I built a budget using ChatGPT and it's a game changer for saving money — here’s how to do it

ChatGPT crunches the numbers so you don't have to

ChatGPT isn't just for helping with projects or planning your next vacation. This AI tool has a hidden talent that could transform your wallet. Budgeting can be a challenge for many of us. Traditional methods often feel overwhelming or time-consuming, leading to abandoned spreadsheets and neglected apps. That's where an unexpected ally comes in — Open AI's ChatGPT.

While ChatGPT can help you write a better cover letter, perfect your resume, and analyze PDFs for free, its capabilities extend into personal finance territory, too. I recently discovered ChatGPT's hidden talent for budgeting, and it's been a lifesaver. Instead of providing a one-size-fits-all plan, it helped me craft a budget that actually made sense for my life and financial goals.

If you're looking to save money but find traditional budgeting methods uninspiring, you're in the right place. Let's explore how ChatGPT can be your personal finance assistant, helping you create a budget that not only looks good on paper, but actually helps you save.

1. Log in to ChatGPT

Start by logging in to ChatGPT on your browser or mobile device.

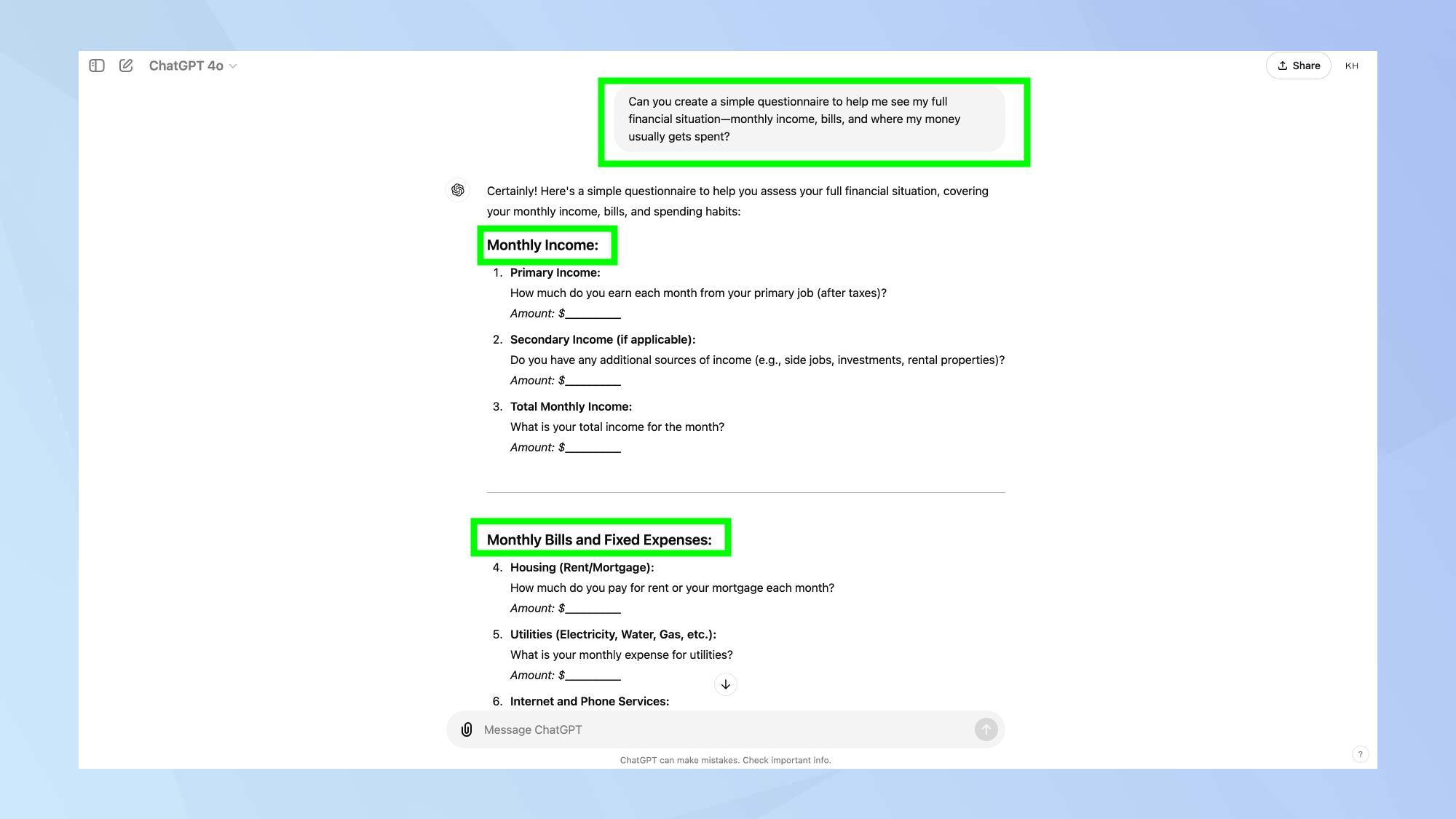

2. Take a snapshot of your financial situation

Before you dive into budgeting, you need a clear picture of where your money goes. This will help you get a handle on the big picture without feeling overwhelmed.

In the prompt box, ask ChatGPT something like: "Can you create a simple questionnaire to help me see my full financial situation—monthly income, bills, and where my money usually gets spent?"

This will cover questions ranging from monthly bills and fixed expenses, to savings and investments. Fill out the questionnaire and then move onto the next step.

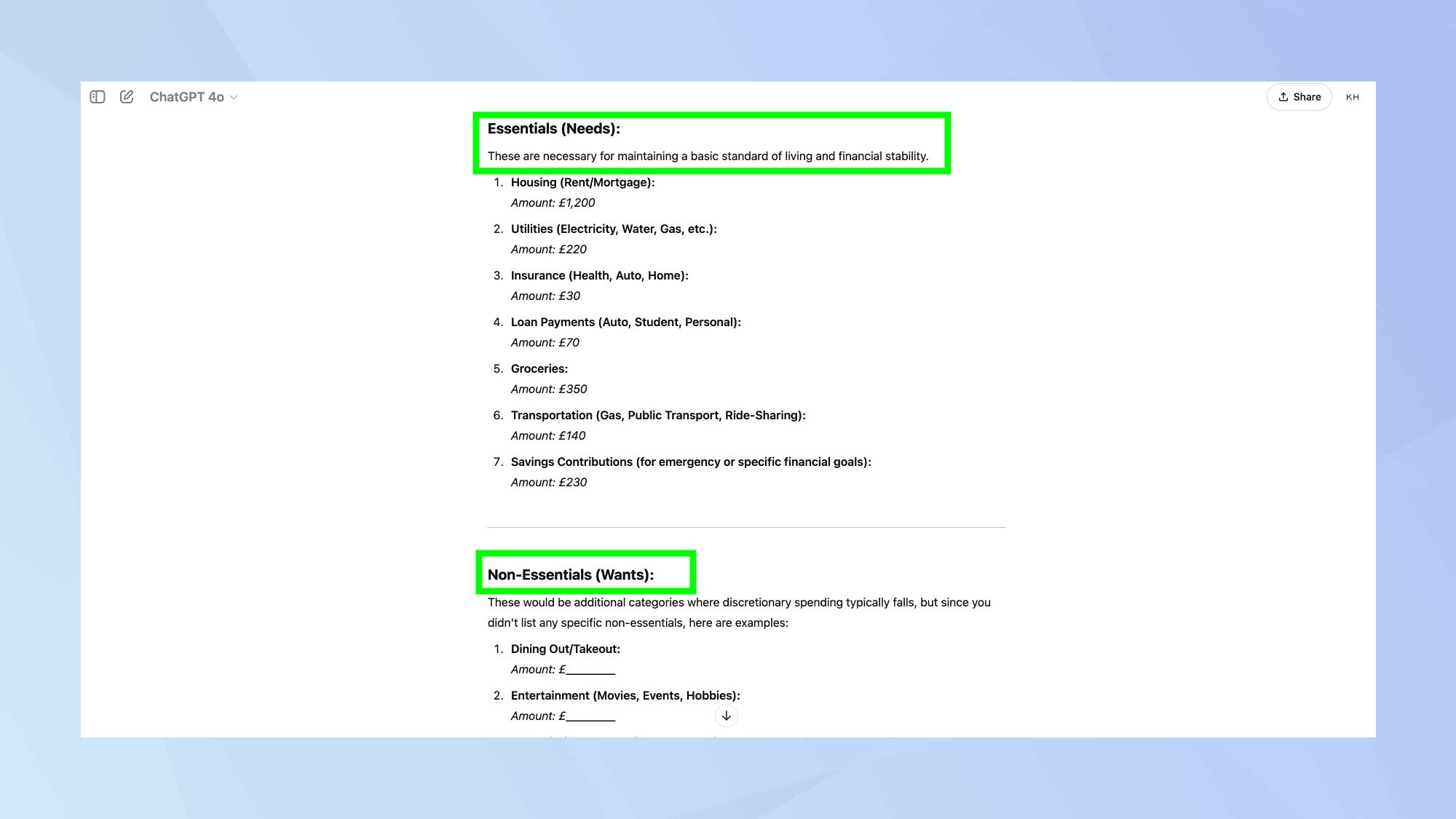

3. Sort out your spending

We all have habits we might not even notice, like buying a latte every day (guilty) or forgetting about that monthly subscription we don't use (also guilty).

Next, ask ChatGPT: "Can you help me organize my spending into categories like essentials (things I need) and non-essentials (things I want)?" You'll get clarity on where you can make changes without feeling like you're giving up too much.

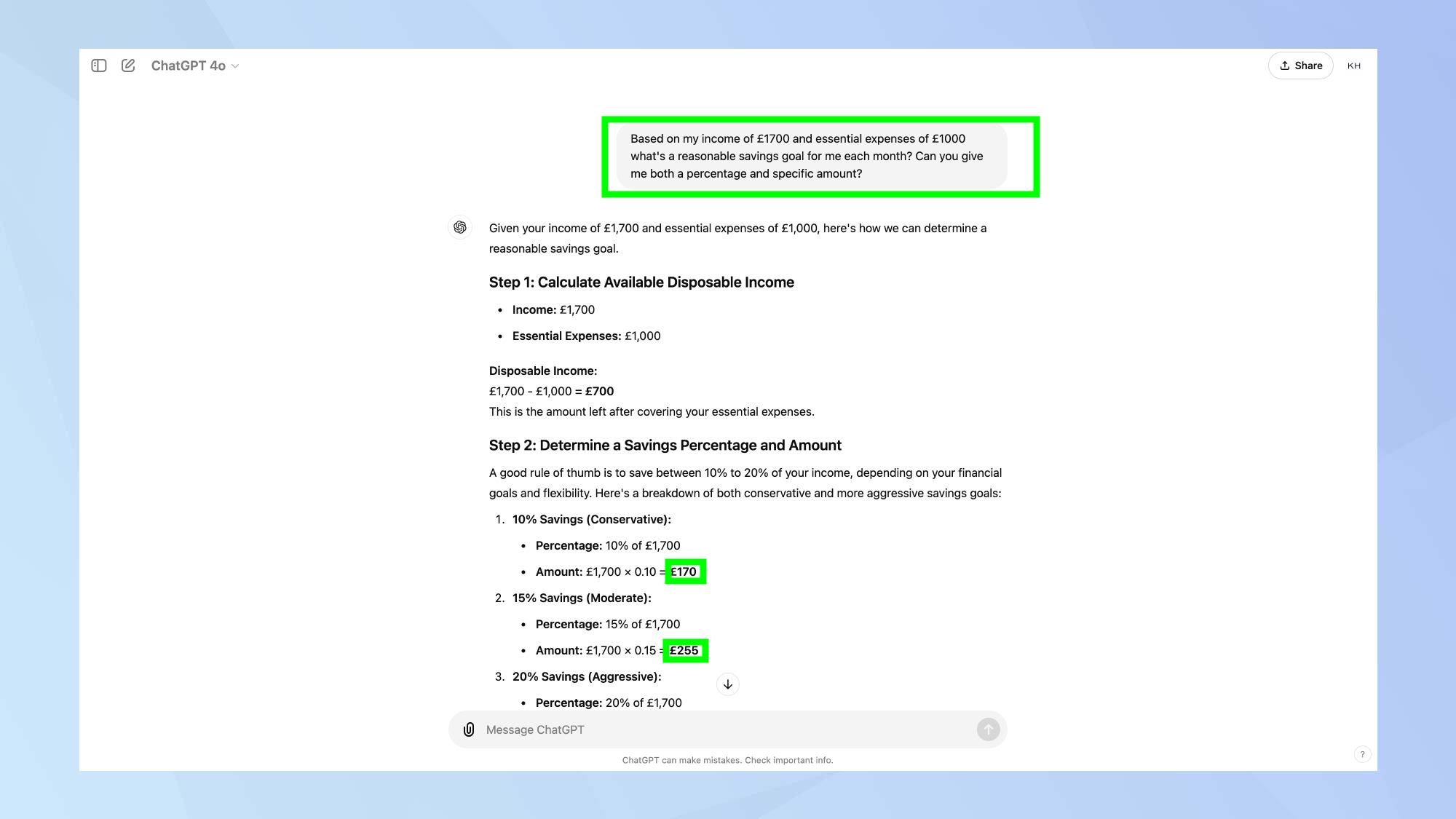

4. Set a savings goal that actually works for you

We all want to save, but if you aim too high, it can be discouraging. Ask ChatGPT: "Based on my income of [X] and essential expenses of [Y], what's a reasonable savings goal for me each month? Can you give me both a percentage and specific amount?"

The great thing about this is it advises how to much to save based on what works best for you — conservative, moderate, or aggressive saving. This way, you’re setting yourself up for success, not frustration.

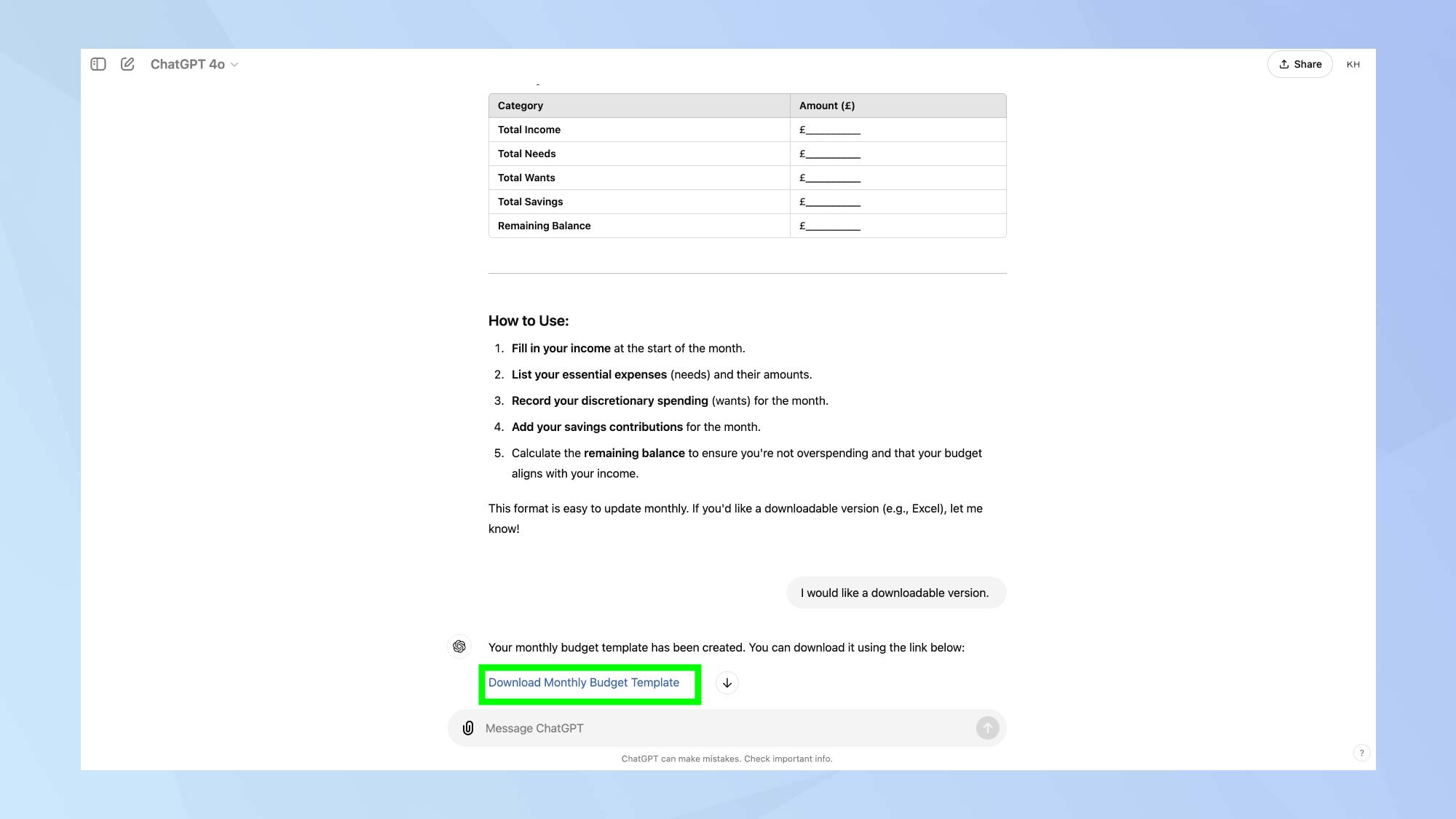

5. Build a budget that fits your life

No one likes the idea of sitting down with a complicated spreadsheet. Keep it simple with a request like: "Can you create a super easy monthly budget template for me, with sections for income, needs, wants, and savings? Something I can fill out quickly each month."

You’ll be less likely to avoid it if it’s quick and easy to use. At the end, ChatGPT will give you instructions on how to use the template as well as the option to create a downloadable option (Excel), which is a nice touch.

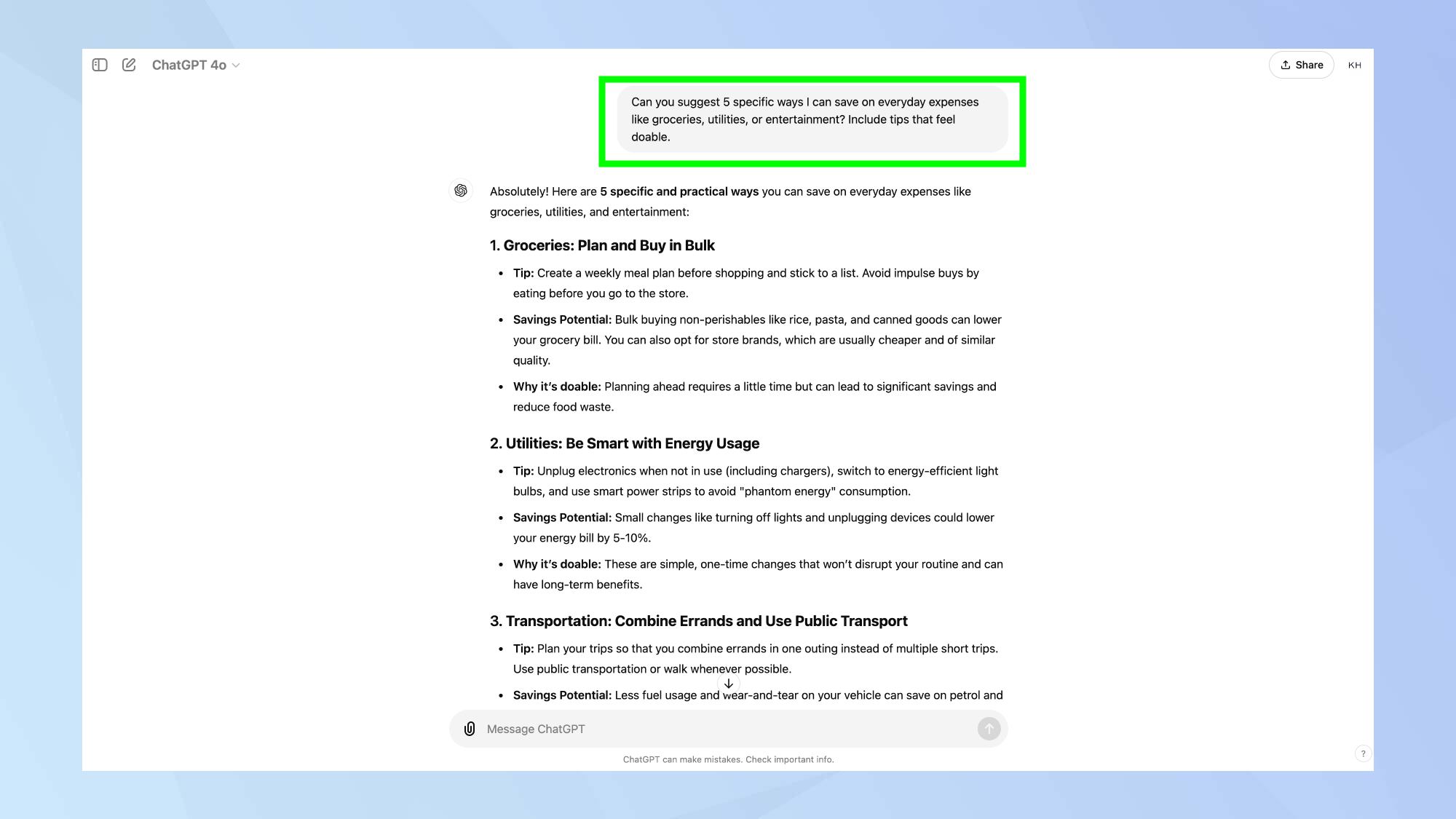

6. Find ways to trim the fat

Cutting back doesn’t have to feel like a punishment. You might be surprised how small tweaks can lead to big savings over time.

Ask ChatGPT: "Can you suggest 5 specific ways I can save on everyday expenses like groceries, utilities, or entertainment? Include tips that feel doable."

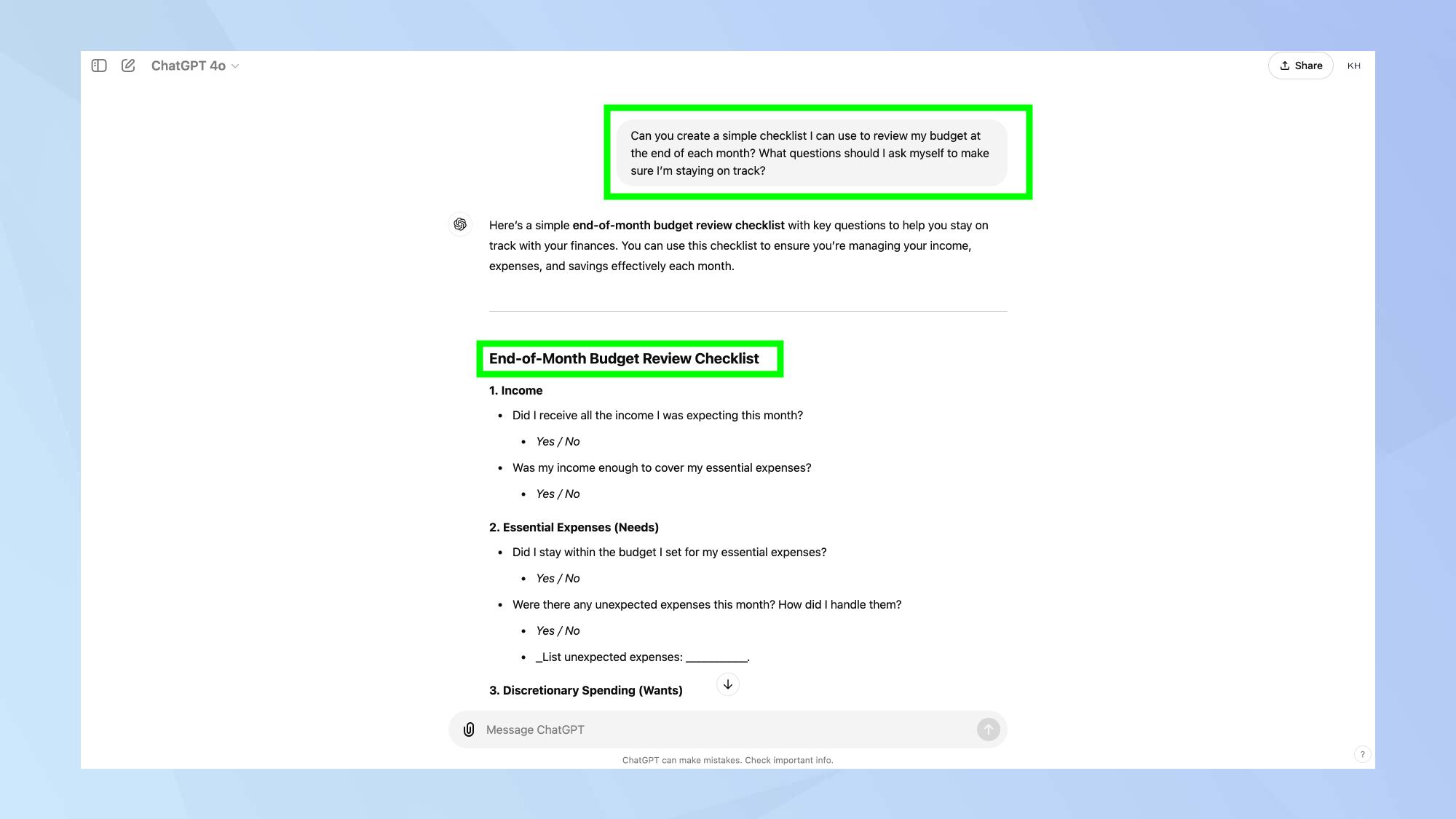

7. Stay on track

Accountability is everything when it comes to sticking to a budget. A great way to stick to your plan is to ask ChatGPT a prompt like: "Can you create a simple checklist I can use to review my budget at the end of each month? What questions should I ask myself to make sure I’m staying on track?"

And there you have it! With these steps and ChatGPT's help, you're now equipped to create a budget that not only makes sense but actually helps you save. Remember, the key to financial success is consistency, so stick with it and watch your savings grow. Happy budgeting!

Ready to explore more of ChatGPT's potential? Learn how to use the ChatGPT app on iPhone and Android for on-the-go budgeting. Discover 7 things ChatGPT can do you should try today, and boost your AI skills with 5 ChatGPT tips to try for getting smarter answers to your prompts.

Sign up to get the BEST of Tom's Guide direct to your inbox.

Get instant access to breaking news, the hottest reviews, great deals and helpful tips.

Kaycee is an Editor at Tom’s Guide and has been writing for as long as she can remember. Her journey into the tech world began as Cazoo's Knowledge Content Specialist, igniting her enthusiasm for technology. When she’s not exploring the latest gadgets and innovations, Kaycee can be found immersed in her favorite video games, or penning her second poetry collection.