I Used Apple Card Overseas and Had a Lot of Problems

I wish Apple Card was a Visa

Visa really is everywhere you want to be. It’s not just a marketing slogan, but a cruel fact I learned when I tried to rely solely on my Apple Card during a recent trip to Italy.

I’ve been testing out Apple’s credit card since it launched in August. And that includes taking it overseas to see how this card performs away from the safety of an Apple Store. The verdict? The Apple Card isn’t always the best travel companion, at least when you head overseas.

Apple Card: It just works (sometimes)

When I landed in Rome, I found the ItaliaRail machine and purchased two tickets from the airport to Roma Termini station in the heart of the city. I noticed the tap-to-pay sign, even in my sleep-deprived, jetlagged state. (It may have been noon in Rome, my West Coast-fixed brain was feeling every bit like it was 3 a.m. in California). I pulled out my iPhone, not knowing what to expect. To my surprise, Apple Pay worked — I’ve got the Apple Card set up as my default method of payment — and my first attempt at using the Apple Card in Italy was a success.

My second attempt at using Apple Card was at the Vodafone kiosk in the Fiumicino airport, where I was also able to use Apple Pay. This airport, it seemed, was completely on board with mobile payments.

I tried to stick with Apple Card throughout my vacation — a quick jaunt in Rome and a week in Florence and Tuscany — just to make paying off the trip easy, but it wasn’t as seamless an experience as I had hoped after those early successes, especially when I turned to the physical Apple Card you’re meant to use when mobile payments aren’t an option.

Apple card declines: An investigation

In Florence, there were few tap-to-pay terminals. Even worse, it seemed no one accepted MasterCard, the global payment network used by Apple Card. Almost everywhere I handed over my white titanium Apple Card, from restaurants to museums, the server or customer service agent would invariably return with: “No MasterCard,” and, in some cases, “Your card was declined.”

It was the latter that threw me off, especially when it happened three times in one day at three separate venues.

Sign up to get the BEST of Tom's Guide direct to your inbox.

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

“Hmm,” I thought. “Maybe I should’ve put a travel alert on the card.”

I thought Apple had placed a freeze on my spending after a few Italian transactions to prevent fraud. So I opened the Wallet app and selected my Apple Card, then tapped on the ellipses that hides the support contacts at the top right. I decided to send a message to the Apple Card support number about my international woes, but my text didn’t go through. (I forgot that the Vodafone customer service agent had turned off iMessage when I bought an Italian SIM card; otherwise this might have worked.) Then I tried calling the support line, but the automated recording was in Italian. Just as I was about to give up hope and retire my Apple Card for the rest of my trip, I called the support line again — this time using Skype so I could control the language.

After a brief hold, I was connected with Darnell, an Apple Card specialist with Goldman Sachs and an overall lovely human being. He asked for my last name and the last four digits of my social security number to look up my account (as the card lacks an actual number). Then Darnell said something that took me by surprise: My card hadn’t actually been declined anywhere.

Apple Card: You’re using it wrong

Darnell told me it was possible that retailers and restaurants where it had been “declined” just didn’t accept MasterCard, and didn’t realize Apple Card was a MasterCard at first.

Another possible explanation: The Apple Card’s magnetic strip is oriented on the flip side of where most credit cards strips are — on the bottom of the rear of the card instead of the top — and isn’t as obvious as most strips. It looks like a silver design element in contrast to the white, which may have confused some merchants.

Because there were no records of declines on my card, the only conclusion I (and Darnell) could come to was that the card had been swiped incorrectly.

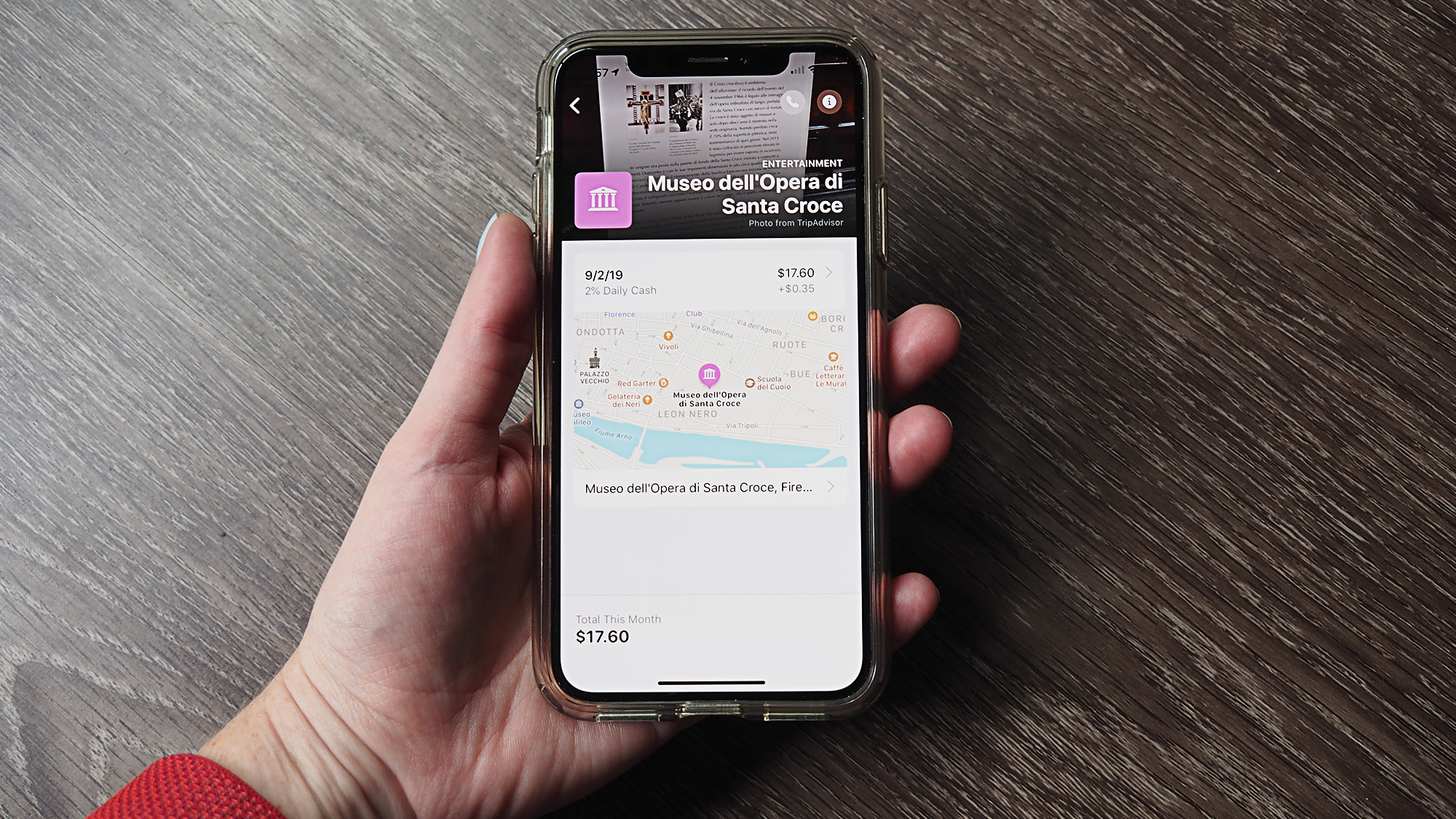

This seemed more likely after I handed over the card at a museum in Florence, only to be told that my card was declined. Then I noticed the universal tap-to-pay symbol on the card reader and decided to give Apple Pay a shot. My Apple Card transaction worked instantly.

Bottom line

After racking up all of those “declines,” I became less inclined to hand over my physical Apple Card while traveling. It added unnecessary time and irritation to every transaction. But my back-up card, the American Express Platinum, was also rejected all over Italy. So the card I used most often during my vacation ended up being an old Chase Sapphire Preferred — a Visa.

I still used Apple Card wherever I saw a tap-to-pay or mobile payments sign to earn the 2% cash back that Apple promises. But I’ve learned my lesson: When traveling internationally, always carry multiple forms of payment. And never leave home without a Visa — just in case.

Caitlin is a Senior editor for Gizmodo. She has also worked on Tom's Guide, Macworld, PCWorld and the Las Vegas Review-Journal. When she's not testing out the latest devices, you can find her running around the streets of Los Angeles, putting in morning miles or searching for the best tacos.