Buying cheap tech could take a hit in 2025 — Trump’s tariffs, explained

If the proposed Taiwan-based chip tariffs kick in, tech products could get pricey, and here's what it means for you

“Tariffs, tariffs, tariffs!” Whether you’ve been following the U.S. economy or not, you’ve surely seen this word plastered all over the news — you can’t escape it.

To give you the big picture of what’s happening, U.S. President Donald Trump announced a 10% tariff on products from China, as well as a 25% tariff on steel and aluminum imports. On top of that, Trump is considering implementing tariffs on Taiwan-based chips – a move that could affect Apple products, as well as anything that requires processors, GPUs and chipsets from Nvidia, AMD, Qualcomm and MediaTek.

Bottom line? Your favorite tech — everything from the best iPhones and best MacBooks to PCs, gaming consoles and more — could all feel the ripple effect of these tariffs.

Tariffs are inherently political, but let’s drop all the partisan noise. Left, right or indifferent – I just want to know how these new measures will affect you, dear reader, particularly if you’re a U.S.-based consumer.

To cut through the chatter, I reached out to experts to help make sense of how Trump’s tariffs will impact your tech, budget and daily life.

But before we dive into their insights, let’s first break down what tariffs actually are.

What are tariffs?

Tariffs are taxes, or extra fees, added to imports — products brought in from other countries. To paint you a picture, let's say a package arrives at a New York port from China. To clear customs, the importing company must pay a fee (i.e., a tariff) to the U.S. government.

Sign up to get the BEST of Tom's Guide direct to your inbox.

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

As the BBC pointed out, under Trump’s 10% tariff on Chinese imports, a $10 item would incur an extra $1 charge.

Without going full-blown historical nerd on you, U.S. tariffs started as a major revenue source and evolved into a trade policy tool. When the government deemed trade practices unfair, it turned to tariffs as a protective measure.

For example, in 2009, President Barack Obama slapped China with tariffs to protect the U.S. steelwork industry, which was negatively affected by a surge of low-cost Chinese tire imports. According to CNN Business, this action “saved 1,200 tire jobs,” but Americans suffered price surges on tires.

Tariffs can also be used as a negotiation instrument. For example, in 2019, during his first term as president, Trump threatened to hit Mexico with tariffs if it refused to curb the flow of Central American migrants entering the United States. According to Politico, this strategy worked in Trump’s favor.

Fast forward to 2025, and we’re on a different playing field. Why is Trump turning to tariffs again? Let’s hear it from the horse’s mouth.

Trump explains his latest tariff moves

According to the White House’s official fact sheet, Trump considers illegal immigration and fentanyl trafficking to be an “extraordinary threat” to the U.S. The Trump administration claims China supplies the chemicals, while Mexican gangs traffic them and operate fentanyl labs in Canada.

In response, Trump threatened tariffs on these countries until “the crisis is alleviated.” It’s worth noting that Canadian Prime Minister Justin Trudeau claims that Canada is responsible for less than one percent of fentanyl entering the U.S.

As of this writing, Trump paused tariffs on Mexico and Canada — both countries agreed to deploy troops to their borders to address migrant and drug smuggling concerns. The 10% tariff on China, on the other hand, still stands.

Tariffs on steel and aluminum

Trump claims that tariffs on metals are necessary to protect America’s steel and aluminum industries, which have been harmed by “unfair trade practices” and “global excess capacity.” Keep in mind that this isn’t a new move for Trump. In March 2018, he slapped “most countries” with tariffs on steel and aluminum during his first term.The tariffs were later extended to the EU, Canada and Mexico three months later. In May 2019, Trump lifted the metal tariffs on Canada and Mexico – but not for the EU.

Did Trump's first-term metal tariffs meet his objective to protect domestic manufacturing? According to Fox Business, they led to a 1.4% reduction in manufacturing employment and a 4.1% increase in production costs.

In 2021, President Joe Biden replaced Trump’s EU tariffs with a “quota system,” meaning some EU steel and aluminum entered the U.S. tariff-free, but anything beyond the cap still faced import duties.

In 2025, Trump is imposing stricter metal tariffs. This means no country is safe (i.e., no exemptions apply) as he aims to force companies to source materials within the U.S.

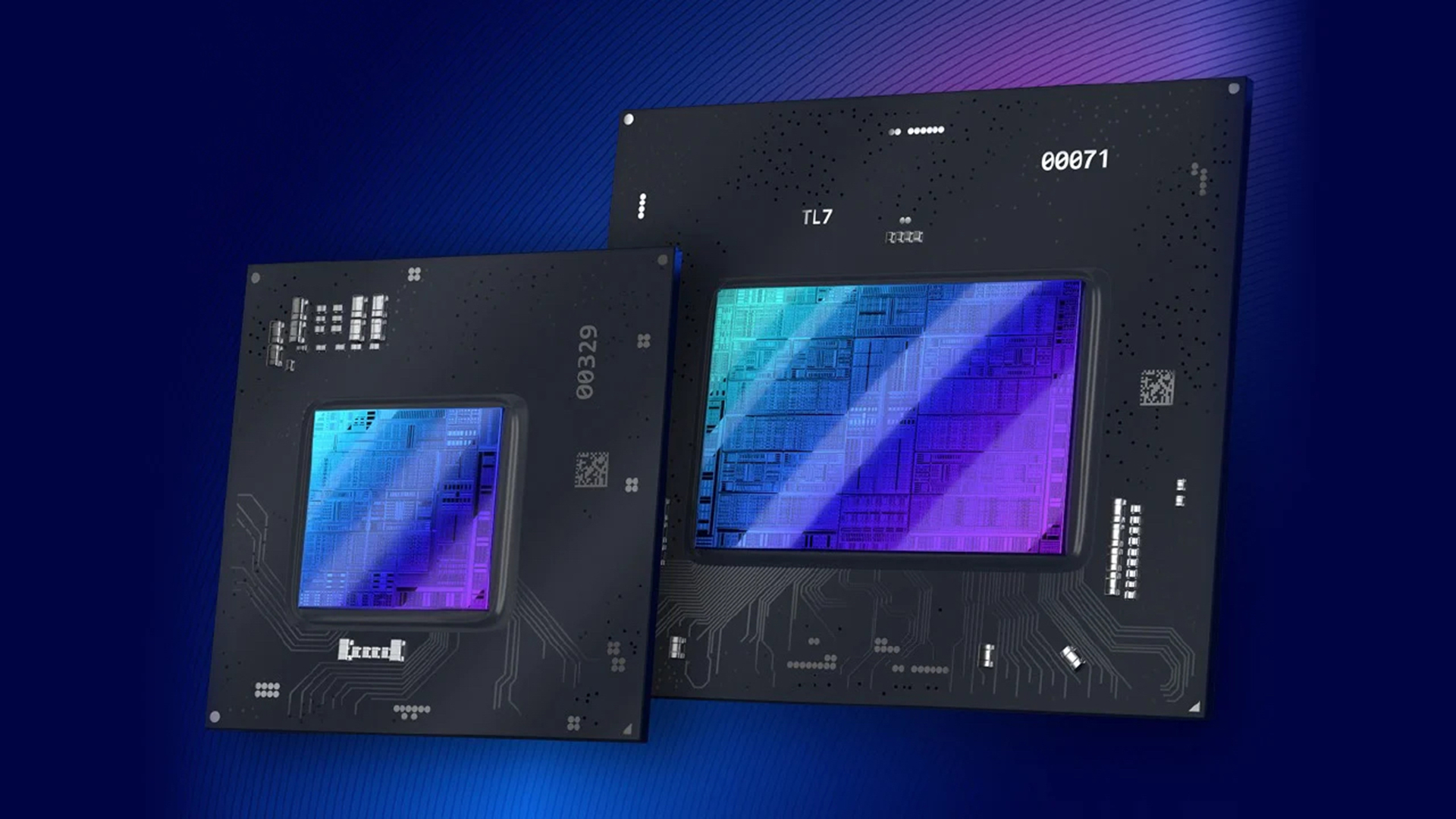

Tariffs on chips

Now let’s talk about Taiwan-based semiconductors and chips being in Trump’s crosshairs.

“Tariffs on foreign production of computer chips and pharmaceuticals [will] return production of these essential goods to America,” he said at the House Republican Issues Conference in January, adding that Taiwan has secured 98% percent of the chip manufacturing sector.

To fact check here, according to CFR Research, Taiwan has a market dominance of 68%, which is significant. In the realm of advanced chip manufacturing (i.e., cutting-edge chips with sophisticated processes), Taiwan’s superiority is even more pronounced, claiming a market share of more than 90%.

According to Trump, these tariffs on metals, Chinese goods, and chips designed to protect American interests, so why are economists breaking out in cold sweats?

Some experts warn that these tariffs could further raise tech product prices in an already costly market, which is totally not ideal as inflation continues to soar.

Experts on how Trump’s tariffs will affect tech

That being said, I reached out to Jason Miller, Professor of Supply Chain Management at Eli Broad College of Business. He told Tom’s Guide that the 10% tariffs on Chinese imports won’t move the needle much.

“The ultimate cost impact borne by U.S. consumers is likely to be fairly small,” Miller said. “Trade data for 2024 shows that China accounts for around two-fifths of cell phone imports and one-third of electronic computer imports.”

Miller concluded that consumers should expect costs to increase by no more than five percent for the goods directly affected by tariffs, which, while not negligible, is far from the drastic price hikes some fear. Thanks to existing trade margins, most consumers are unlikely to notice a dramatic difference at checkout, Miller explained, citing the Bureau of Economics’ input and output accounts.

Shawn DuBravac, chief economist and senior director of research at the Consumer Electronics Association, also said that consumers should expect price hikes, especially since “many laptops, computers, TVs and smartphones rely on components or final assembly in China.”

Some companies will absorb the higher costs, but others will pass on the tariff impact to consumers. “Consumers should expect price hikes, particularly in mid-range and budget devices where profit margins are thinner,” DuBravac said.

In other words, budget-friendly devices where affordability is a selling point will struggle to maintain competitive pricing and keep costs low. Think cheap gaming laptops, Chromebooks, Amazon Fire tablets, entry-level phones and budget TVs like TCL and Hisense.

But what about the metal tariffs, will they affect the tech industry? According to Miller, not much.

“The steel and aluminum tariffs will have minimal effect on prices for computers and smartphones, as those products are mostly assembled overseas and hence aren't affected by the U.S. making imported aluminum and steel more expensive,” Miller told Tom’s Guide.

I asked Dubravac whether the tariffs will affect laptops, and he shared a similar sentiment. “Aluminum is generally less than 0.5% of the cost of a laptop, so a rise in aluminum will have a minimal impact on the final price,” he said.

What about the Taiwan-based chip tariffs?

The tariffs on metals won’t cause much disruption, but when it comes to the proposed Taiwan-based chip tariffs, it’s a whole different story.

“By some estimates, a disruption to Taiwan semiconductor manufacturing could increase prices for components like logic chips by up to 59%,” DuBravac said, citing a U.S. International Trade Commission working paper.

Miller concurred with DuBravac: “Proposed tariffs on imports from Taiwan would have a disproportionate impact on prices for semiconductors & GPUs; we currently are importing over $30 billion a quarter from Taiwan.”

Put simply, most Americans can stomach the minor impact of tariffs on Chinese goods and metals. But once Trump slaps Taiwan with chip tariffs, be prepared to clutch your pearls. You’ll get sticker shock while shopping for laptops, smartphones, gaming consoles and nearly every modern gadget powered by semiconductor technology. Yikes!

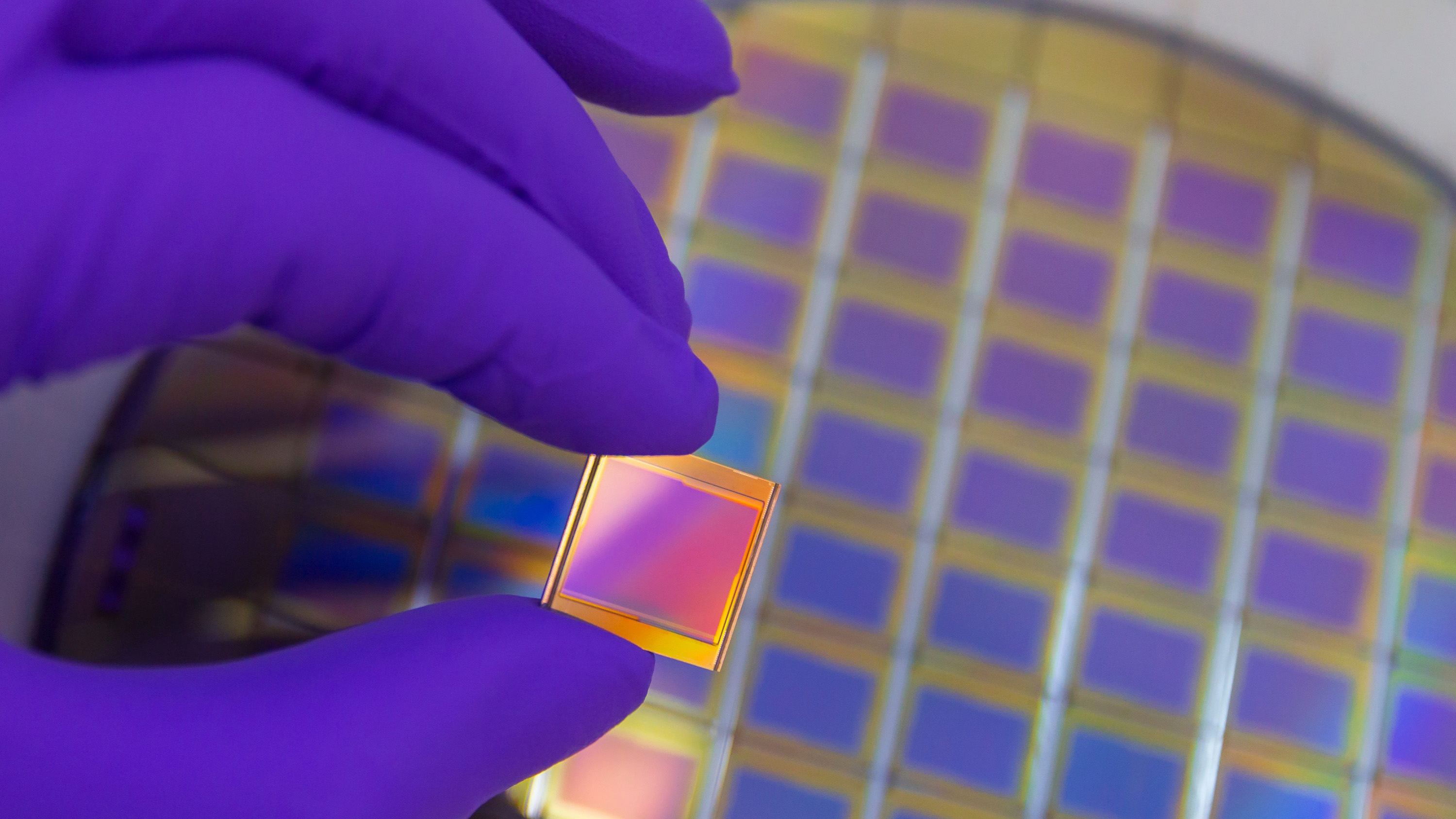

Will the tariffs help the U.S. reclaim chipmaking dominance?

As noted earlier, one of President Trump’s key goals is to position the U.S. as a dominant force in chip manufacturing.

Will Trump’s proposed Taiwan-based chip tariffs help him meet this objective? According to the experts, maybe. But it’s a long shot – and it could take years.

Companies can’t just flip a switch and move production elsewhere. “That won’t happen overnight,” Dubravac said. “Short-term price increases are almost inevitable.” Even something as small as replacing a single component requires extensive testing, supplier verification and integration — a process that can take more than a year before a product is deemed “market-ready.”

According to DuBravac, there’s been notable progress in expanding U.S. semiconductor manufacturing, but the country still produces just 10 to 12 percent of the world’s supply.

“It would take many years of record investment to double that,” DuBravac said. “Even if companies accelerated construction investment today, the impact is years away.”

Final thoughts

So, what did I learn from the experts? Trump’s tariffs will raise prices on electronics, from smartphones to gaming consoles, but the increases for most products will likely be marginal.

Budget tech, however, is where the impact will be most noticeable — these products may struggle to maintain their low-cost reputation. In this category, expect price hikes, stripped-down features or a shifting definition of what “affordable” really means.

Now, if Trump officially announces tariffs on Taiwan-based chips, you’ll suffer some serious sticker shock. Prices on flagship smartphones, gaming rigs and more will skyrocket – all while you foot the bill for a semiconductor strategy that won’t pay off anytime soon.

It will take years — if not decades — before domestic chip production reaches a level that meaningfully offsets reliance on Taiwan.

More from Tom's Guide

- Musk, TikTok, and big tech – Donald Trump and data privacy

- I write about AI for a living — here's my 7 favorite free AI tools to try now

- I review over 200 laptops each year — here are the best laptops

Kimberly Gedeon is a tech explorer who enjoys doing deep dives into the most popular gadgets, from the latest iPhones to the most immersive VR headsets. She's drawn to strange, avant-garde, bizarre tech, whether it's a 3D laptop, a gaming rig that can transform into a briefcase or smart glasses that can capture video. Her journalism career kicked off about a decade ago at MadameNoire where she covered tech and business before landing as a tech editor at Laptop Mag in 2020, then as the tech editor at Mashable in 2023.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.