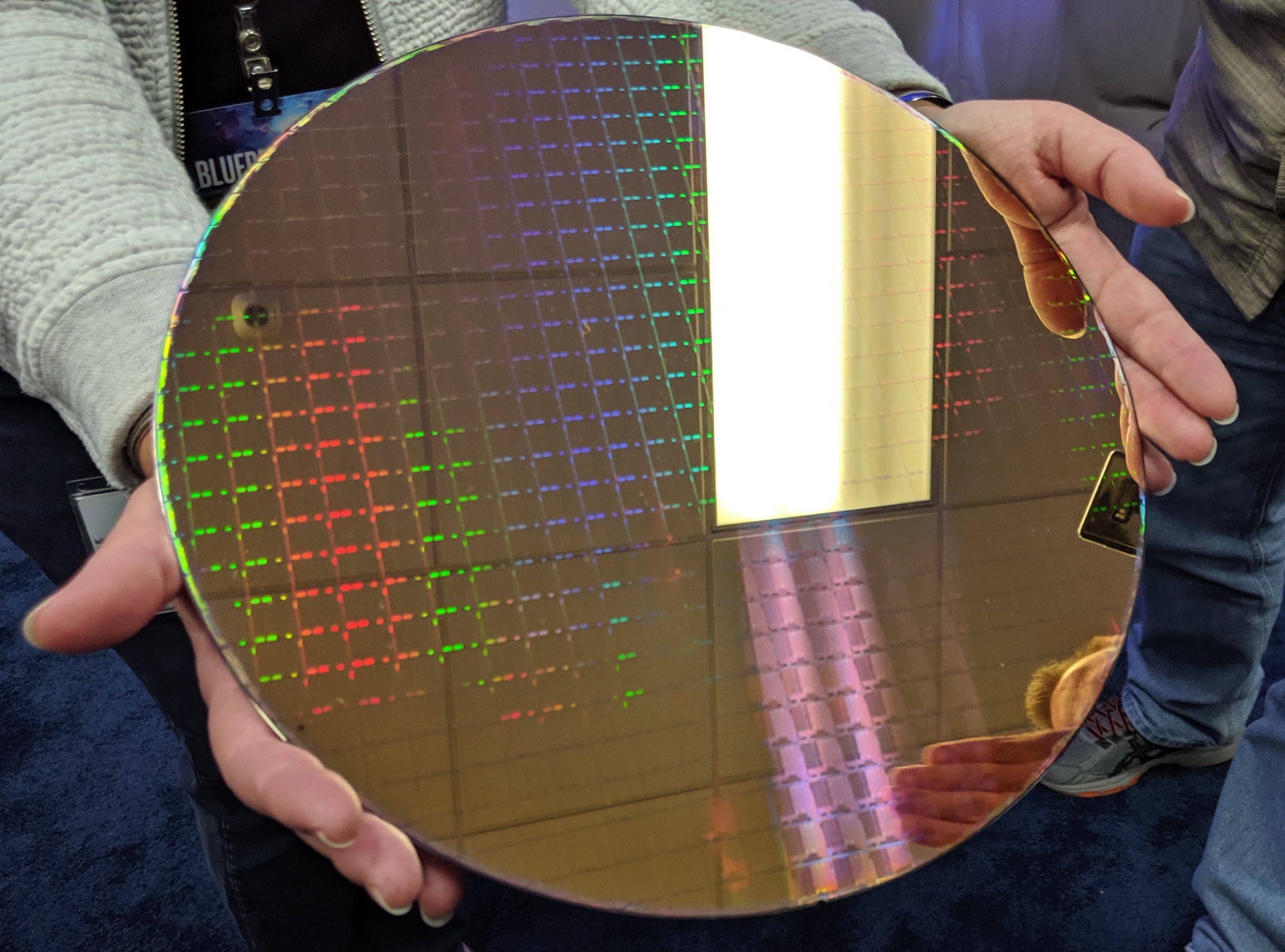

Arm doesn't make chips — instead, it designs them and provides the instruction sets that underpin the mobile processors found in everything from iPhones to the oddball Microsoft Surface Duo. And when Apple Silicon sees MacBooks drop Intel chips for Cupertino’s in-house slices of silicon, the Arm architecture will be at the heart of Mac machines. Nvidia is best known for its GeForce graphics cards, but it also makes chips for artificial intelligence, data centre, and embedded systems use.

- Here are the best phones you can get right now

- The best laptops right now

- Plus: Nvidia RTX 3080 overclocked benchmarks reveal crazy speeds

In short, these are two huge movers and shakers in the chip world becoming one. Here's what that could mean for you and the tech you love. This'll involve a bit of speculation on our part, so strap in.

Your next phone could have a powerful AI boost

Nvidia’s initial ambition for Arm is to push its tech into the chip designer’s vast network. It’s far too early to know what that will look like. But we suspect it will see Nvidia’s GPU-powered AI tech expanded from professional graphics cards and data center use and into smartphones.

J P Gownder, principal analyst at Forrester, also sees this as a distinct possibility: “Graphics and AI are crucial to the future of devices, and Nvidia has both. Arm - already embedded in tens of billions devices from smartphones to industrial equipment to home devices - will gain access to world-class technology in graphics and AI, two areas where NVIDIA's GPUs excel. Nvidia will gain access to far more outlets for its technologies, potentially licensing technologies through Arm.”

“In the short run, there is very little overlap between the two companies' products, but there are many potential medium- and long-term synergies when adding GPUs and CPUs together.”

Both Qualcomm and Apple already have chips with AI technology built into their respective Snapdragon and A-Series silicon. So we’d not be surprised to see Nvidia and Arm offer chip designs that mix Arm’s Cortex processor designs with Nvidia's GPU tech.

Sign up to get the BEST of Tom's Guide direct to your inbox.

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

This could allow smartphones to become even smarter by using extra onboard AI tech to learn on the go, even in places where there’s no signal. We’ve seen this with Qualcomm’s AI Engine for example.

But AI tech is a huge part of Nvidia — it provides a lot of hardware and systems for self-driving cars after all — and it could bring its research and tech to the Arm ecosystem. All that could mean a phone that responds better to its user, recognizes voice commands with more fidelity, delivers improved image processing, and boosts augmented reality experiences.

GeForce tech could filter down to phones

Now we don’t expect the iPhone 13 or Samsung Galaxy S21 to come with an GeForce RTX 3000-series graphics accelerator. But Nvidia could work with Arm to bring some of its graphics tech to smartphone chips.

Arm already licenses graphics accelerator designs in the form of its Mali GPUs. So it wouldn't be a stretch of the imagination for Nvidia to bring its tech into Arm’s R&D and see the Mali GPU replaced with tech derived from Nvidia’s latest GPU architecture.

Samsung is already working with AMD to bring the latter’s GPU tech to the former’s Exynos chips. So mobile chips with Nvidia GPUs could very much become a thing.

And that could mean phones that have the power to deliver true high-end gaming graphics. Nvidia’s deep-learning supersampling tech already enables high-end graphics to have less of a demand in overhead performance.

So it could work with Arm to retool that tech into something that would work on a mobile system-on-a-chip (SoC) and thus deliver impressive graphics on a mobile device without melting down its silicon innards.

We’ve already seen how mobile processors can clock up to 2.84GHz, at least in the case of the Snapdragon 865 Plus. So the introduction of Nvidia tech into mobile GPUs could really supercharge how smartphones can handle high-fidelity graphics.

Arm and Nvidia chips could challenge Intel and AMD

Nvidia's only CPU and mobile-centric hardware has been the Tegra line of SoCs. These were found in a few mobile devices some years ago; the Google Nexus 7 had a Tegra chipset for example. But Nvidia has mostly stuck with graphics, AI and embedded systems work.

Meanwhile, Arm’s chip design and architecture has been slowly spreading its wings beyond mobile tech. Apple is looking at using Arm based chips for future Macs and Windows 10 has been made to work on RISC architecture and run on ARM-based chips.

At the moment, the performance of off-the-shelf ARM-based chips can’t compete with AMD Ryzen or Intel Core processors. But with Nvidia's experience in making SoCs and its graphics cards, that could change.

More R&D using Nvidia’s vast finances and knowledge sharing could see new Tegra SoCs emerge that contain more powerful CPUs and impressive graphics power. Nvidia doesn't even have to make these chips, it could simply integrate its tech and future SoC designs into Arm’s licensing.

That means we could see Apple take that tech and use it to build Arm and Nvidia-based Apple Silicon chips that not only deliver solid everyday performance, but also have a good bit of graphics power.

The idea of a new 12-inch MacBook with built around Arm architecture and a powerful next-gen Tegra chip at a competitive price is rather compelling. Especially if you consider how Apple will get its developer ecosystem to work hard on developing apps to run on Arm.

This would be bad news for Intel and AMD, as the encroaching threat of ARM-based chips in the computing world could be accelerated into a full-scale invasion by Nvidia. AMD and Intel’s PC processor duopoly could then be eroded by Nvidia and ARM; after all, Nvidia already competes with AMD in the PC GPU arena, so why not CPUs?

Nintendo Switch consoles could get a big power boost

Speaking of Tegra chips, the current Nintendo Switch and Nintendo Switch Lite use Nvidia's Tegra X1 SoC. It uses Arm Cortex CPU cores and a GPU built around Nvidia’s rather old Maxwell architecture. The console is due an upgrade, as the Tegra X1 wasn't exactly new when the Switch came out in 2017.

We’re expecting an upgraded Tegra chip with the Nintendo Switch 2, which could arrive as soon as next year according to rumors. But much like Nvidia and Arm could tackle chip for PCs, it could also deliver more powerful SoCs for devices such as future Switch consoles.

If all goes well with the Arm purchases, Nvidia could come with a Tegra chip that not only has upgraded Nvidia GPU tech but also better interaction between the CPU and graphics. And that chip could find its way into a second or third-generation Switch. Considering that the next Switch has been tipped to offer 4K visuals, a major processor upgrade seems inevitable.

That’s a tantalizing prospect, as current Switch already manages to deliver some impressive visuals from an off-the-shelf silicon — see The Legend of Zelda: Breath of the Wild. So just imagine what Nintendo could do with a more powerful or custom chip.

Licenced to chip

The combined might of Nvidia and ARM could really screw with the smartphone world in general. And for a variety of reasons.

Arm has long been a neutral company, licensing its architecture and processor designs to pretty much anyone one who wants to make a mobile chipset. And Nvidia has long been a customer of Arm.

But much like the apprentice becomes the master, now the customer has become the owner.

If Nvidia keeps everything as it is with Arm but bundles its technology into the Arm chip designs, then chip makers and users of those chips could see the benefit. Qualcomm could start integrating Nvidia GPU tech with its Snapdragon SoCs. And as mentioned, the likes of Microsoft and Apple could get even more tech to work with when it comes to making Windows 10 and macOS run on Arm-based silicon.

“Integrating Nvidia's graphics and AI capabilities into Arm chips will help Apple compete with the heavyweight Intel-based chips it is jettisoning,” said Gownder. “But Microsoft has continued to push for Windows on Arm, and this could create more effective mobile devices for its ecosystem.”

This is all well and good in theory. And Nvidia arguably does not directly compete with a lot of mobile chip makers.

But if Nvidia decided it wanted to use the acquisition of Arm to push its Tegra chips into smartphones or create Nvidia-branded Arm CPUs, which Huang has said is a possibility, then Nvidia could find itself in competition with the likes of Qualcomm and Samsung’s Exynos chips.

As such Nvidia might — and we stress might — end up ramping up licencing fees to stymie its new rivals. It could even force people who want to use Arm chip designs to adopt Nvidia tech alongside them, and that could cause a major industry upset.

“An acquisition by Nvidia would be detrimental to Arm and its ecosystem. Independence is critical to the ongoing success of Arm and once that is compromised, its value will start to erode. It would accelerate the growth of RISC-V as an open-source alternative,” Geoff Blaber, vice president of research at CCS Insight explained.

“This will rightly face huge opposition, most notably from Arm licensees who have collectively shipped an average of 22 billion chips annually over the last three years. A huge diversity of businesses from Apple to Qualcomm are dependent on Arm and will be motivated to unite in opposition”.

There’s a lot of potential for chip and phone makers to take exception to Nvidia’s acquisition and subsequent use of Arm. This is especially true of Chinese companies, as Nvidia’s acquisition would mean Arm is under the control of a U.S. company, and Chinese and American political and economic relations aren’t great at the moment.

As such, we could see these companies move away from Arm designs and the RISC instruction set. And as Blaber mentioned, they could adopt the royalty-free, open-source RISC-V architecture.

That would mean upsetting the underlying foundation on which most smartphones are built upon. And the result could be the development of new chips and thus new phones that require the likes of iOS and Android to be reworked, or even lead to whole new mobile operating systems.

Such a move could effectively create a third ecosystem in the phone world, as well as forked versions of Android and possibly iOS; given Apple’s tight control over its hardware and software it would likely choose to stick with RISC or adopt RISC-V rather than try and use both. In short, if this situation comes to fruition, picking the right smartphone could be a confusing mess of trying to figure out compatibility, software support and hardware performance.

Arm-ed and dangerous

The business machinations of billion dollar companies might seem rather dry and hard to quantify when frankly unfathomable sums of money are being bandied around. But Nvidia's acquisition of Arm could shake up a large part of the tech world we currently know.

There’s a chance that the acquisition might not be waved through by various regulators and might be blocked by the U.S., U.K. Europe and China, But as it stands it looks like Nvidia could compete its acquisition of one of the most significant companies in the world of chips.

The ramifications could be good, bad, or ugly — all all three — leading to more powerful hardware but also disparate ecosystems of devices. Either way, there’s a lot of potential for this ephemeral corporate acquisition to effect the very tech you’re using to read this article; exciting times.

Roland Moore-Colyer a Managing Editor at Tom’s Guide with a focus on news, features and opinion articles. He often writes about gaming, phones, laptops and other bits of hardware; he’s also got an interest in cars. When not at his desk Roland can be found wandering around London, often with a look of curiosity on his face.